Consumer products (CP) companies have been on a roller-coaster ride since the beginning of the pandemic. The latest post-pandemic twist arrived in late Spring 2022, when CP companies signaled price increases as a way of combating cost inflation. Surprisingly, they found a favorable environment for taking pricing action – consumer spending has remained resilient, and retailers have been amenable to accepting price increases (and passing them along to shoppers).

As such, most CP companies have posted significant revenue growth in Q3 2022. In Packaged Foods, for example, sales were up by 12.6% on average on a rolling 12-week basis as of October 2022, according to NielsenIQ data published by Goldman Sachs. Price increases of 17.6% were offset by a volume contraction of 4.2%. That performance is in sharp contrast to what was observed in the same period a year ago, which is more representative of the historical pre-pandemic norm in the Packaged Foods sector: sales were up by 4.8% in Q3 2021, with price increases of 3.7% and a slight volume growth of 1.1%.

Investors have certainly taken notice. After CP companies reported their Q3 2022 results, the S&P 500 Consumer Staples index regained momentum, sitting at a 12% gain at the end of December after being down by 13.5% for the year through the end of September (compared to a five-year CAGR of 6.5%).

Headwinds on the horizon

What seems like great news for the industry (and for investors) may in fact prove to be a much trickier situation.

Much of the recent CP stock price momentum is linked to expectations that revenue gains posted in recent months can be sustained in the future. However, those expectations seem unrealistic given the deteriorating macro-economic environment: inflation remains high, both consumer confidence and personal savings rate are at historic lows, consumer spending has decelerated substantially, and shoppers have started to trade down. JPMorgan Chase CEO, Jamie Dimon, estimates that the $1.5 trillion in excess savings that consumers have amassed during the pandemic will run out sometime midyear 2023 at the current spending rate.

A sustained period of slow-to-no growth (or even sales contraction) is starting to look like a very plausible scenario.

The $6.5 billion margin challenge

To put the challenge into perspective, AlixPartners conducted a warranted share price analysis on a sample of 24 U.S.-based publicly traded CP companies across different industry sectors. Our analysis shows investors have priced in the expectation that these CP companies will grow topline by approximately 4% on average while expanding margins by roughly 40 bps.

With a possible recession looming, we have asked ourselves: how much margin expansion would it be necessary to offset a flat revenue scenario in 2023 and 2024? The answer is +93 bps. In short, CP companies in our sample would have to more than double their expected margin expansion gains to make up for the adverse share price impact of flat revenue performance in the next couple of years. In dollar terms, collectively, that translates into $6.5 billion in incremental margin gain requirement over the 2023-2024 period (or $271 million per company, on average).

Unlocking next-level productivity

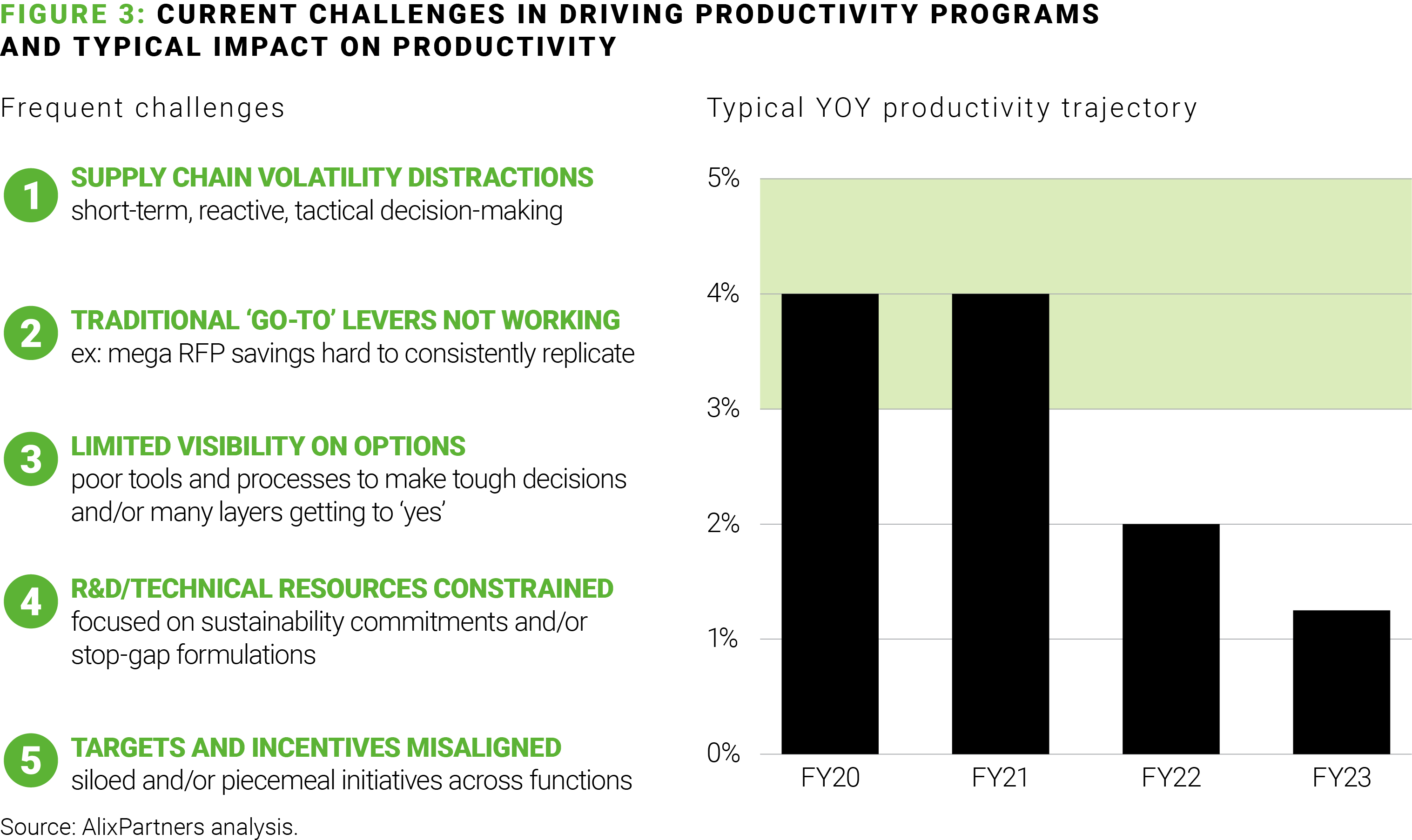

With limited ability to replicate pricing increases and sustain revenue growth momentum, CP companies will need to refocus on driving meaningful incremental margin expansion through productivity improvement and cost reduction. And yet this comes at a time when CP companies are facing significant challenges in building their productivity trajectory momentum.

To succeed in this new environment, CP companies will have to move beyond tactical blocking-and-tackling and address productivity differently than historical norms. That means adopting a thoughtful, systematic, and disciplined approach to both filling the productivity pipeline as well as building the execution engine. Both aspects are equally important, and one doesn’t work without the other.

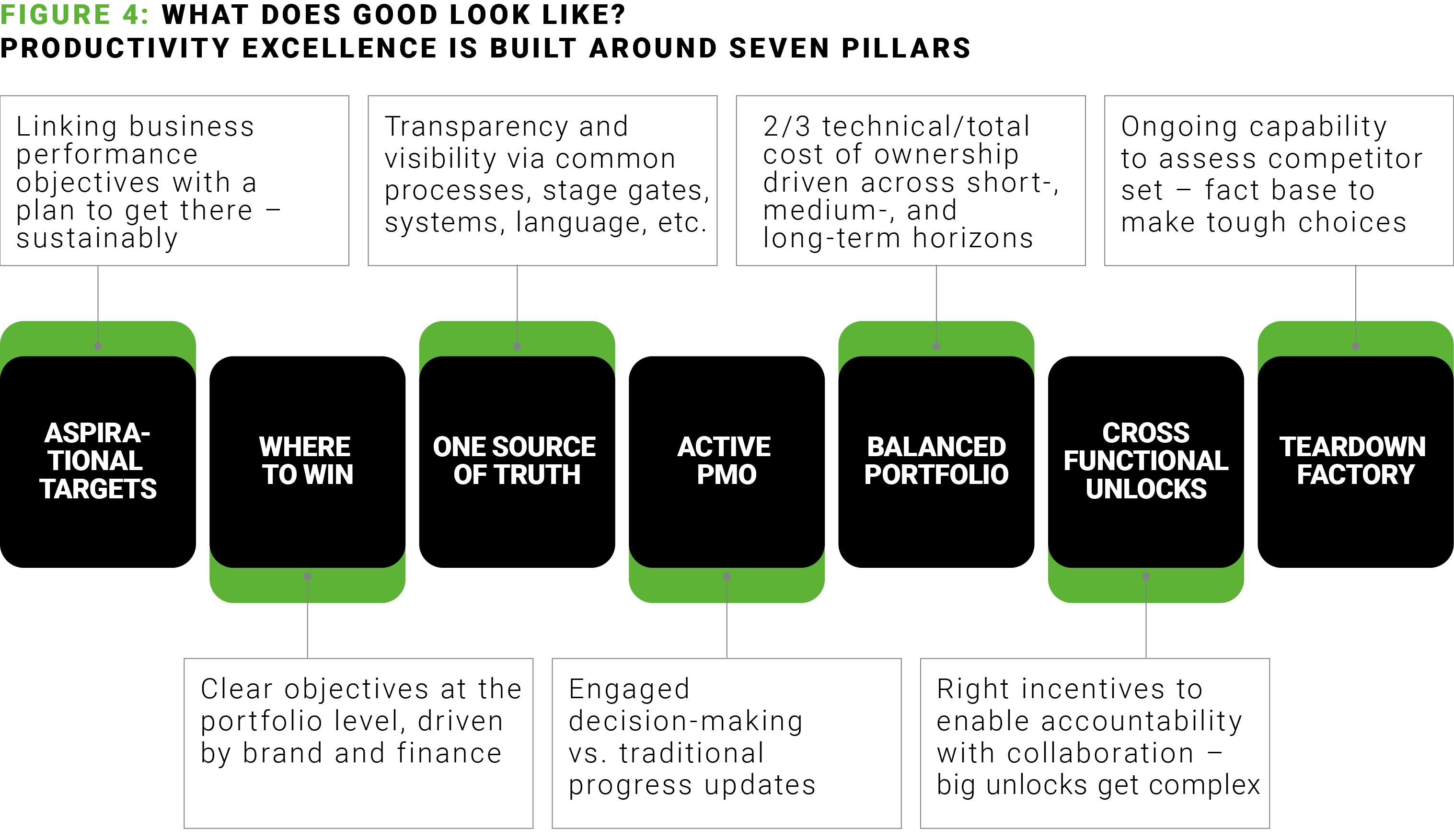

So, what does good look like? In our experience, productivity excellence is built around seven pillars:

Here are some practical steps to start (or enhance) the journey:

- Set the aspiration: Conduct a full review of productivity potential, taking an activist investor perspective to challenge the status quo and unlock new opportunities.

- Establish a productivity engine: Put the “hardware” and “software” in place to enable systematic and disciplined execution, including an enterprise program management office structure to coordinate actions centrally and across BUs and functions, clear stage-gates to define pipeline progression in value and execution, single source of truth enabled by program management (not project management) tools, and active and visible engagement in decision-making and governance by BU and functional leadership.

- Drive cultural and operational change from the top: Create a compelling narrative, tell the story, lead by example (e.g., by showing personal engagement, breaking paradigms, making tough decisions, demonstrating accountability), align incentives, continually market impact and achievements (internally), and set external commitments (externally to investors).

- Enable the teams: Provide resourcing to execute, make appropriate investments (e.g., capital, external support), and build and institutionalize capabilities while driving outcomes (i.e., sustain ability to achieve productivity in the future).

- Build productivity into operations: Embed productivity in annual and multi-year strategic planning processes and in the regular cadence of business reviews (e.g., management dashboards, quarterly business reviews), reward impact, “brand” the program, maintain internal and external visibility through ongoing communications, and provide training.

All signs are pointing to the urgent need for CP companies to have their enhanced margin expansion plan of attack in place and be ready for execution. The time to act is now.