As the media and retail landscapes reshape under macroeconomic pressure, retail media networks (RMNs) and connected TV (CTV) are fast becoming essential components of the media mix. Rather than a niche innovation, their integration reflects a broader industry shift toward media channels that balance scale with accountability.

Tariffs have created a most uncertain economic environment. Between disrupted supply chains and cautious consumer spending, the cost of doing business has grown, compressing margins and intensifying scrutiny on marketing spend. The result? A hard pivot toward media channels that deliver measurable outcomes, efficiency, and direct commercial return.

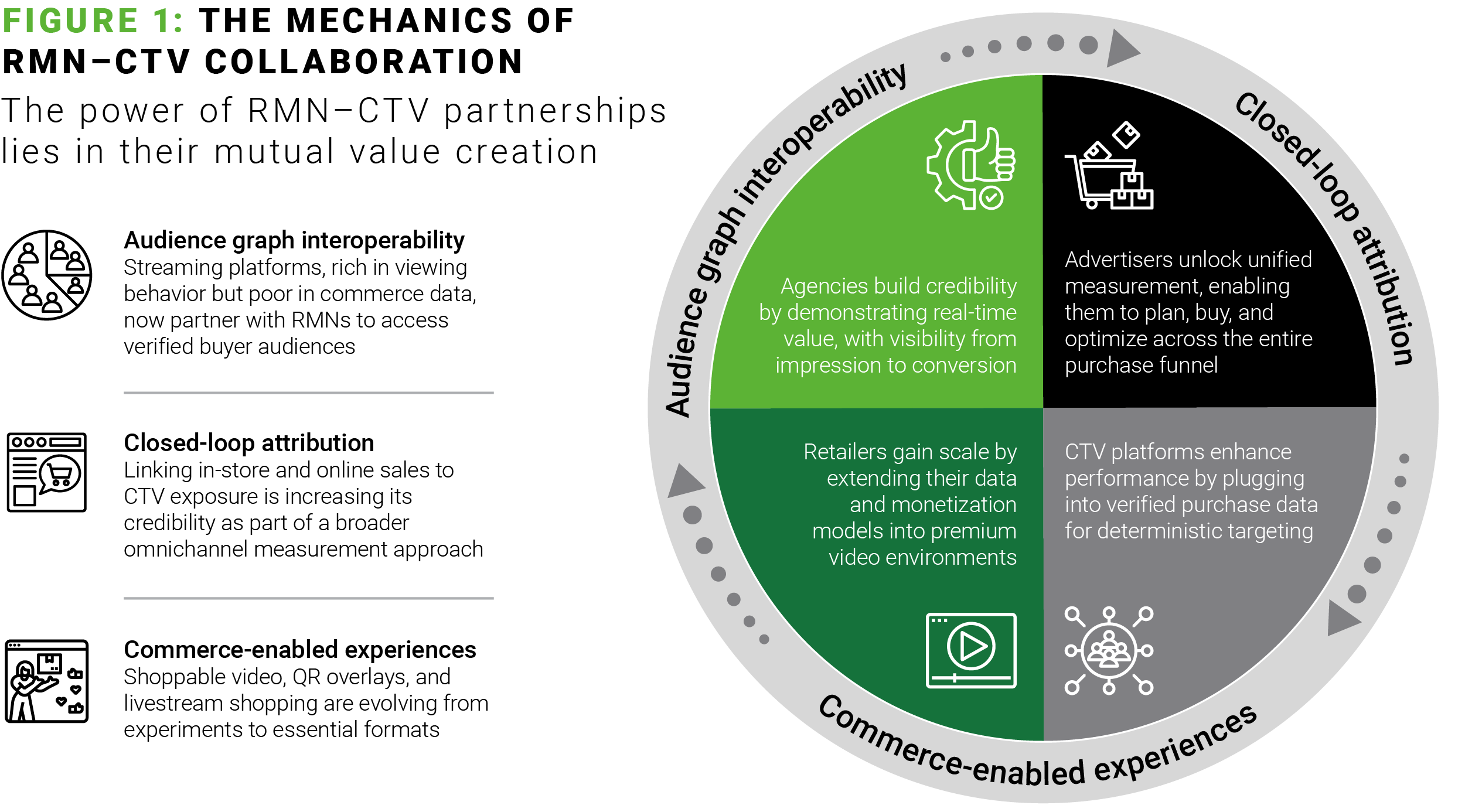

RMNs offer precision, measurability, and direct access to first-party transaction data. CTV brings scale, storytelling, and the ability to engage at the top of the funnel. Together, they form a performance engine that spans the full customer journey, from awareness to conversion.

Tariffs accelerate a strategic shift

By driving up import costs, tariffs are further squeezing product margins—particularly in categories like toys, apparel, and electronics that depend heavily on Chinese manufacturing. This margin pressure is cascading into advertising decisions, forcing brands to reassess where every dollar goes and shift their media planning strategy.

A 2025 IAB survey found that 45% of advertisers plan to cut budgets due to tariff-driven cost pressures, shifting spend away from broad but hard-to-measure channels like print, linear TV, and branded entertainment. Even within digital, the same survey highlights that social will be among the hardest hit. Instead, advertisers are leaning into performance-driven media—particularly search, RMNs, and CTV—for their measurable ROI and real-time precision targeting.

Efficiency becomes the benchmark

In a constrained economy, accountability becomes the currency. Retail media, with its closed-loop measurement capabilities, is the clear winner. It allows marketers to tie ad spend directly to sales, providing defensible returns on investment and enabling real-time optimization. In parallel CTV brings storytelling and upper-funnel engagement. Combined, these create a full-funnel ecosystem—from awareness to purchase—all powered by verified transaction data and deterministic targeting.

Campaigns that leverage CTV alongside retail audience data have shown up to 67% higher ROAS and double the sales revenue year-over-year, as seen in a case study with Walmart Connect and The Trade Desk. Shoppable CTV ads using retail data have also achieved 1.5x higher incremental reach and 1.67x better in-funnel conversion rates compared to standard benchmarks according to eMarketer. That same research shows that more broadly, retail media campaigns using first-party data deliver 50-70% higher incrementality and an average sales lift of 29%, far exceeding the 8-10% typically seen in non-retail digital media. These results underscore how the fusion of CTV and retail data not only enhances targeting but also provides measurable sales impact through closed-loop attribution.

This shift isn’t just tactical—it’s structural. We’re witnessing the erosion of the old divide between brand and performance marketing. In its place is a unified strategy: performance-led storytelling anchored in first-party data.

AlixPartners: Enabling rapid, resilient action

We help clients seize this inflection point with speed and certainty. Our cross-functional teams deliver:

- For brands: High-impact diagnostics, go-to-market optimization, and omnichannel investment strategies that drive revenue in turbulent times.

- For agencies: Operating model transformation, analytics modernization, and strategic alignment across clients, channels, and platforms.

- For retailers: RMN activation, data monetization, and partnership structuring to expand inventory and grow media revenue.

- For CTV publishers: Monetization strategy, commerce product development, and ecosystem integration to unlock retail partnerships and premium demand.

Whether our clients are scaling innovation or managing cost pressures, we bring executional urgency and strategic clarity to every engagement.

A new growth engine

This isn’t just about riding out a tariff wave. Tariffs have simply accelerated what was already in motion. Brands are reallocating budgets away from broad, unmeasured media toward channels that can deliver clear commercial outcomes. At the same time, streaming platforms are racing to deepen their data capabilities, seeking the deterministic insights that only retail partners can provide.

The result is a high-stakes realignment—one defined not by reach alone, but by relevance, efficiency, and accountability. Organizations that embrace this shift will not only defend ROI—they will unlock new revenue models, forge transformative partnerships, and secure long-term advantages in a volatile landscape.

Retail media in partnership with CTV isn’t the next big thing. It’s the now.