Bryan Eshelman

New York

Uncertainty is baked into the 2026 outlook for retail, which remains one of the most disrupted industries. For all the predictions over how the industry will change, a state of permacrisis makes it challenging to act decisively—no one knows where tariff policy or geopolitical conflict will land months from now—but retailers cannot wait for the next shoe to drop.

Many pundits and prognosticators make bold and often binary predictions for the retail market ahead. Our point of view is that retailers need to look at the realm of possible outcomes, knowing the flywheel of disruptive events will accelerate, and focus instead on controlling the controllable. To that end, we’ve analyzed the major variables, and created scenarios for the most game-changing shifts retailers may face this year:

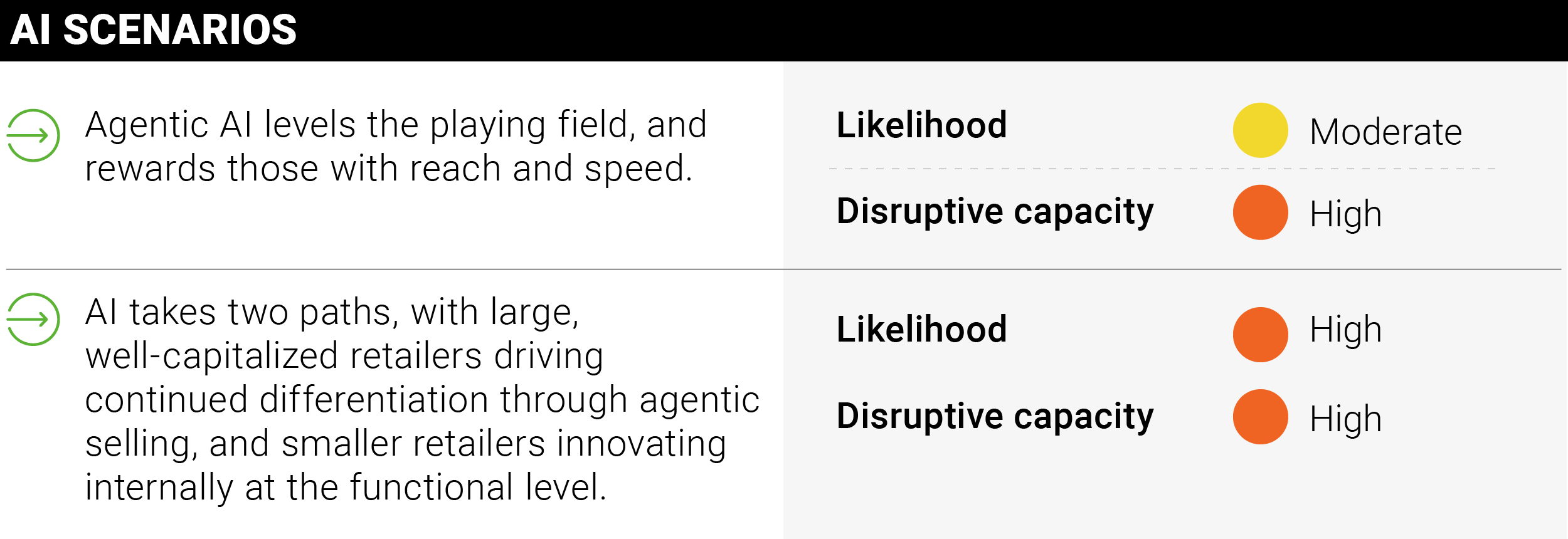

Agentic AI may be a Eureka moment for retailers who crack the code in 2026—but more likely AI drives a longer-term transformation across the industry, begging the question: will it level the playing field, or create a bifurcation between well-capitalized companies and smaller, better differentiated players?

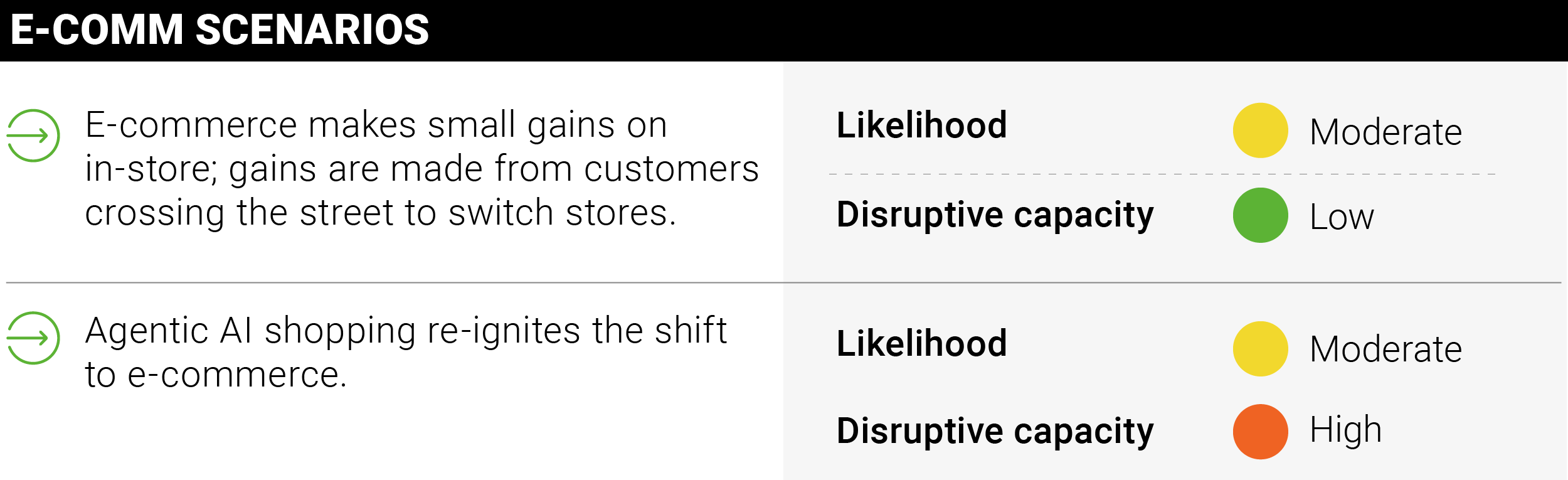

E-commerce may continue to erode the economic viability of brick and mortar, or we might be on the cusp of a new battle between competitors doing the in-store experience well.

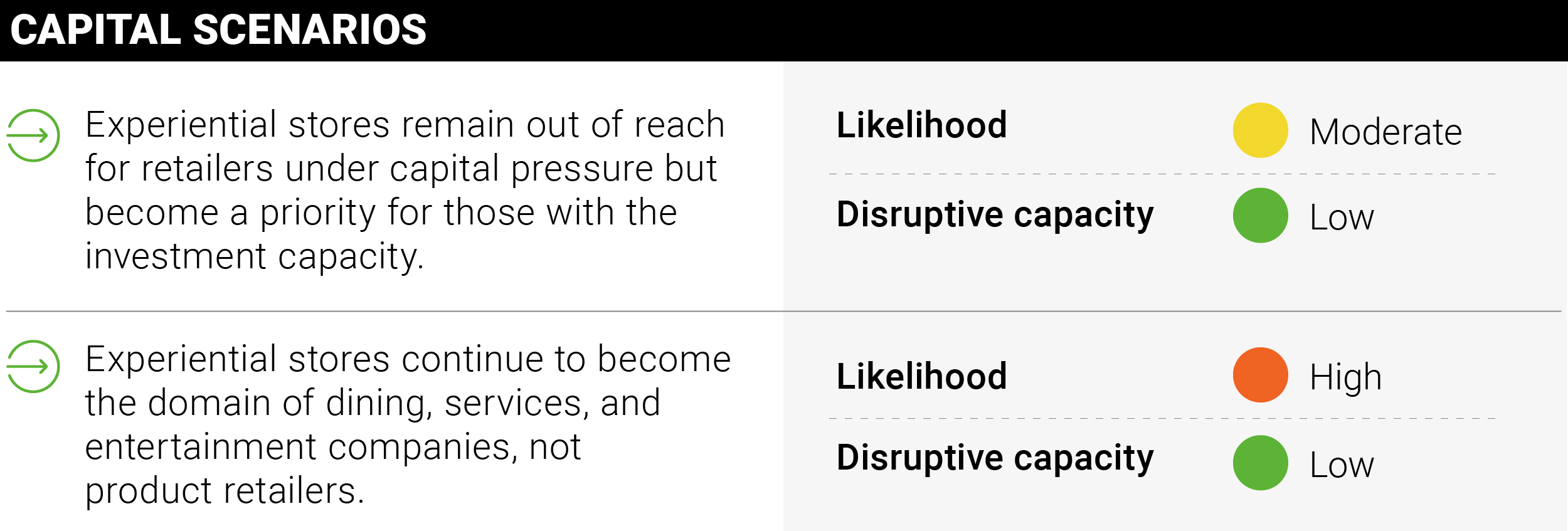

As retailers focus on the value of experiential and fulfillment stores, capital conditions will impact who has the leeway to invest, and which segments show a strong ROI.

Economists are split on whether inflation will rise or ease, with very different ramifications for the cost of capital and viability of deal-making.

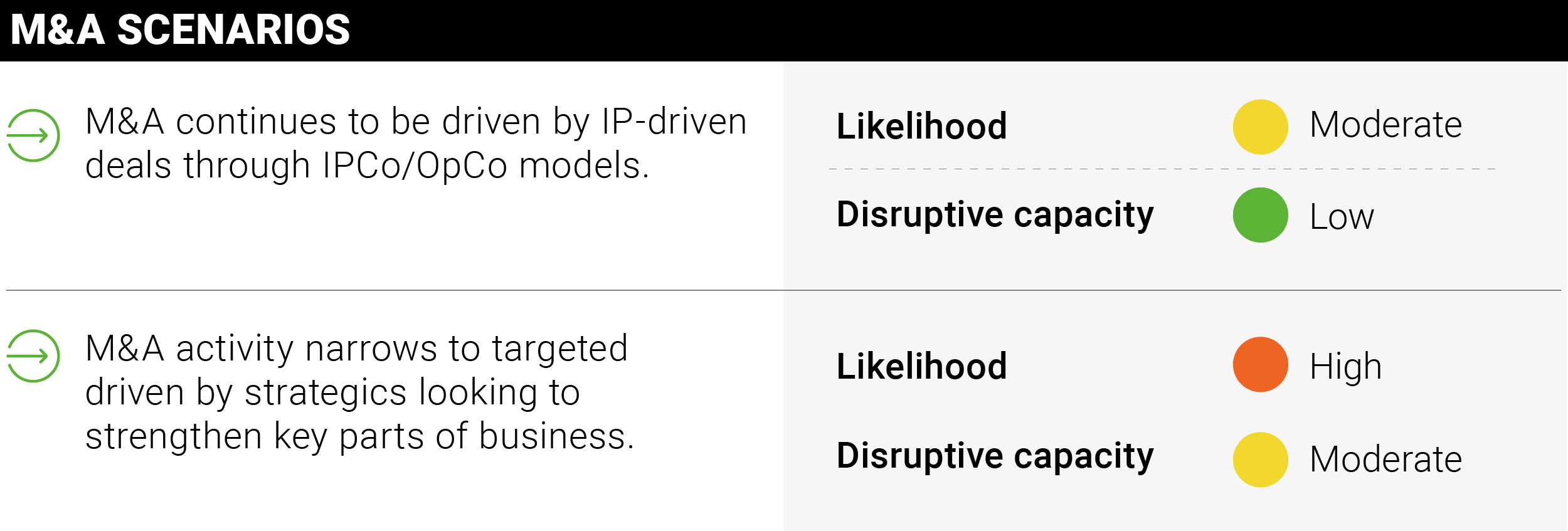

Distress could see the usual M&A playbook kick in for IPCo/OpCo models, or it may narrow to target-driven activity by strategics looking to strengthen key parts of their business.

Understanding the upside and downside risk of these trends is key to planning around uncertainty. In a broadly stagnant market, with agentic AI undermining brand identity and the value of physical retail shifting toward fulfillment and experiential shopping, our clients are focused on generating like-for-like growth using the levers available to them. These include focusing on differentiation tactics to take market share and continuing to be brilliant at the fundamentals of retailing.

The biggest trend of all—volatility—means that companies need to nail the fundamentals, from productivity to supply chain to their value proposition. The gamechangers we identify as potential forces in 2026 will reveal who has adapted to a more fraught consumer and market, and who waited too long to act.

So let’s look at anticipated shifts.

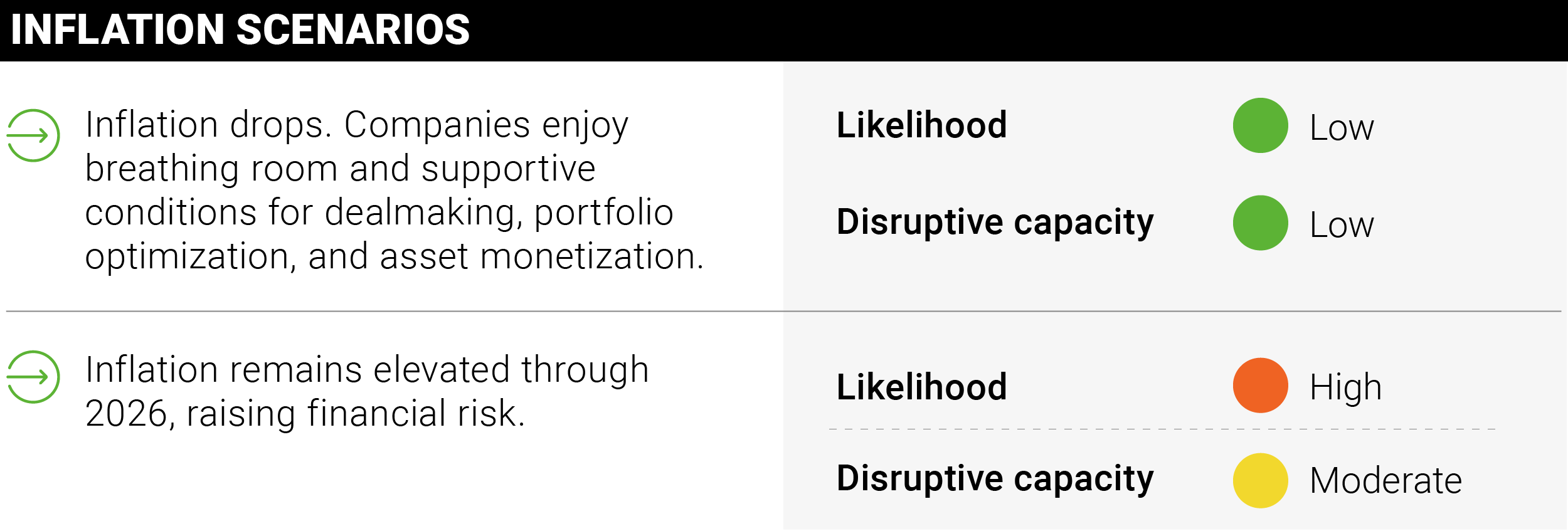

For each scenario, we indicate whether we see it as low, medium, or high likelihood to occur in 2026, and rate the disruptive capacity as a read of the need for companies to adapt their business models for 2027 should the scenario play out. |

The received wisdom is that we are on the cusp of a transformation in how people shop thanks to AI. Autonomous shopping and gen-AI-powered stores are imminently expected to change the shopping experience: it’s already here, we are told, and is set to boost referrals and increase conversions. “Agentic AI is making online shopping feel human again,” reported Ad Age in November 2025. This is the year it all goes down.

Companies are at risk of over-indexing on the shiniest, newest tool, at great cost. Currently, just 32% of retail and consumer product executives say their AI programs are high maturity, per the AlixPartners Disruption Index. For all the talk about investing in AI to get closer to the customer and impact the top line, much AI spend ends up in efficiency plays and back office. That’s a habit retailers need to start to break. The shift to agentic AI will also require higher tech literacy, and for retail executives to learn how to work with global tech leaders.

Thus, we expect that very little will change in 2026, but that everything will change by 2030, and that the shift will expose retailers’ weaknesses. If you have an amazing supply chain and you can do same-day or next-day delivery at a competitive price, agentic shopping is only going to strengthen your position. But if your edge is premised on emotional connection and upselling, you need to consider what will happen to your margins when shoppers can search for the cheapest product, regardless of the vendor. Efficiency will be a big part of the growth agenda.

At the same time, the concept of multi-year large-scale systems with complex ROI is going away and is being replaced by rapid pilots—think a pricing tool imposed on top of existing transaction systems and given a limited runway to prove its value. The ROI of tech will be one of the things AI does transform for retailers. But there won’t be such a fundamental shift in the way that traditional store-based or multi-channel retailing happens over 2026.

The organizing principle of omnichannel retail has been to get customers the product they want as quickly and cheaply as possible. The “Amazon effect,” documented in 2019, saw the behemoth win segment after segment by beating competitors on price—but in early 2026, the company had canceled its bets on purely price-based stores, shutting Amazon Go outlets to focus on Whole Foods stores. Today, it’s a big mistake to view the landscape as purely a race between the cheapest and fastest.

Between the third quarter of 2024 and the third quarter of 2025, e-commerce’s share of retail inched up just 0.2 percentage points, from 16.2% to 16.4%, per Federal Reserve data. As the shift from brick and mortar to e-commerce approaches an equilibrium, the battle is now store against store to win share. And friction, once deemed a killer, defines some of the winners. Those gaining on the biggest players have made value plays, but with smaller SKU lists and consumers clamoring for limited-edition or seasonal offerings that may have sold out before customers can get their hands on the item. The financial strength of HomeGoods and in-real-life (IRL) “treasure hunt” experience is evidence of this, while in beauty, Ulta intends to compete against Sephora by chipping away at brand exclusivity and expanding its door count. We also see the foot race playing out in the grocery sector.

Trader Joes, Aldi, and Lidl notched impressive increases foot traffic in 2025 (Trader Joe’s grew 6.2% by location, against a 1.2% gain for the sector as a whole, per Placer.ai data), likely driven by their approach to private brands and experience. The 2026 AlixPartners Grocery Shopper Perspectives report identified a leap in the share of value-seeking customers who shopped private brands, up to 47% from 32% a year earlier, as big box and traditional grocers lose share (and hi-lo pricing erodes trust). The relative strength of ethnic and health stores also points toward an interest in the retail setting itself, and in product discovery.

We have seen evidence that Gen Z in particular has an acceptance for friction in the shopping process—the 2025 AlixPartners Home Delivery Survey shows a willingness to wait for shipments—which is not to say cheap and fast hurts, but they are playing those asks against their appetite for a brand they enjoy, private label products that match high-end, and items they haven’t tried before. The squeaky shopping cart, it turns out, is not the dealbreaker e-commerce imagined it to be.

Companies will increasingly struggle to secure or generate the capital required to transform traditional stores into experiential destinations and fulfillment hubs, largely because the investment profile of these formats is significantly more demanding at a time of lingering economic caution.

While retail real estate conditions are stabilizing after the turbulence of 2025, with faster lease-up times and strong absorption of quality space, retailers remain hesitant to commit to long-term, capital-intensive strategies. Traditional 10-year leases and large-scale buildouts require confidence in sustained consumer demand, yet inflationary pressures, uncertain discretionary spending, and shifting shopping behaviors continue to constrain balance sheets and investor appetite.

Experiential retail, in particular, raises the financial bar well above that of conventional stores. Destination formats such as Dick’s House of Sport, immersive beauty flagships, or brand theaters like Netflix Houses require prominent, high-traffic locations, extensive buildouts, specialized staffing, and frequent refreshes to keep experiences relevant. These stores often take three to five years to reach profitability, if they do at all through in-store sales alone. For many retailers, especially those outside luxury, beauty, or high-margin lifestyle categories, tying up capital for that long is difficult to justify. Cornell research also suggests that only a narrow segment of customers meaningfully increases spend after engaging with experiential concepts, raising the risk that returns fall short of expectations.

At the same time, retailers are being forced to allocate capital to other critical priorities, particularly supply chain resilience and omnichannel fulfillment. With 70% of C-levels expecting threats from protectionism and trade policies, many are prioritizing investments in nearshoring, supplier diversification, AI-driven visibility, and last-mile efficiency. Stores doubling as micro-fulfillment centers demand additional technology, space reconfiguration, and operational complexity further stretching capital budgets. While these investments promise faster response times and long-term cost savings, they compete directly with experiential initiatives for funding, making trade-offs unavoidable.

As a result, the transition to experiential and fulfillment-centric stores is likely to be uneven. Well-capitalized retailers, such as luxury brands, leading grocers, and digitally native brands with strong margins, can selectively invest in flagship experiences and hybrid formats. However, mid-tier apparel and footwear players, low-margin department stores, and retailers still recovering from recent disruptions may find it difficult to raise or justify the necessary capital.

In this environment, many companies will opt for smaller pilots, short-term leases, pop-ups, and modular experiences rather than full-scale transformations, signaling that while the vision for experiential retail is compelling, the financial reality will limit how broadly and how quickly it can be realized.

Companies entered 2026 in an environment where organic growth remained difficult, pushing financial management to the center of strategy and elevating the importance of M&A, joint ventures, and creative capital structures. As a result, many organizations are leaning harder into acquisitions, carve‑outs, special-purpose vehicles, and partnerships to build scale, expand ecosystems, and unlock capabilities they cannot efficiently develop internally.

Uncertainty over factors like tariffs, impact on both spending and manufacturing costs from immigration policies, and monetary policy have split economists’ predictions for inflation through 2026. Lower inflation would allow for better forecasting, steadier margins, and greater confidence in deploying capital—conditions that support dealmaking, portfolio optimization, and asset monetization strategies that accelerate growth while balancing risk.

Conversely, rising inflation will introduce countervailing pressures that complicate this strategic shift. Higher tariff pass‑through costs, elevated operating expenses, and tightening labor markets add volatility that makes deal underwriting more difficult. Some sectors experience rising goods prices as pre‑tariff inventory has run out, while slowing consumption growth and declining payrolls signal softer demand. These forces create instability rather than simple uncertainty, making it harder for companies to predict outcomes, value assets, or commit to long-term integrations. As a result, firms will place greater emphasis on financial restructuring, balance‑sheet agility, and selective pursuit of distressed assets where the strategic fit is clear.

The result is a marketplace where both opportunity and risk rise simultaneously. Companies prepared for both realities can leverage declining inflation to fuel targeted acquisitions while building resilience against inflationary pockets can gain a strategic edge.

Retail has long been a game of conquest—new geographies, new categories, more physical assets. Distress has been treated as an opportunity for consolidators looking to grow inorganically or take competitors offline, but it has long come with a cost: Acquisitions have brought assets good and bad into portfolios, requiring the owners to liquidate or manage unhealthy parts of the business.

The alternative model we see emerging uses tools to acquire the good parts of a business without taking on the bad, balancing the promise of inorganic growth with deep expertise in turnaround work. The distress of 2026 should see this playbook used more widely: Leaders are pulling out geographies where they can’t make any money, we are seeing category consolidation, and there’s a needle to thread between general expansion and focusing the business on winning sectors, geographies, or categories.

We see this narrower focus in the value segment, allowing companies like ALDI to win share with a much tinier product range. Added to this, the traditional mechanisms for managing distress do not improve the health of an ailing business over time: If you are a struggling retailer going into Chapter 11 and you don't change anything but your store assets, you'll very likely still be struggling on the other side.