Steve Scales, Jr.

New York

Holiday shoppers are clicking “add to cart” faster than ever as shipping vans weave through streets to deliver the goods on time. As e-commerce surges with holiday volume, shipping windows, fulfillment promises, and return policies become make-or-break factors for winning and retaining customers. For retail leaders facing heightened competition, thinning margins, and jittery consumers, the difference between delighting and disappointing a shopper this season may come down to how they manage the invisible art of holiday logistics in an environment where every penny counts.

Since 2012, AlixPartners has conducted the Annual Home Delivery Survey to understand how consumers’ expectations for delivery services have shifted with the growth of e-commerce. Starting in 2023, we added the voice of executives to our survey to understand how retailers planned to meet those expectations. We recently examined the top 100 retailers to gain insights into their stated shipping time expectations, delivery windows, and return policies. Additionally, we examined the number of offers that include paid memberships with benefits related to shipping costs and returns.

As retailers seek to differentiate themselves from the competition, benchmarking against their peers may be a way to develop a competitive edge in terms of deliveries and returns, provided they can make the economics work.

However, our analysis of the top 100 retailers reveals that few retailers have found a way to differentiate themselves in terms of speed and cost, other than by offering membership programs (such as Amazon Prime and Walmart+) that encourage volume ordering to offset the somewhat steep annual fees.

All but three of the top retailers included in our analysis offer the basic level of services: Buy online, pickup in store. BOPIS is a win-win for customers and brick and mortar retailers. Customers avoid paying shipping fees and don’t have to worry about delivery times. Additionally, they know the item is reserved and waiting for them. Retailers hope that customers dashing in to pick up the reserved item might remember something else they need or make a spontaneous purchase. To differentiate a ubiquitous offering, retailers should ensure they provide the smoothest experience possible, with clear signage and a fully staffed retrieval operation. While BOPIS is the most cost-effective option, it is also the riskiest, as it is highly dependent upon inventory accuracy and a timely fulfillment operation to meet customer expectations.

Curbside pick-up also provides the near-immediacy option and can be enhanced through geofencing, rapid deployment of staff to the curb, and dedicated pickup lanes and spaces. While this provides another level of customer convenience, retailers lose the opportunity for impulse buys.

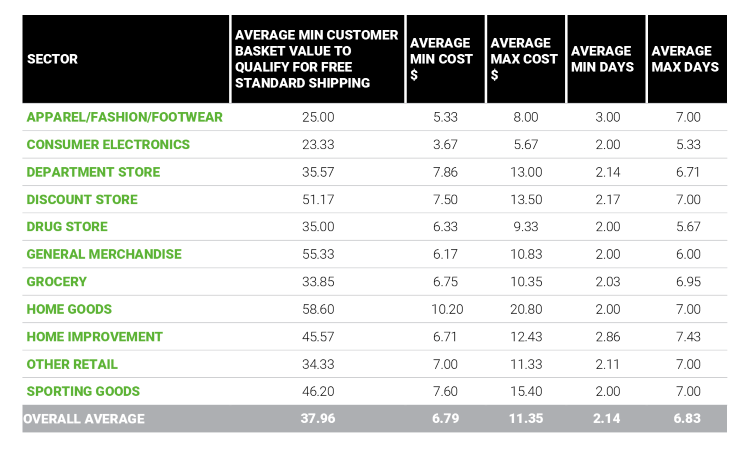

Standard shipping windows are remarkably uniform, with top retailers offering delivery within 2-7 days. Over the last several years, the AlixPartners Annual Home Delivery survey revealed that consumers expect to receive goods on average in 3.6 days. If that can’t be met, they may consider shopping elsewhere. Additionally, the threshold for qualifying for free shipping is creeping up. Gone are the days of a $25 minimum; the average among the top 100 retailers is $38. Raising free-shipping minimums and membership requirements were actions executives reported as their main strategies to combat rising shipping costs in the 2025 Home Delivery 2025 survey. Additionally, executives responding to our survey conceded the difficulties in meeting the 3.6 shipping window consumers prefer.

Figure 1: Standard delivery

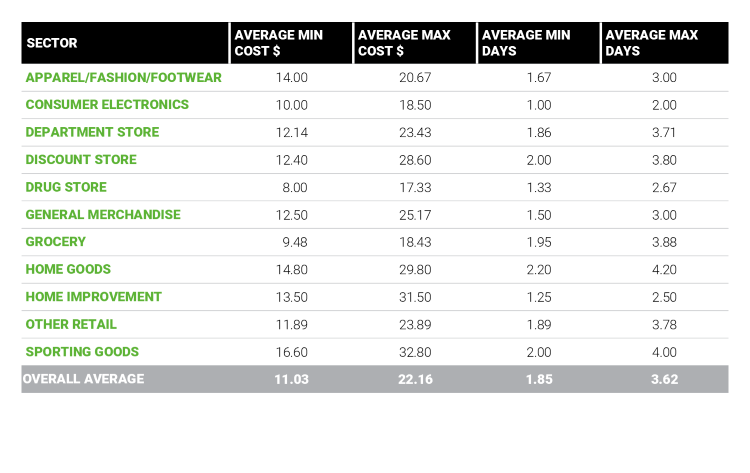

When shoppers aren’t content to wait for standard shipping, expedited shipping, offered by all but 8 in our top 100 data set, is the next option. The average minimum number of days across this set of retailers is 1.8 days, and the average maximum is 3.6. On the cost side, the average minimum charge for expedited shipping is $11.03, and the average maximum charge is $22.16.

Figure 2: Expedited shipping

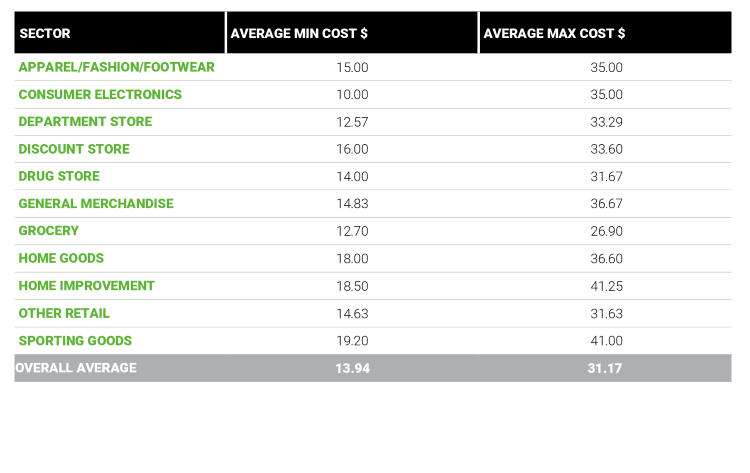

Ultra-fast shipping options are no longer a differentiator. Research from Capital One Shopping reveals that 80% of consumers expect retailers to offer same-day delivery options, and 30% expect free same-day delivery.

Roughly 80% of the top 100 retailers offer a next-day delivery option, with average costs ranging from almost $14 to $31.

Figure 3: Next-day delivery

Return policies also show considerable variance, with exclusions based on the type of products. For example, grocers won’t accept returned perishable products. Fashion retailers often exclude specialty apparel (such as prom dresses), and certain electronics cannot be returned if the box has been opened. A 30-day return window is most common (88 out of 100), with some retailers commonly extending this to 45 days for December purchases. Two leading electronics retailers have a 15-day window, and the remaining have 60 to 90 days. The most generous return windows of 90 days are offered by members-only clubs (BJ’s, Costco, and Sam’s).

While 45 of the top 100 retailers don’t accept returns by mail, this group is dominated by grocery and drug store chains. When it comes to return fees, only one of the top 100 charges a flat fee of $6.99 (unless the product is defective). Other retailers do not have a stated fee for most products, but many have restocking fees for a range of items (read the fine print).

Many retailers offer shoppers the opportunity to exchange online purchases in stores, providing another opportunity for impulse purchases. But according to our 2025 Home Delivery Survey, consumers have expressed a clear preference for handling returns by dropping them off at a UPS or FedEx location.

Membership benefits related to shipping vary among the 13 retailers in the top 100 that offer these programs, but standard free shipping is a common core offering among 11 of the 13. The average annual membership cost among the retailers included in our analysis is $98, and benefits vary widely by company and category. These companies are likely to position the membership fees, especially the most expensive ones, around key benefits, such as convenience and annual savings on shipping fees.

Retailers who consider home delivery as part of their brand experience should think beyond offering fast versus standard delivery options. Instead, offering shoppers more control over how and when their shipments arrive by providing defined delivery windows, the ability to reschedule, and evening or appointment deliveries aligns with evolving consumer expectations.

The standard distribution center model must be modified or augmented to enable this level of consumer control. Moving inventory closer to customers is key; micro-fulfillment centers, urban hubs, or ship-from-store operations are some of the options grocers, home improvement, and general merchandise retailers are rolling out to provide more flexibility in their fulfillment and delivery network.

As the busy final shopping days approach, will retailers adjust their policies and tighten the “order by date” for guaranteed delivery with expedited shipping options? Once the books are closed on this holiday season, retailers should assess how they can begin to prepare for the next one. As customer expectations evolve faster than delivery trucks can roll out, retailers that invest now in flexible, efficient fulfillment strategies will set the pace—and the margins—for next year’s holiday race.