Lisa Hu

Chinese households are entering 2026 with tighter everyday budgets and higher expectations for value with every purchase. In this increasingly challenging market, success hinges on one core challenge: turning more demanding consumers into resilient, repeatable demand.

Part 1 - Outlook: Global rules now apply – China moves from confidence to hard-won growth

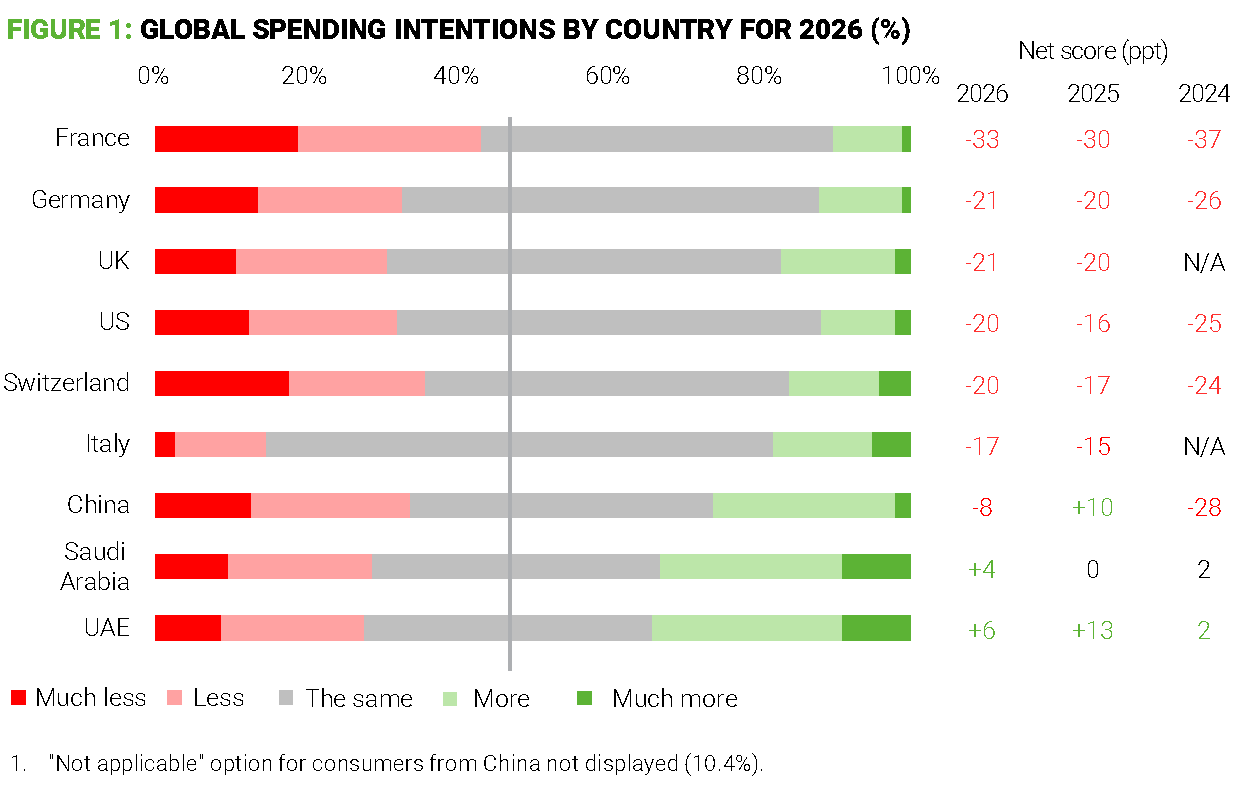

AlixPartners’ Global Consumer Outlook 2026 (GCO) is a tale of two downturns. In mature markets worldwide, consumers expect to spend less—a continuation of the steady slide in confidence seen over recent years. Persistent inflation, higher borrowing costs and economic uncertainty are prompting even groups that had previously held strong—older and higher-income consumers—to watch their wallets more closely. But in China, the downshift is much sharper: net spending intent has swung from +10 percentage points (ppt) in 2025 to -8 ppt for 2026 (Figure 1). It’s not just a deepening of the pullback, but a marked turnaround from growth engine to reversal risk.

Globally, the only demographic retaining slightly positive net spending intentions is adults under 35. In China, the retreat is near-universal: even younger adults no longer share the relative optimism reported by their counterparts elsewhere.

Given the depth and breadth of the reversal—and the ongoing pressures on housing, jobs, and income—this softening of Chinese consumer confidence looks more like a structural reset than a passing dip. China’s shoppers have joined the global slowdown; retailers that treat this as a strategic inflection point—and move quickly to recalibrate their propositions, pricing and footprint—will be best placed to increase share in a market where every sale has to be actively won.

Intentional and disciplined, not simply constrained

Consumers worldwide may be holding back on purchases, but Chinese households are applying a distinctly deliberate, value-driven approach to spending that goes beyond blanket belt-tightening. They are not only spending less but spending smarter: every purchase is subject to scrutiny for clear proof of value; each category must re-earn its place in the household wallet. Consumers are more willing to delay, downgrade, or substitute than in previous cycles.

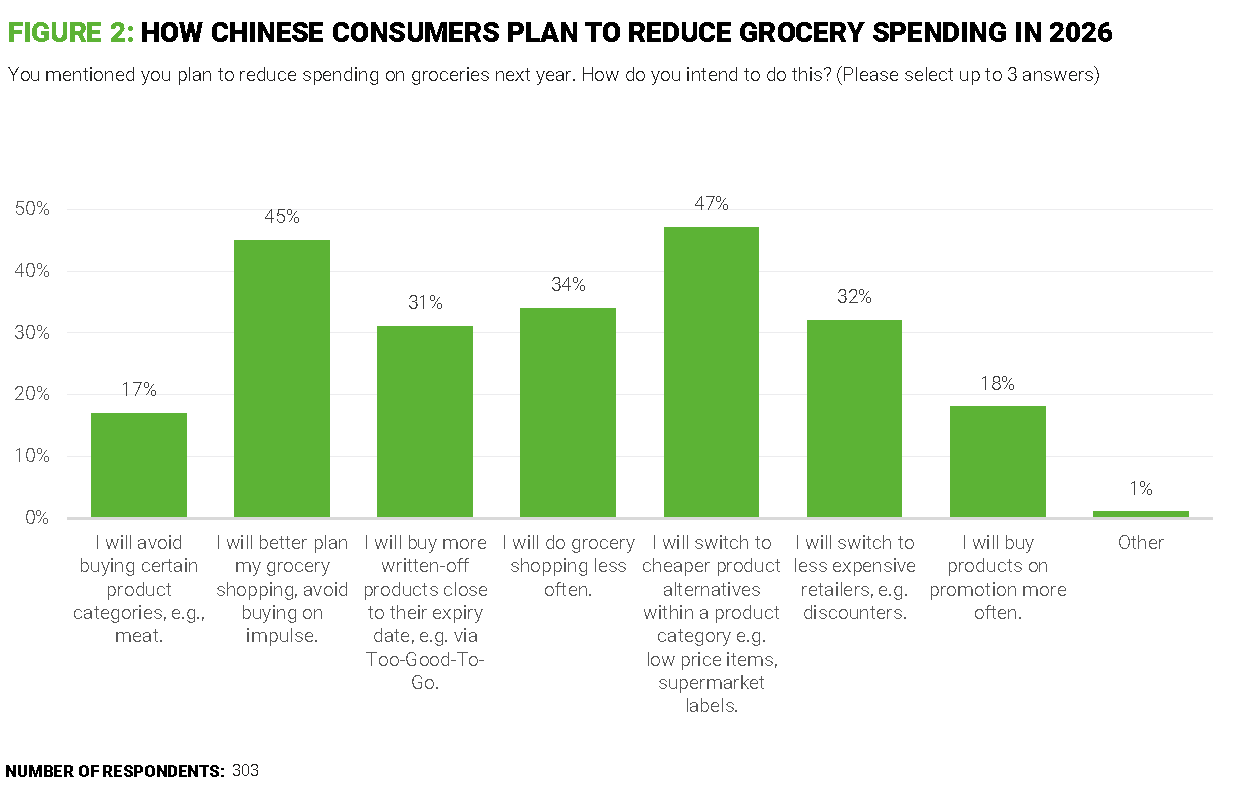

Grocery spending: China is a telling outlier

Even essentials aren’t insulated from the budget squeeze. Groceries are the only category expected to grow on a global level in 2026, with a net +8ppt spending intent—driven largely by price rather than volume gains. China breaks the pattern: a slight 2 ppt net decline in planned spend reflects even keener price sensitivity. Shoppers report highly methodical food-shopping behaviors: most commonly cited were trading down to cheaper products and private labels, planning meals and avoiding impulse purchases, and shopping less frequently (Figure 2). This contrasts with many Western markets where the sharper pullback is in non-food retail and out-of-home experiences, with grocery still bolstered by the shift to spending more time at home.

Aspirational frugality: cautious today, adventurous tomorrow

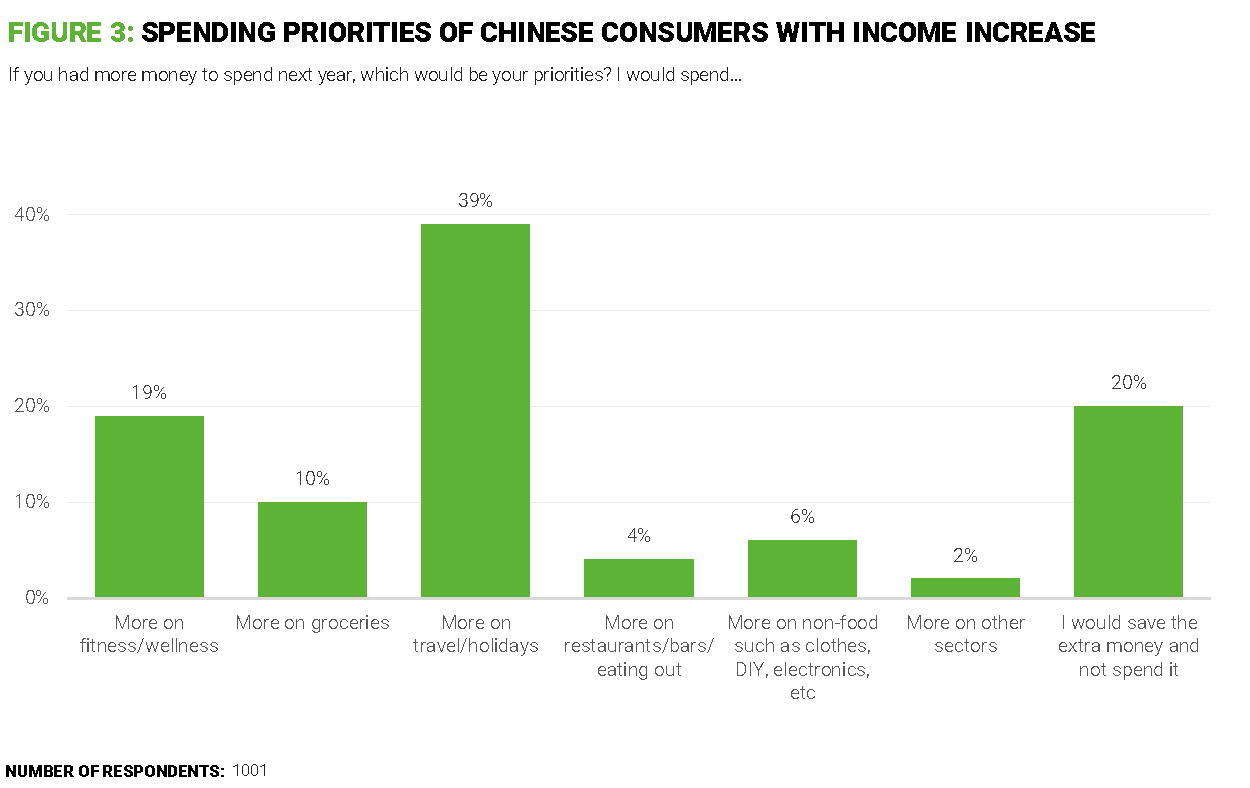

While the near-term looks lean, the data points to potential future upside for retailers that lean into the new consumer mindset. Chinese GCO respondents reported that they might be thinking twice about discretionary purchases, but their “wish list” choices suggest aspirations have been put on pause, but not abandoned. When asked how they would allocate any additional income, only 20% prioritized saving over spending more in any category—compared to 31% globally. Their top choice was travel and holidays (39%), followed by fitness and wellness (19%) (Figure 3). That stands in stark contrast to the picture in the U.S., where 42% said they would put any extra funds straight into savings; the runner-up priority was topping up grocery budgets. U.S. consumers remain focused on practical essentials—but Chinese households are prepared to invest in experiences and self-improvement when they see room to spend.

For retailers in China, this combination of restraint and aspiration creates a market that will remain structurally value-driven, but retains significant latent demand in categories that feel meaningful, help consumers to recharge, or offer a clear sense of progress or reward. This dual mindset points to a winning formula: offer dependable value in daily purchases, combined with moments of curated premium experience, to capture and satisfy that mix of consumer prudence and aspiration.

Part 2 - Retail playbook: winning in a value-driven market

The shift in sentiment is an opportunity to sharpen competitiveness, not a reason to pull back. Moving early—optimizing portfolios, reinforcing value propositions, rethinking formats, and investing in AI and analytics—is critical to capturing an outsized share of the new considered, cost-conscious demand.

Portfolio strategy: focus and grow

This is the time for disciplined, strategic expansion, not withdrawal. Prioritize profitable stores and viable catchments. Reallocate capital to locations and formats with strong traffic and strategic relevance. Forward-thinking operators are already renegotiating rents, shortening leases, and testing pop-ups or flexible footprints to de-risk fixed costs, while concentrating investment in high-productivity “hero” sites.

Proposition: articulate value and build trust

Double down on value and new formats: a consumer continually reevaluating what deserves a place in the budget will respond to more transparent pricing and well-aimed promotions that make value easier to see and believe. This could include “good-better-best” price ladders, clearly signposted trade-down paths, more targeted discounts, and loyalty schemes that reward frequency and long-term value rather than one-off bargain-hunting.

Analytics: engage the new value-seeker, profitably

Channel and format innovation is already reshaping China’s retail landscape. Value-seeking consumers are migrating away from traditional department stores and hypermarkets to membership warehouse clubs, snack chains, and discount stores, which are now growing at double-digit rates (in some cases, 40-90% year-on-year). Many retailers are expanding into live-commerce, short-video platforms, and community group-buy, so that they can reach bargain-hungry consumers who compare prices online.

Data-driven decision-making is key to serving this fluid demand profitably. Advanced analytics can help boost conversion without blanket discounting—tailoring micro-local product selections, designing basket-level promotions, and personalized offers. In a selective, slower-growth environment, real-time price point adjustment and inventory allocation are core capabilities rather than nice-to-haves.

Experience spend: turn visits into value

Experience-led categories are bearing the brunt of the value debate, with out-of-home food and beverage operators under the most acute pressure. 31% of consumers globally, and 39% in China, say these experiences don’t deliver sufficient value to justify the expense. For restaurants and entertainment venues, “good enough” is no longer enough. Recovery depends on dialling up distinctiveness: curating memorable experiences that can’t easily be replicated at home. Clearer price ladders and bundles (such as family sharing formats and off-peak deals) articulate what guests are getting, and at what discount; better, more personalized service and atmosphere help convince customers that their money was well spent.

Wellness: harness the next wave of demand

Fitness, wellness and self-care are a promising frontier for retailers: as confidence returns, Chinese consumers are poised to direct more of their savings towards wellness categories that deliver tangible health, lifestyle and performance benefits. The key to capturing early demand is making wellness feel both accessible today and aspirational for tomorrow. Now is the time to sharpen and simplify health-focused offers, from better-for-you snacks and FMCG to activewear and simple home workout gear. Benefit-led product curation (improved sleep, lower stress, stronger immunity) is more persuasive than vague lifestyle claims. Partnering with gyms, wellness apps, and other fitness brands on bundled memberships—and linking loyalty rewards to longer-term wellness goals—helps pull value-seekers into ecosystems that drive higher frequency and lasting loyalty over time.

Restructure for agility and resilience

Finally: structural readiness will determine performance. Many players will need to consolidate overlapping brands, streamline support functions, and invest in automation across logistics and stores to reduce the operating cost per unit of demand. The goal is a leaner, more intelligent retail base: agile enough to weather a cautious climate, and then to scale quickly when consumers begin to spend again.