Success in private equity deals during first 100 days centers on prioritizing people and aligning strategy

AlixPartners’ survey found that private equity and portfolio companies both rank management team alignment as top priority in the first 100 days, but they differ on most other priorities.

NEW YORK (May 1, 2019) – In the first 100 days after the close of a private equity deal, both the private equity investor and the portfolio company (“portco”) management team must establish and ensure that the portco CEO and CFO are aligned on strategy, goals, and key expectations according to a new survey by the global consulting firm AlixPartners and Vardis, the global private equity search firm.

While there was overall agreement on the importance of alignment, the AlixPartners-Vardis Fourth Annual Private Equity Leadership Survey found notable differences in responses about most of the other top priorities in the first 100 days. For the first time, “human capital” was ranked as the #2 concern with potential investors, second only to “growth.” Portcos ranked “assess the management team” second, but it was the sixth priority for PE firms which ranked validation of the investment thesis and delivery of quick wins as the second highest priority. While “analyze the company culture” was closer to the bottom of their priority lists, 50% of the portco respondents chose this one, versus only 19% of the PE firms.

CEOs and CFOs – mismatched priorities

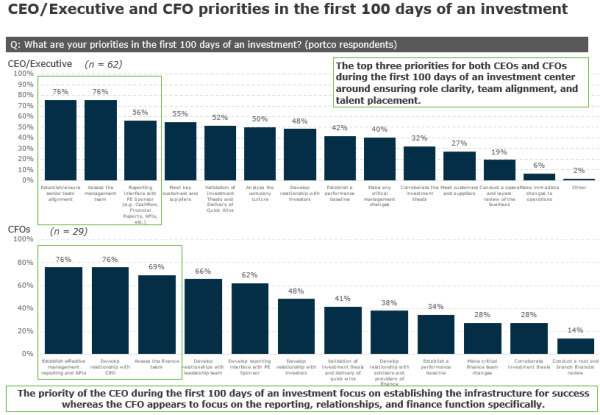

CEOs’ top three priorities were “establish/ensure senior team alignment”, “assess the management team”, and “reporting interface with PE sponsor” (for example, on financial KPIs). This suggests that chief executives focus on establishing the infrastructure for success in the post-deal period. For the CFOs, the top three priorities were “establish effective management reporting and KPIs”, “develop relationship with CEO”, and “assess the finance team.”

Assessing performance

CEOs rank business reviews at the top of their list (70%) of mechanisms to review and assess their performance and individual performance reviews at the bottom (24%). In contrast, CFOs’ performance is being assessed primarily through individual performance reviews (73%), with use of real-time metrics and feedback from CFOs’ direct reports coming in at a distant 33% and 13%, respectively. These findings suggest that, unlike with CEOs, CFOs’ performance is judged mostly on metrics, data, and reporting as opposed to their leadership capabilities. But while only 27% of the CEOs wanted assessments of their own strengths and challenges, 52% of the CFOs said they desired this form of support.

Addressing portco CEO performance

Interestingly, 69% of the PE respondents in our study said that, in cases where a portco CEO’s performance is deemed inadequate, they seek a solution other than replacing him or her. As much as 52% said they craft a remediation plan, with termination as the consequence of continued underperformance. And 17% said they look to executive coaching. 31% Begin the process of replacement and terminate the CEO.

The desire to give underperforming CEOs a chance to improve is understandable, given the disruption and costs that turnover in this role can inflict on a portfolio company. (As just one example, some sources estimate that total costs of replacing an executive can amount to 15 times his or her salary.)

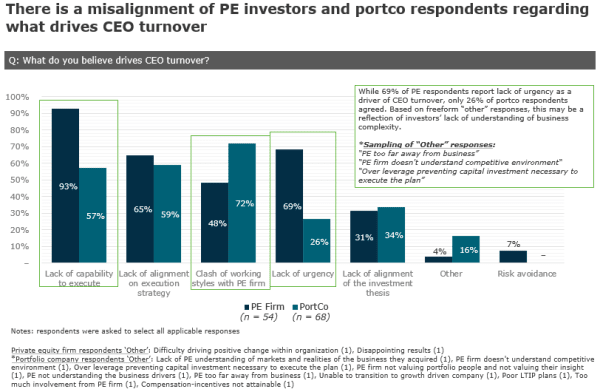

When asked what drives CEO turnover, PE investors decidedly cited “lack of capability” (93%) with “lack of urgency” not far behind (69%). Portco CEOs, however, responded that a clash of working styles with the PE firm was the most prominent driver and secondarily noted lack of alignment on execution strategy. Interestingly, when asked about CFO turnover, PE firms ranked “lack of technical and financial capabilities” highest followed closely by “insufficient communication skills and/or financial reporting capabilities.” In response to the same question, CFOs indicated clash of working styles with the PE firm was the primary driver (73%) with clash of working styles with the CEO as the next most significant reason for turnover. The authors suggest that most, if not all, of these reasons for costly turnover are both predictable and preventable by taking specific actions at the outset of any investment.

Ted Bililies, PhD, global leader of the Organization & Transformative Leadership practice at AlixPartners and a managing director at the firm, said, “This year’s survey findings point to a sharper awareness that success in the first 100 days is about not just the CEO but everyone around him or her as well. PE firms must take swift action to define expectations for key value-creating roles and work together to identify and address the most problematic sources of misalignment before they can pose a serious threat to each party’s goals.

“Given PE firms’ recognition that having the right talent in place is vital to fuelling growth in their portcos, investors would do well to closely monitor and manage CEOs’ commitment to making agreed-upon changes during and well after the first 100 days, and not give too long a leash to underperforming CEOs,” Dr. Bililies added.

About the survey

The AlixPartners-Vardis Fourth Annual Private Equity Survey, conducted in conjunction with Vardis, the global private equity executive search firm, was administered October through December 2018. There were 158 total respondents comprised of 54 managing directors and operating partners from PE firms and 98 senior executives (primarily CEOs and CFOs) from portfolio companies. The largest share of portco respondents were with companies with annual revenues of $100 million to $500 million. The majority of PE firm respondents reported assets under management of less than $20 billion.

Please contact Ed Canaday for more detailed survey results.

About AlixPartners

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Our clients include companies, corporate boards, law firms, investment banks, private equity firms, and others. Founded in 1981, AlixPartners is headquartered in New York, and has offices in more than 20 cities around the world. For more information, visit www.alixpartners.com.