Private equity success isn’t just about the numbers; it’s also about the people, according to AlixPartners survey

63% of private equity firm respondents cited “human capital” at portfolio companies as their number-two concern, behind revenue and margin growth

NEW YORK (March 26, 2019) – Managing the relationship with a private equity portfolio company’s (“portco”) CEO and CFO is among the most critical priorities for PE firms, according to a new survey of leaders at PE firms and portcos by the global consulting firm AlixPartners and Vardis, the global private equity search firm. Trouble in any of the three “legs” of this relationship triangle can torpedo the success of an investment by preventing key members of the management team from executing the investment thesis, thereby ultimately sabotaging returns.

Conflicting views on defining investment thesis

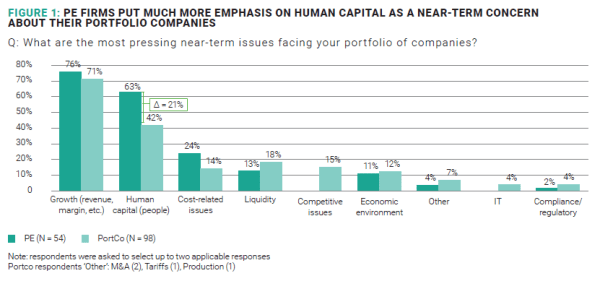

The AlixPartners-Vardis Fourth Annual Private Equity Leadership Survey found a stark contrast in responses from PE and portcos about what they considered the most-pressing near-term issues portfolio companies face. Although “growth” topped the lists of both of the groups, 63% of the PE-firm respondents cited “human capital” as their number two concern compared with 42% of portco respondents.

The survey showed misalignment between PE and portco views on what constitute the most powerful levers of value creation in portfolio companies. Specifically, both PE and portco respondents in this year’s survey see organic and inorganic growth as key value-creation drivers for portcos—but 52% of PE respondents also named operational efficiency as an important value driver, versus just 30% of portco respondents.

Comparing year-over-year responses, this year’s survey showed additional signs that PE firms are increasingly recognizing that investment success isn’t only about the numbers. It’s about the people: specifically, the PE-CEO-CFO relationship. Of the PE respondents who indicated that they install or upgrade portco management teams, 40% wait more than one year to replace the CEO. As much as 72% of those that retain portcos’ existing management teams still end up replacing the CEO after one year.

CEOs are too slow to act

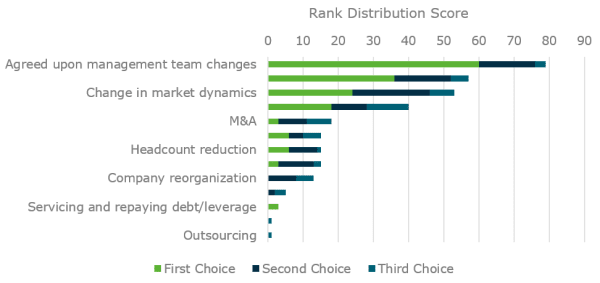

According to the survey PE investors are signalling a current and impending need to implement management changes to drive their investments. However, they appear to still have work to do in this area. The majority of PE firm respondents say portco CEOs are too slow to execute the agreed upon management team changes.

In which areas are portco CEOs too slow?

When assessing portco leadership and culture, lots of talk, little action

In last year’s survey, investors cited assessing portco management teams and establishing senior team alignment as top priorities. However, despite longer hold times and stiffer competition for talent, a weighted average of roughly 50% of the investors responding to this year’s survey said they’re not doing much to change their talent-management strategies—including CEO and CFO succession planning. In fact, the response “No change” to the question of whether hold times had caused owners to rethink their approach to CEO succession was up from 38% last year. Furthermore, while 48% of PE investors said it was very important to assess the dynamics of the CEO/CFO relationship, only 74% of these investors conduct pre-deal independent assessments for CEOs, and 61% for CFOs. When it comes to culture, as much as 86% of the portco executives in this year’s study said they see culture assessment as important when a PE firm adds a new asset to its portfolio. But just 28% of them said their PE investors “always” or “often” conduct such assessments.

Red flags

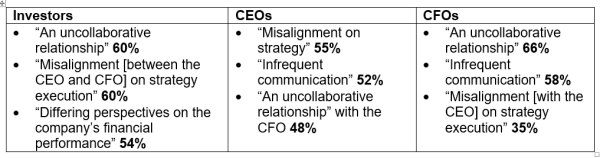

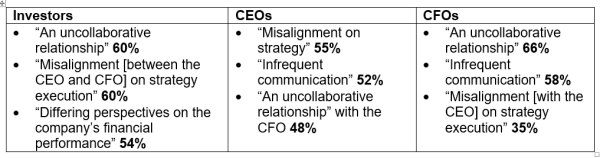

The top three most revealing signs of trouble among portco managements are:

- Misalignment on strategy

- Infrequent communication

- An uncollaborative relationship between the CEO and CFO

Ted Bililies, PhD, global leader of the Organization & Transformative Leadership practice at AlixPartners and a managing director at the firm, said, “As this year’s survey findings make clear, misalignment between PE investors’ and portco executives’ perceptions and expectations persist on multiple fronts. Proactively building trust and open communication among PE sponsors and portfolio company top executives [about matters such as accountability and expectations] is key to managing this relationship triangle and getting it right from the beginning is critical to success.

“While it’s encouraging, and indeed surprising, to see PE firms assigning such a high priority on the need to focus on human talent management strategy, there’s a clear disconnect with them actually doing it. To safeguard an investment’s success, PE owners must proactively manage each dimension of this triangle, including identifying and swiftly mitigating risks.”

About the survey

The AlixPartners-Vardis Fourth Annual Private Equity Survey, conducted in conjunction with Vardis, the global private equity executive search firm, was administered October through December 2018. There were 158 total respondents comprised of 54 managing directors and operating partners from PE firms and 98 senior executives (primarily CEOs and CFOs) from portfolio companies. The largest share of portco respondents were with companies with annual revenues of $100 million to $500 million. The majority of PE firm respondents reported assets under management of less than $20 billion.

Please contact Ed Canaday for more detailed survey results and verbatim quotes from sponsors.

About AlixPartners

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Our clients include companies, corporate boards, law firms, investment banks, private equity firms, and others. Founded in 1981, AlixPartners is headquartered in New York, and has offices in more than 20 cities around the world. For more information, visit www.alixpartners.com.