PE portfolio company leaders aren’t cut out for the job, survey says

NEW YORK (March 29, 2023) – Only a bare majority of private equity leaders (54% PE firms/53% portcos) believe portfolio companies (portcos) have the right leaders in place to deal with the multiple disruptions their enterprises face, according to respondents in AlixPartners’ Eighth Annual Private Equity Leadership Survey.

Effective leadership is more critical than ever as PE firms and portcos confront multiple macroeconomic disruptions—a slowdown or recession, inflation, steeply rising interest rates, and geopolitical risks—along with ongoing supply chain disruptions, accelerating technological change, a continuing war for skilled talent, and a growing need to address ESG issues. Of the survey respondents’ priorities for generating value during these turbulent times, leadership effectiveness ranked at the top of the list for PE leaders (70%) and portcos (52%). Not surprisingly given the challenging environment for creating value, PE firms ranked bolt-on acquisitions last among their top five priorities. Instead, the task of value creation falls squarely on leading the business effectively, and designing and operating it efficiently, with an eye toward revenue and margin growth and cost control.

“Agile and resilient leadership is the key—the ability to set goals and a vision, establish priorities, and motivate and organize people, and then pivot quickly when disruption moves the goalposts, as we’ve seen this month in the banking sector,” said Ted Bililies, Partner & Managing Director and Head of the Transformative Leadership practice at AlixPartners. “While there are significant differences in emphasis between PE firms and their portco managers about which leadership capabilities are necessary to achieve these goals, both groups clearly see that strong leadership and efficient execution define the path to success.”

Portco leadership under the PE microscope

PE executives are keenly focused on the performance of the portco leadership team.

When asked about the most important talent issues to focus on, they are twice as likely to cite the quality of the executive team as portco leaders are. Both PE firm and portco executives recognize the critical role of leadership in setting enterprise strategy. But when it comes to turning strategy into reality—from vision to plan; from forecast to results; from deal thesis to value creation—there’s a difference.

PE operating partners zero in on the first year of ownership—the critical first few quarters during which they and their portco counterparts need to capture synergies and get a running start on value creation. Hence, their emphasis on focus and urgency. For their part, portco leaders emphasize the importance of building capabilities and culture for the out-years.

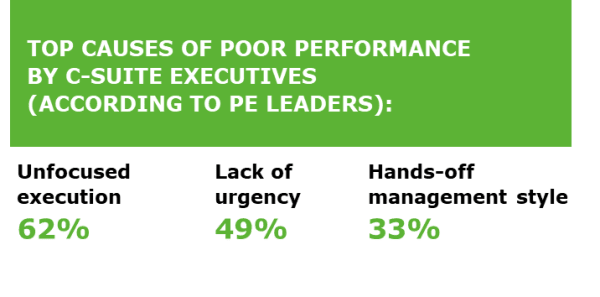

“In the mind of private equity, the best leaders drive change, motivate their teams, are resilient and agile; they see the big picture. To PE leaders, these traits matter because they have the greatest impact on generating high returns for investors. When things go wrong, in their view, it’s because leadership has been unfocused in execution, not urgent enough in in how it executes, or too hands-off,” said Rich Wallace, Partner & Managing Director and Americas Co-Leader of Digital.

“It’s the economy…”

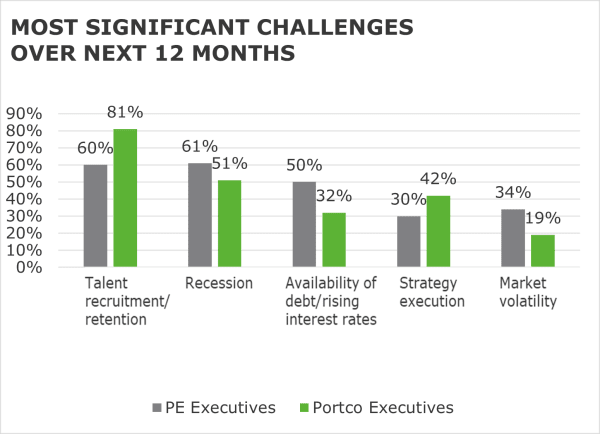

Two years ago, “market dynamics and disruption” ranked fourth in the priority list for PE and portco leadership (after strategy prioritization, communication, and execution). This year, three of the top five organizational challenges are economic.

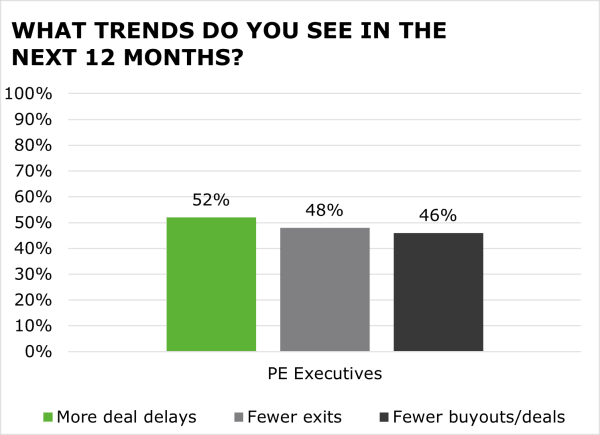

Deal delays picking up

These headwinds are leading to about half of PE industry leaders saying they expect that deals will be fewer and take longer, and that exits will be harder and holding periods longer. With deals delayed or more expensive, exits put on hold, and low economic growth, PE firms and the companies they own will be less able to create value through financial engineering.

“As our survey data has shown, the disruptions impacting the PE industry have major implications for leadership and leadership strategy. The time to act is now: PE firms and portcos should assess their leadership team against their strategic needs, build up their talent machine, and ensure their leaders are both change agents and team builders,” concluded Dr. Bililies.

About the survey

Each year, findings from the AlixPartners PE Leadership Survey deliver valuable insights on themes relevant to the success of private equity (PE) investments. This year’s survey was administered online from October through December 2022. Respondents consisted of 145 PE firm managing directors, operating partners, or founders and 53 portfolio company (portco) directors, the majority of whom are CEOs or chief financial officers. Seventy-five percent of the PE firm respondents are with companies based in North America, as are 79% of the portco respondents. The largest share of portco respondents (42%) are with companies registering annual revenues of $100 million to $500 million, with another 30% at companies with annual revenues of less than $100 million. Thirty-eight percent of PE firm respondents reported their firms’ assets under management (AUM) as less than $5 billion, and 30% have AUM of $5 billion to $20 billion.

We collaborated with IPEM, a Paris-based association for European PE investments, in its survey of 188 European PE investors and managers, and we include some of IPEM’s perspectives in this report.

Please contact Ed Canaday for more detailed survey results.

About AlixPartners

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Our clients include companies, corporate boards, law firms, investment banks, private equity firms, and others. Founded in 1981, AlixPartners is headquartered in New York and has offices in more than 20 cities around the world. For more information, visit www.alixpartners.com.