Sonia Lapinsky

New York

Last year, we relaunched our historic Consumer Sentiment Index (CSI) to uncover what truly matters to consumers, and help retailers focus on meaningful priorities. This year, shoppers have been on a roller-coaster of tariffs, inflation, and price hikes, leaving sentiment at a low.

Our latest CSI—built on insights from more than 9,000 shoppers—clearly shows how these pressures are reshaping consumer priorities.

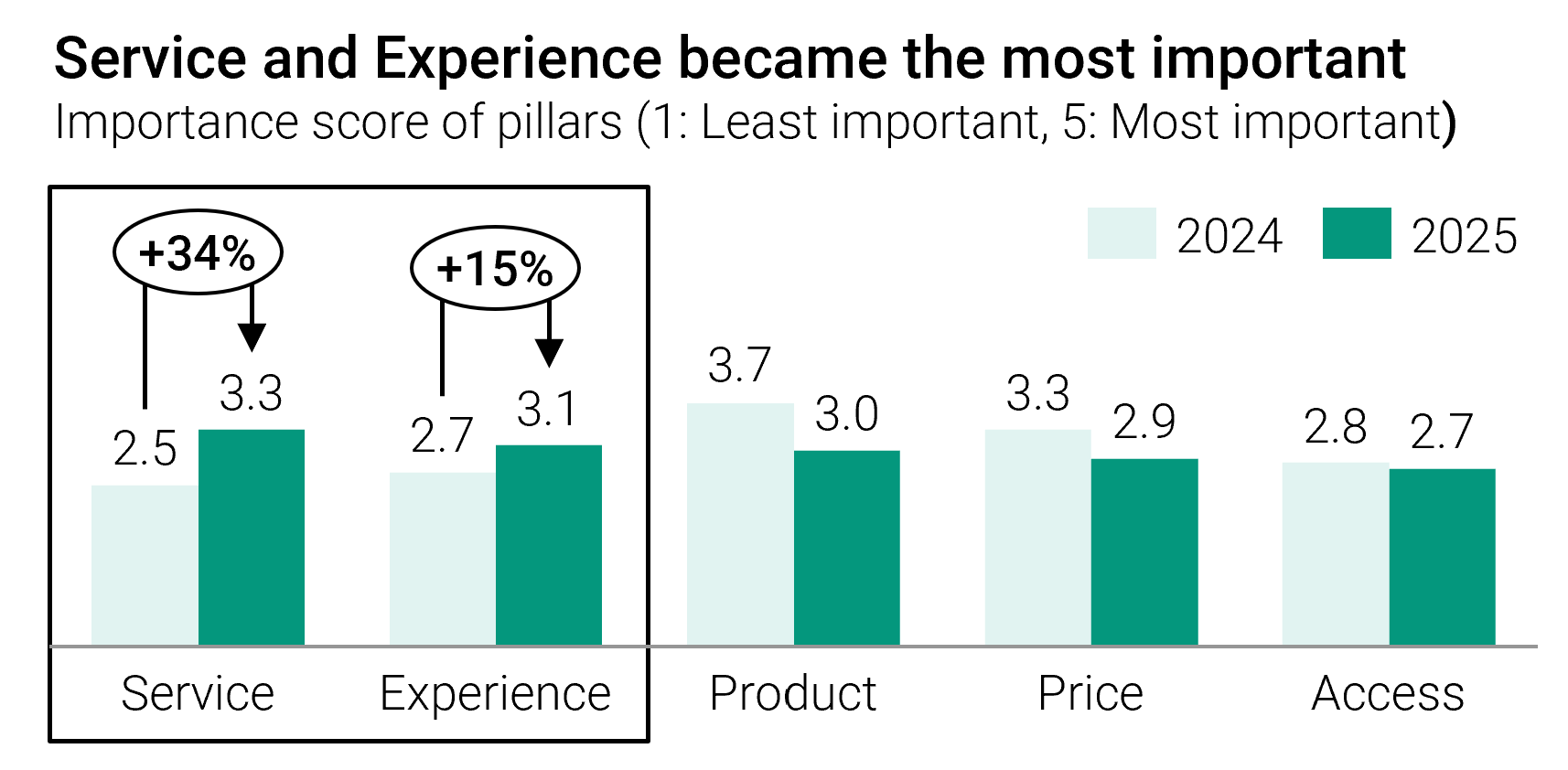

Service and experience have jumped in importance, while price has dropped—but it’s not that simple. Brand connection is outshining discounts and value is being redefined as consumers prioritize ease, convenience, access, and trust.

The shake-up is brutal: legacy leaders like Chanel, Kohl’s, and Abercrombie are slipping. The new leaders like On, Levi’s, Ralph Lauren, and Tory Burch have emerged.

Even as specialty faces a spending pullback, some brands are breaking through. Today, connection—not discounts—drives growth, with service and experience now consumers’ top priorities. Leaders like Ralph Lauren and American Eagle connect deeply with their core consumer – whether through attention-grabbing campaigns or by tapping into emotional heritage. But if they fail to follow through with standout service and unforgettable experiences, they risk losing that connection—and the consumer.

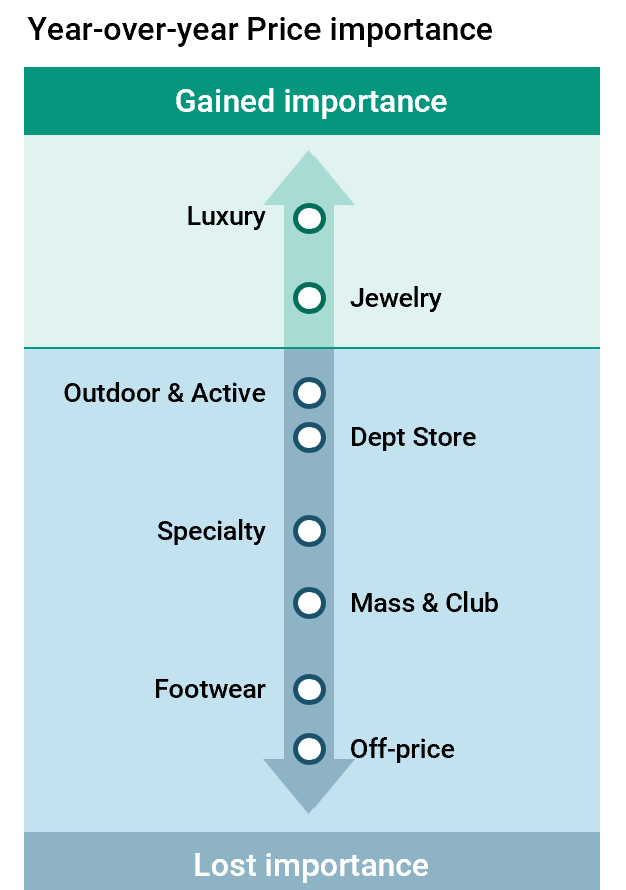

Price has dropped in importance across 7 of 9 sectors, signaling a major consumer shift. Shoppers still care about cost, but demand trust, transparency, and quality first. Discounts no longer guarantee demand—brands relying on pricing games risk fatigue, lost credibility, and defection.

Younger generations are reshaping accessories, favoring resale, rental, and dupes over ownership, while older shoppers still prize quality and permanence. Authenticity is the unifying demand, with consumers trusting platforms to provide proof. Winners will balance flexibility, trust, and timeless value.

After decades of hype, personalization is falling flat. Fewer than 30% of consumers value current tactics. Data privacy now outranks personalization, while relevance matters most. Shoppers want trust, respect, human assistance, and connection.

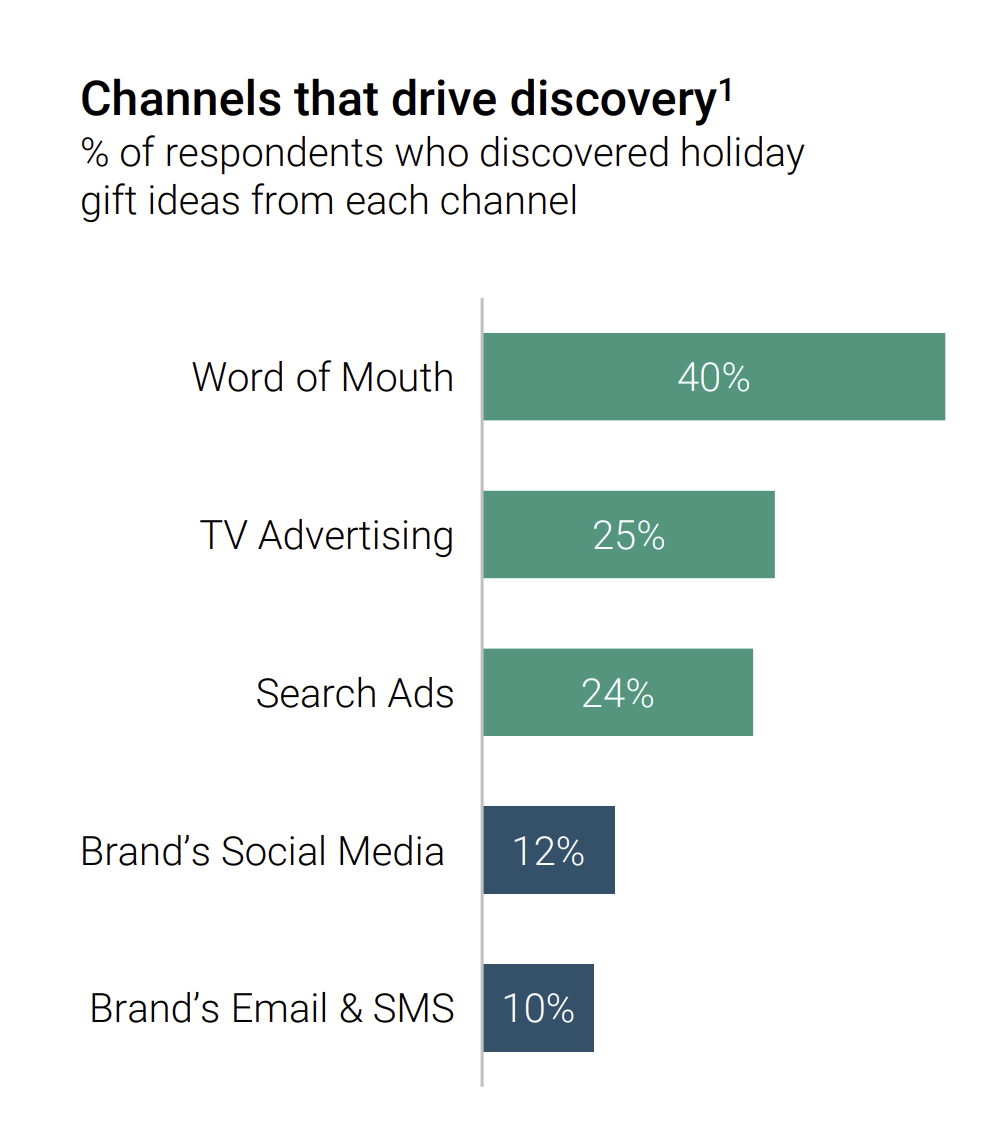

1 AlixPartners US Retail Holiday Outlook Survey, 2025

We take a deeper look into these themes, plus we analyze nine subsectors to understand how consumer sentiment is shifting, revealing exactly what’s in, and who’s out. The full details are inside this year’s CSI - read it here.