Consumers make three core demands when it comes to the perimeter of the grocery store: They want quality product, reasonably priced, reliably in stock. As grocers create their go-to-market strategies, they balance these variables based on what matters most to their specific customers. The parallel opportunity — often missed — is the extension of those priorities to the supply chain.

Most retailers optimize for cost and inventory levels, making fresh food quality an afterthought. That orientation is a mistake for regional and specialty grocers that rely on superior fresh departments as their key differentiator against national players.

A recent spate of fresh-focused supply chain investments reveals that even mass merchandisers that didn’t traditionally focus on the perimeter now see fresh as their next frontier. They recognize its importance in driving top-line growth, and they are making operational model changes to strengthen their position.

Frequency as a function of fresh

It's no secret why nationals have made it a strategic imperative to increase their share of the fresh dollar. It’s the same reason Amazon began its grocery adventure nearly a decade ago: frequency. Frequency is also the motive behind Amazon’s recent debut of free same-day fresh food delivery for Prime members. Frequency has long been the strength of regional and specialty grocers, while nationals generally capture larger baskets on fewer trips. Fresh food makes the difference.

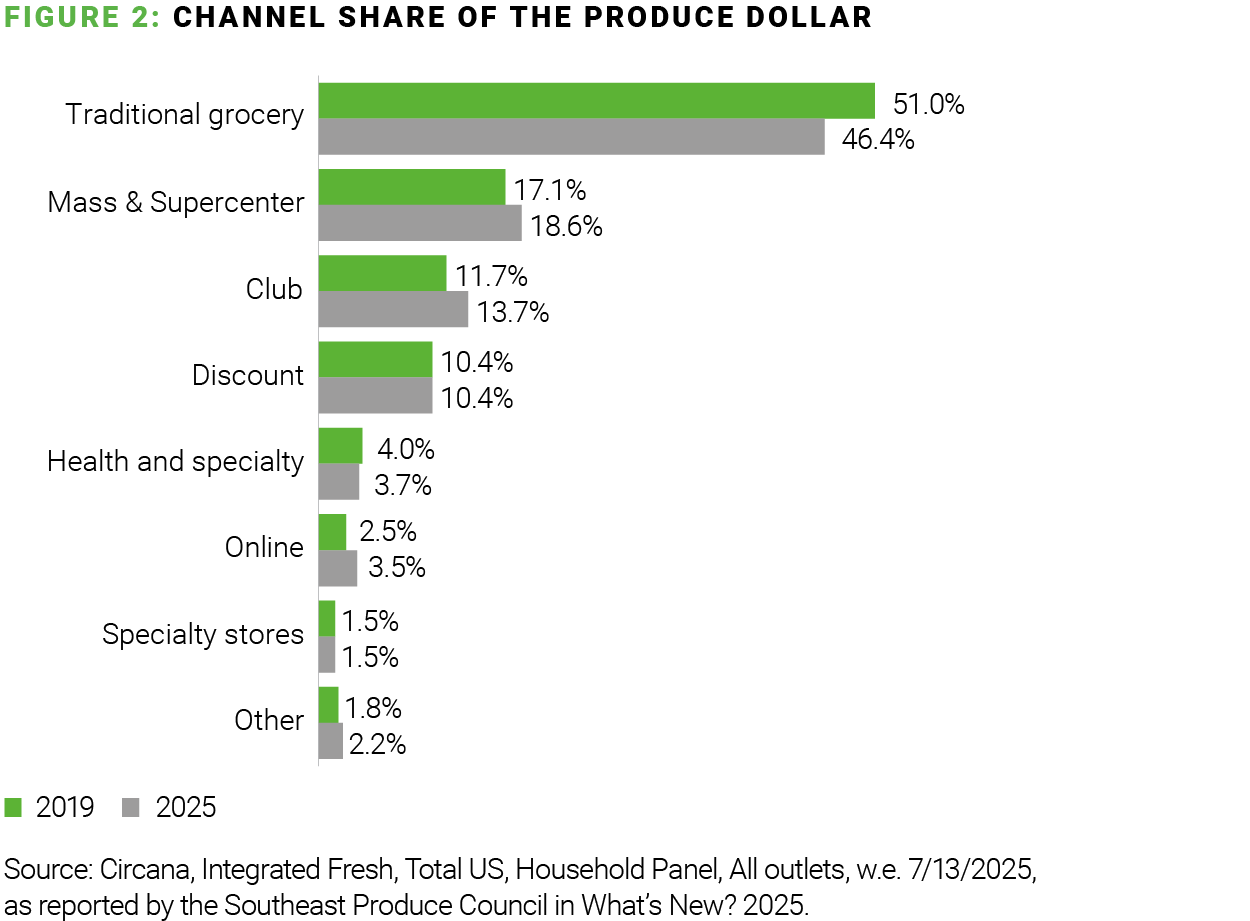

Not so long ago, nationals had a lackluster reputation in that area, but they have upped their game. Fresh isn’t the barrier for nationals — even EDLP retailers — that it used to be, and the continuing shift of market share proves it. Not only have nationals gained market share overall, but they’ve done so in traffic-driving departments like fresh produce.

National players’ strategic focus on and improving performance in fresh food should incite a serious sense of urgency in regional and specialty grocers. If their share of the fresh dollar declines, so too will trips, and overall sales will follow the same dismal trajectory.

For nationals, fresh is a growth opportunity. For regionals and specialty grocers, it is a matter of survival. This is a zero-sum game; every share gain for one retailer is a share loss for another.

Because fresh food is what separates regional and specialty grocers from nationals, they must take advantage of every opportunity to protect and expand their reputation for superior fresh departments. It should be a top priority — and that should be reflected in their approach to supply chain. Cost and stock levels always matter, but so do shelf life, handling, quality control and other metrics and processes necessary to deliver an elevated fresh experience in stores.

Done right, supply chain optimization that takes fresh food quality into account can go a long way toward widening the gap to nationals in quality and narrowing the gap in price.

The fresh effect

Maintaining high standards for fresh matters for regional and specialty grocers first and foremost because it matters to their customers. It creates the ultimate halo effect, enhancing overall quality perception, shopper trust, and loyalty.

A less obvious reason to fixate on freshness is the opportunity for greater profit. When product moves through the supply chain more quickly, more of it gets sold; less turns into shrink.

Slower movement might deliver some cost savings up front but may well introduce other costs further down the line; every time product expires in the custody of a retailer, financial loss abounds — the cost of goods, the cost of labor that went into displaying and shrinking out the product, the cost of future sales that customers shift to other stores after observing subpar product on display, the cost to dispose of the product, and on and on.

Improving freshness and sell-through strengthens the relationship with the customer, but it also lowers the costs associated with waste. Thinking about the implications of every supply chain decision on fresh food quality makes sense for the customer, and it makes sense for the business. Practices that reduce waste can also contribute greatly to sustainability goals.

Leveraging supply chain to further differentiate fresh departments

As regional and specialty grocers consider their opportunities in supply chain, where scale is so often prized above all, they should remember that a smaller footprint can actually be an advantage. Below are just a few examples.

Different partners and products — Because regionals have fewer stores, they require less volume, so they can access a different supply base, namely smaller growers and producers that offer local and specialty items. While nationals have to insist on standardization, regionals can be more flexible. They can keep their assortment fresh by rotating through seasonal and trending items.

Ease and speed of implementation — Regionals should have an easier time maintaining standards. They should be able to exert greater control simply because there’s less to control. If a regional wants to level up the quality control procedures for goods coming into its distribution center, for example, it might need two more people. Were Walmart to commit to the same process, it might need to hire 50 people because it has so many more DCs.

Department ownership at store level — Demand forecasting technology, once only available for national players that had the wherewithal to build it themselves, has largely been democratized and should certainly be utilized by regional and specialty grocers that aren’t using it already. One additional asset they have that nationals do not, however, is a fleet of experienced department managers. Many of these store-level leaders have such familiarity with their customers that they can make savvy assortment decisions and snag opportunities that might be missed by a system. Creating a feedback loop so that their observations can be incorporated into buying and distribution decisions will also produce a unique benefit for regional and specialty grocers.

Stronger vendor relationships — Regionals can much more easily invite their suppliers into their world, whether that’s bringing the product experts into the DCs so inspectors can receive training on quality, or whether it’s bringing in growers to sample product in stores. Partnering with promising small suppliers and helping them grow their business will often result in vendors giving the retailer preference on quality, on supply in the event of shortages, and more.

Putting freshness on par with cost and inventory optimization isn’t a radical idea. It’s merely treating fresh like any other business area, where best practices are those that maximize sales and minimize losses. Maintaining sales-driving conditions (in stock, stable inventory, high quality product on display, a clean environment, etc.) will naturally increase volumes and throughput and drive down costs related to waste along the way.

Driving down costs will allow regional and specialty grocers to be more competitive in price, which is especially critical in a landscape that offers consumers EDLP options on every corner.

Differentiation at risk

Regional and specialty grocers shouldn’t underestimate the advances that national players have made and continue to make in fresh food. Over the last 20 years, mass merchandisers dismantled the original “one-stop shop” by establishing price leadership in everything non-fresh. Now they want to revive the title and claim it for themselves — and they can do it if they get close enough on fresh.

As national players aim to narrow that gap, regional and specialty grocers have to be relentless in finding ways to maintain their fresh advantage and get sharper on pricing at the same time. They put themselves in the best position to accomplish both when they optimize their supply chains for fresh food quality and shelf life and take care to regard their size as the benefit it can be.

Want more? Here’s additional fresh insight from our team of grocery experts.

Unite your merchants, your marketers, and your stores for fresh food success

Prioritize selling conversations with your fresh food suppliers

Three ways grocery retailers can promote more profitably in fresh

2025 Grocery Shopper Perspectives Report