Reggie Van Lee

Private equity’s (PE’s) advantage over the public markets has narrowed. For several decades, PE’s superior performance attracted capital—and rewarded investors—so well that the PE industry grew far faster than the economy. But as relative performance has weakened, the industry is finding it harder to attract new capital, and some institutional investors are reducing their holdings.

Even though some firms are struggling, others continue to deliver outstanding performance. What sets these winners apart? Because the private equity industry is, well, private, little has been known about the specific strategies and practices associated with superior financial performance. Our research, which we described in an earlier article, identified 57 leading practices, across the various stages of the PE fund life cycle, based on a survey of experienced industry executives.

The rest of this article lays out the practices that scored highest for their impacts on value creation. In future articles, we will dive deeper into these practices and how they affect firm and portfolio-company performance.

Companies have to know which best practices make sense for them and where to invest to improve. Choosing the right practices and investments can help a firm stand out from the crowd to investors and target companies by virtue of its performance and differentiated offerings.

How to interpret the scores

The scores are measures of the degree to which survey respondents agreed or strongly agreed a practice is a leading practice that can produce superior value for investors. Respondents could also choose neutral or strongly disagree/disagree.

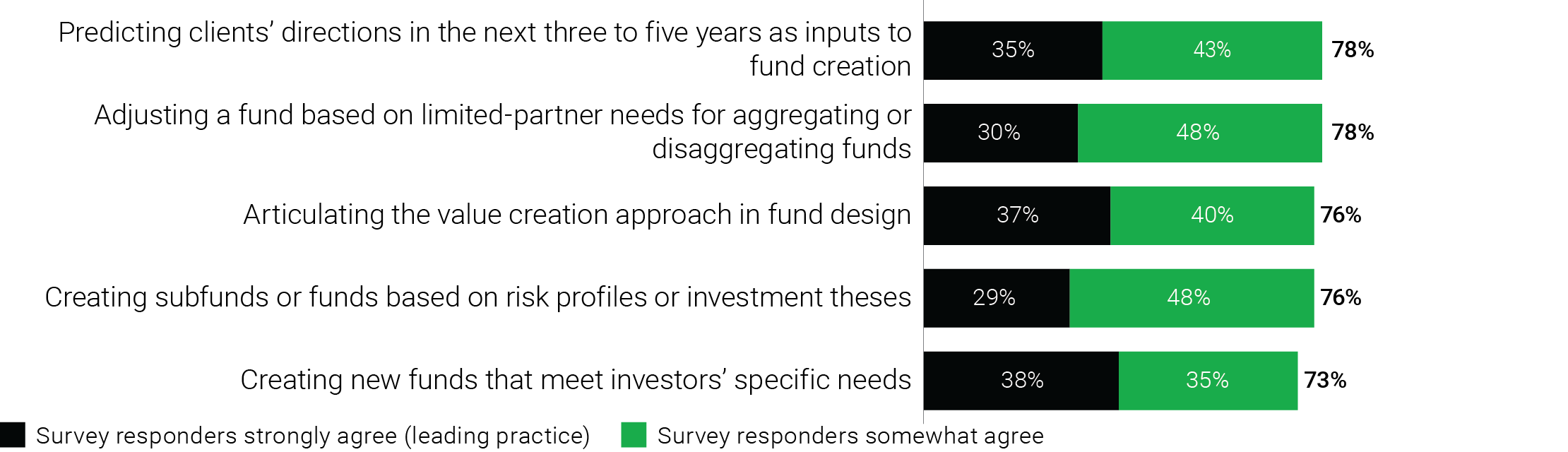

Product (fund) development

Industry experts identified five elements of fund development that produce superior value. The five have one thing in common: As in the creation of any product, understanding customer needs is key. In fund development, customer focus shows up as anticipating investors’ future needs, tailoring funds that appeal to specific groups of investors, configuring or reconfiguring funds, and articulating the investment thesis and value proposition. Those abilities produce benefits in two directions: They attract investors by making it easier for them to find funds that match their goals, and they can lead to smarter fund development as firms get a better understanding of the needs of their investor-customers.

Strength of belief that leading practices within Product (fund) development

contribute to superior PE Firm performance

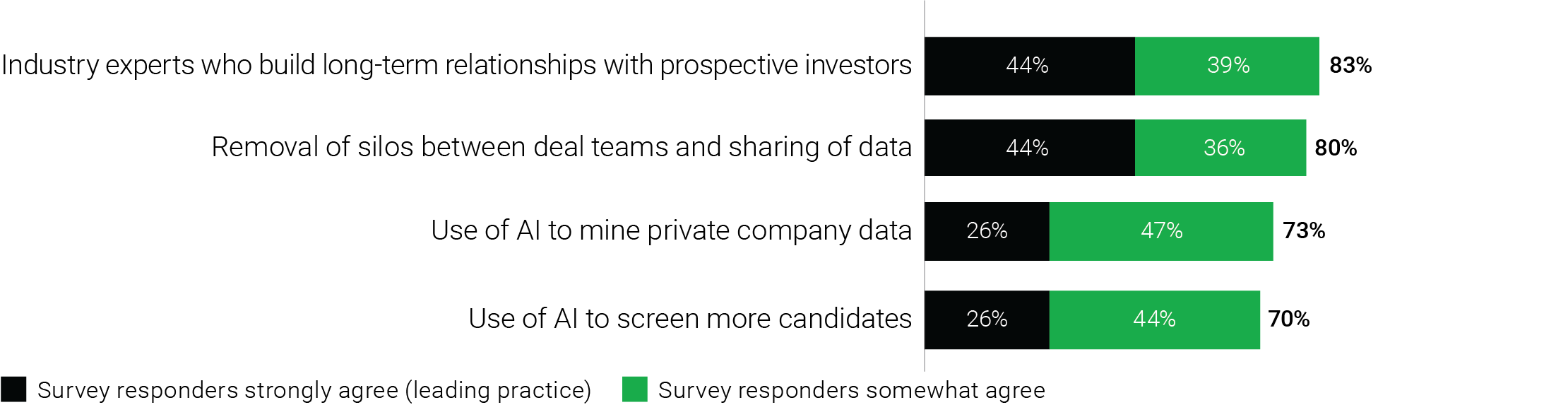

Fundraising

Customer focus shows up as both a differentiator and a value generator in fundraising as well as in fund development. Leading firms use data science to seek out customers; they measure and, presumably, work to improve customer satisfaction scores; and their deal teams are aligned closely with their investor relations teams. Potential investors expect PE firms to treat them as valuable partners, and leading firms ensure that happens.

Strength of belief that leading practices within Fundraising contribute to superior PE Firm performance

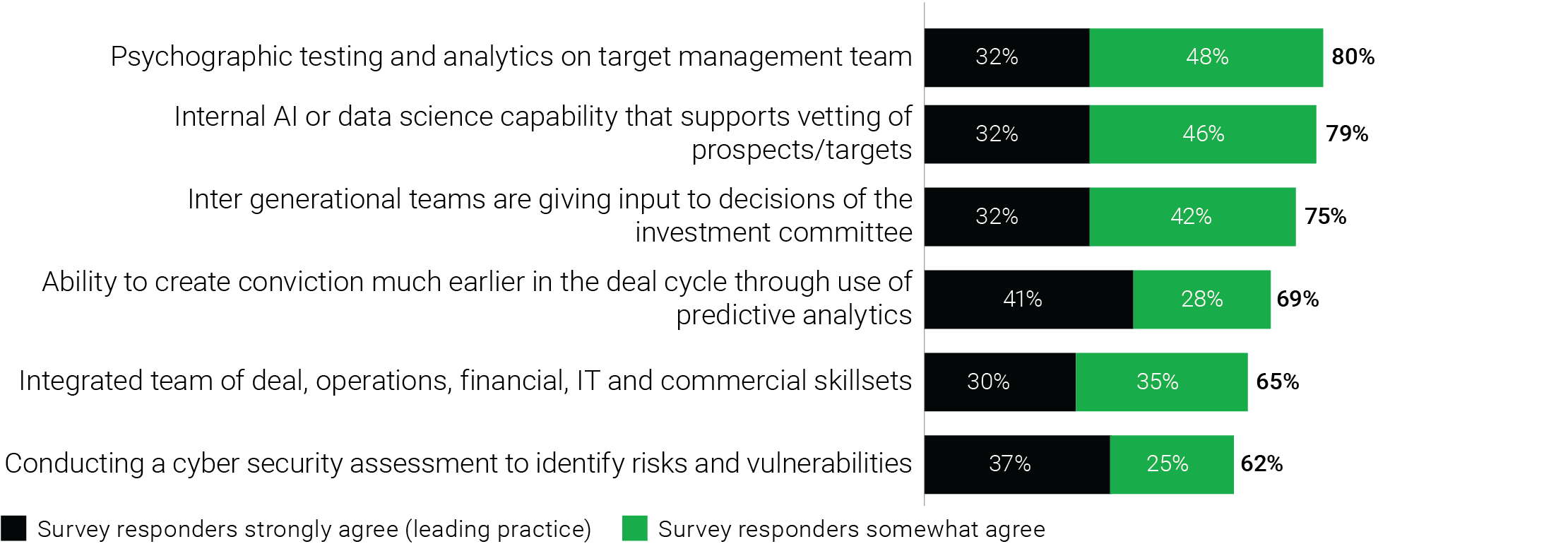

Deal Sourcing

Having generalists who are deeply skilled financial experts but who lack industry knowledge may have worked in the past, but not nowadays. As rollups become more and more common and attractive targets become harder to find, it pays to field deal partners who have deep expertise and have developed longtime relationships in an industry. At the same time, leading firms are using artificial intelligence (AI) to widen the lens through which they look for prospective investments so they can analyze companies quickly and enable more companies to pass through the funnel.

Strength of belief that leading practices within Deal sourcing contribute to superior PE Firm performance

Due diligence

The AlixPartners Private Equity Leadership Survey has consistently documented the increasing importance of leadership in value creation. The earlier a firm can assess a potential investment’s management team’s talent, the better. Having integrated teams in place as part of the diligence process—across finance, operational, technology, and so on—is also key and underscores the importance of breaking down both functional and generational silos at the PE firm.

Strength of belief that leading practices within Due diligence contribute to superior PE Firm performance

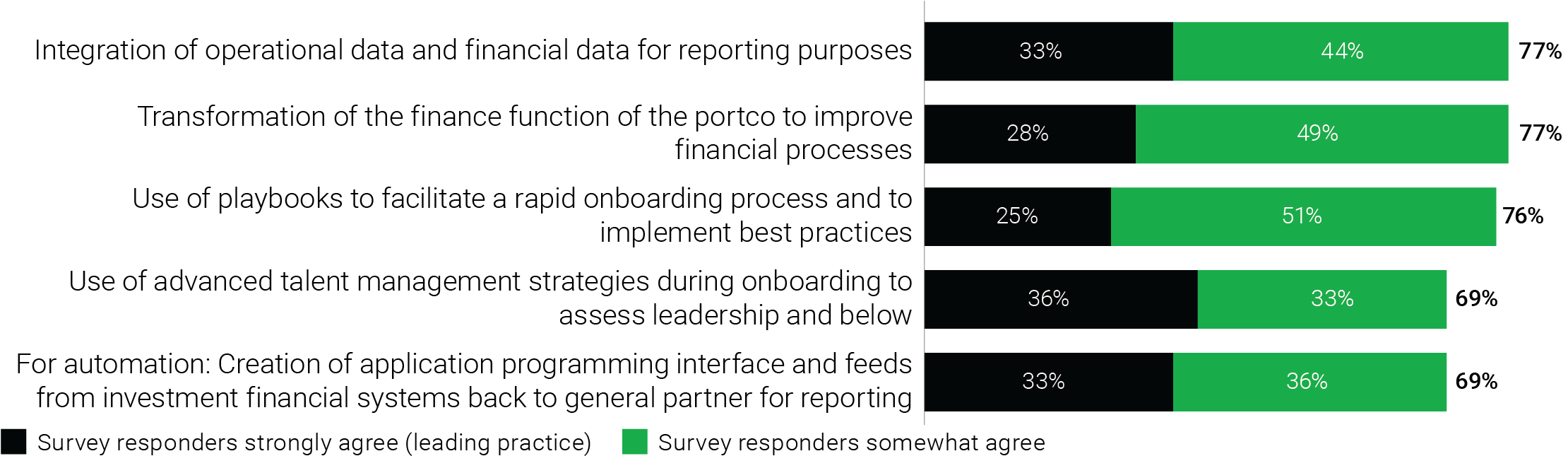

Onboarding

Every leading PE firm has—or should have—a well-developed onboarding playbook. Three of the five leading onboarding practices call out the importance of (1) integrating finance teams and financial data and (2) moving rapidly to ensure that portfolio companies (portcos) have the operating data they and their new owners need in order to improve the finance function and to organize and automate the collection of financial data. Onboarding is also the period during which leadership changes, if any, should be made and during which assessments should go deeper into the organization.

Strength of belief that leading practices within Onboarding contribute to superior PE Firm performance

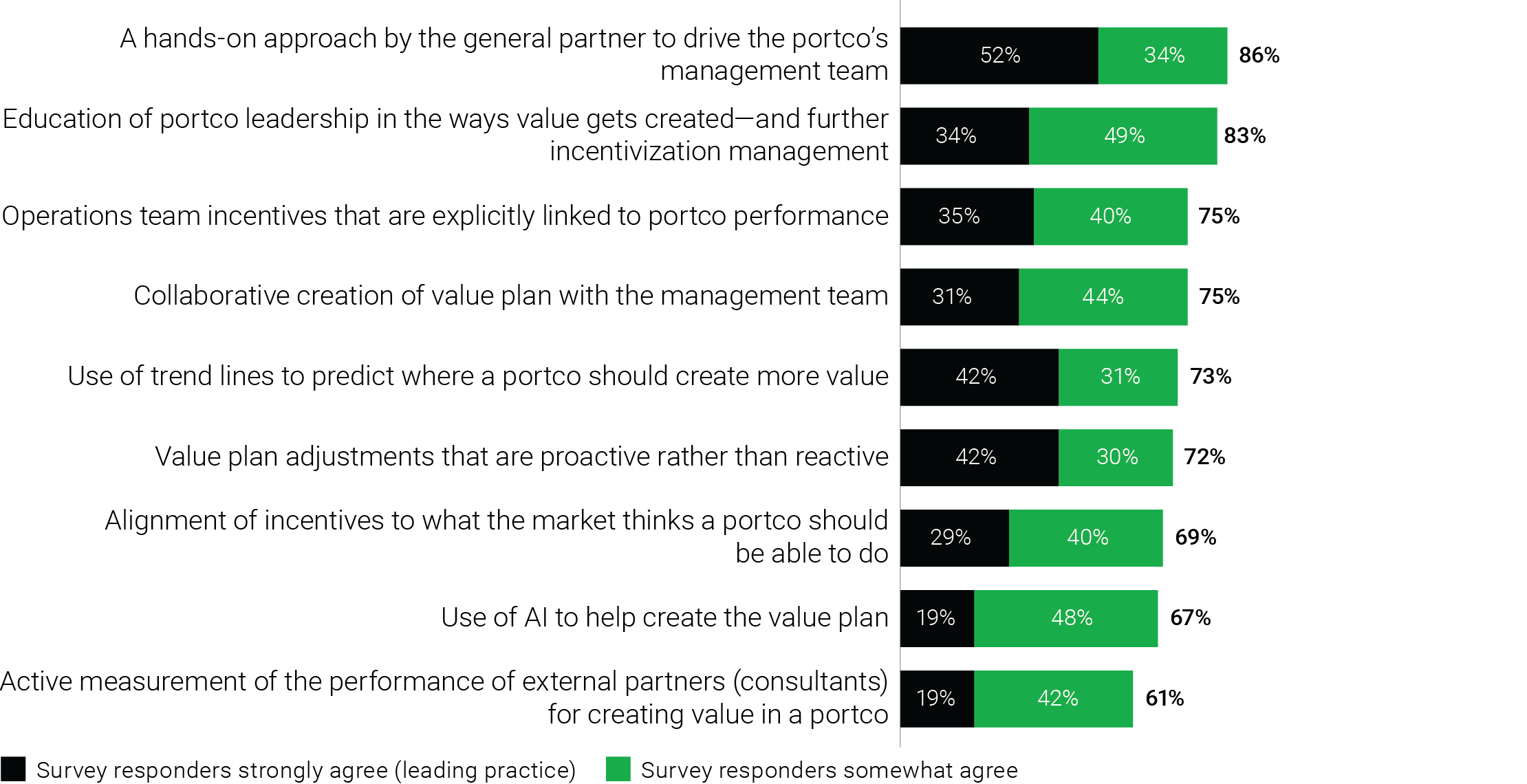

Value creation

Value gets created at every stage of the PE life cycle. However, the number-one practice of all of the 57 practices across the life cycle is the one that takes a hands-on approach to value creation during the holding period, as cited by 86% of respondents. That hands-on approach means having operating partners and boards that are closely involved in your investment and that are continuously working with and supporting portco leadership on strategy and execution rather than just selecting talent, setting goals, and leaving portcos more or less alone..

A hands-on approach becomes more effective when both management teams and internal general partner (GP) teams have correct and aligned incentives, a shared view of the value creation plan, and a clear understanding of the market and the business environment. Together these best practices reduce tensions between investor and asset and help define the ways each party can help the other achieve the goals both of them seek to achieve.

Strength of belief that leading practices within Value creation contribute to superior PE Firm performance

Portfolio monitoring

A hands-on approach to value creation has to be accompanied by a clear and long-term strategic view to make sure that operators are not so focused on the trees that they lose sight of the forest—that is, the deal thesis, industry trends, and macroeconomic trends. That understanding of trends and deal theses should be deployed not just at the portco level but also across a portfolio so as to identify opportunities and predict stressors. During our interviews with industry experts, even though there was agreement on the kinds of best practices that could be adopted during this phase, there appeared to be less agreement that a lot of firms actually are doing those practices. Therefore, implementations of best practices may be the one area that, across all phases, deserves the most attention to ensure that investments stay on track.

Strength of belief that leading practices within Portfolio monitoring contribute to superior PE Firm performance

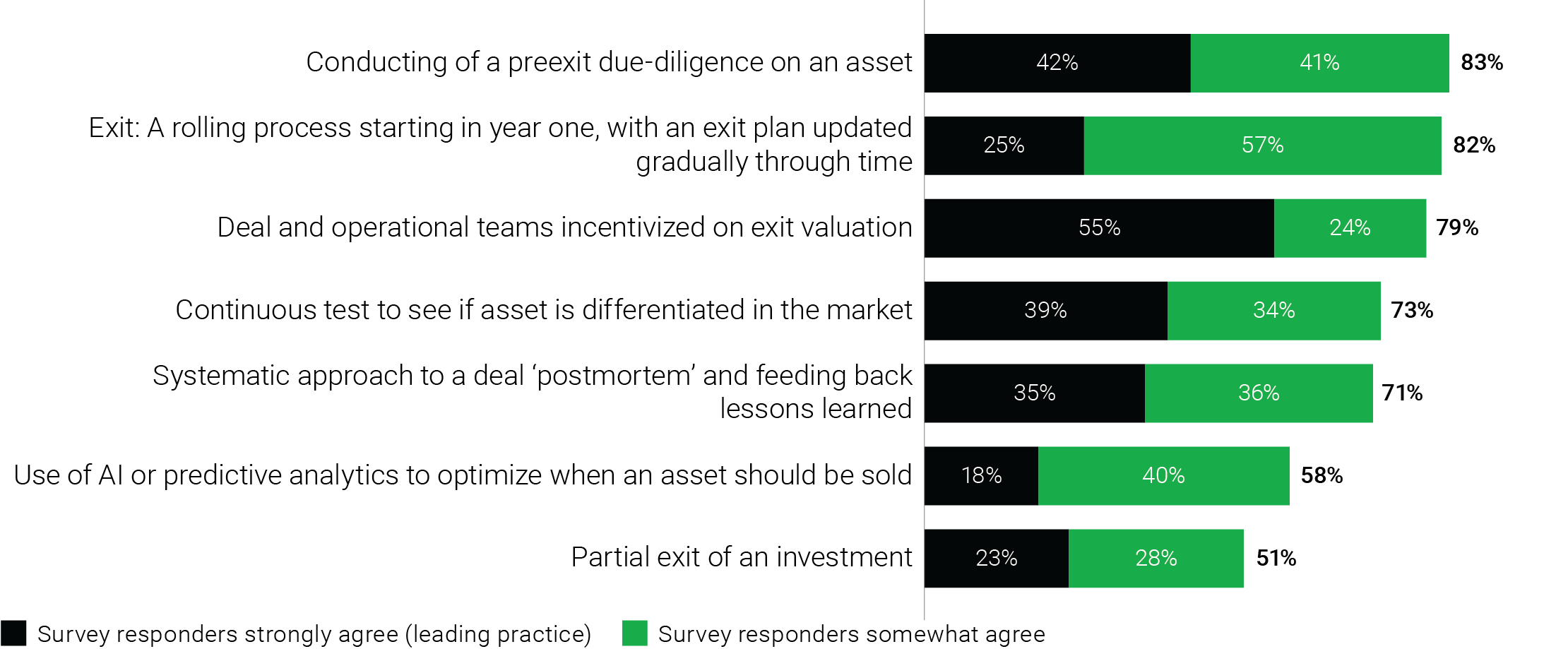

Exit

Three practices stand out with regard to maximizing value when portcos get sold and exit the fund. The number-one practice is to conduct a preexit due diligence through the eyes of a potential buyer. The second practice is recognition that a firm should begin with the end in mind; that is, the firm should operate throughout the holding period with its exit goals in mind. The third practice is to design incentives that ensure alignment between limited partners, operating partners, and portco leadership so that all are working toward the same goal. Those and the other leading practices add up to one thing: Exiting is not just a transaction; it is a process. And like all processes, exiting should be managed to produce continuous improvement, which is why conducting a postexit postmortem is an important practice.

Strength of belief that leading practices within Exit contribute to superior PE Firm performance

PE firm leaders owe it to themselves and to their investors and portco managers to undertake a candid assessment of their performance in each of those practice areas. Some practices will be more important to some firms than to others, depending on strategy, and no firm will get straight A’s on such a report card, but every firm ought to be able to raise its overall grade point average.

We’ll go deeper into each of these areas in subsequent articles. Before that, however, we’ll look at another set of leading practices: those that connect one stage of the value chain to another. In the same way that an operating business has to optimize both its vertical functions and its horizontal processes, so PE firms have to examine practices that cut across the value chain—things like talent management, data analytics, and firm integration. We’ll discuss those next time.