Matt Clark

London

Understandably, COVID-19’s impact on retail has been the sector’s focus for the last 15 months. Lockdowns, changing consumer priorities driven by health and financial worries and the dramatic alterations to shopping behaviour have all contributed to a tumultuous period for the sector.

However, this was a sector that already had some significant issues. And, as our latest Disruption Index shows, it is likely to remain a challenged industry for some time to come.

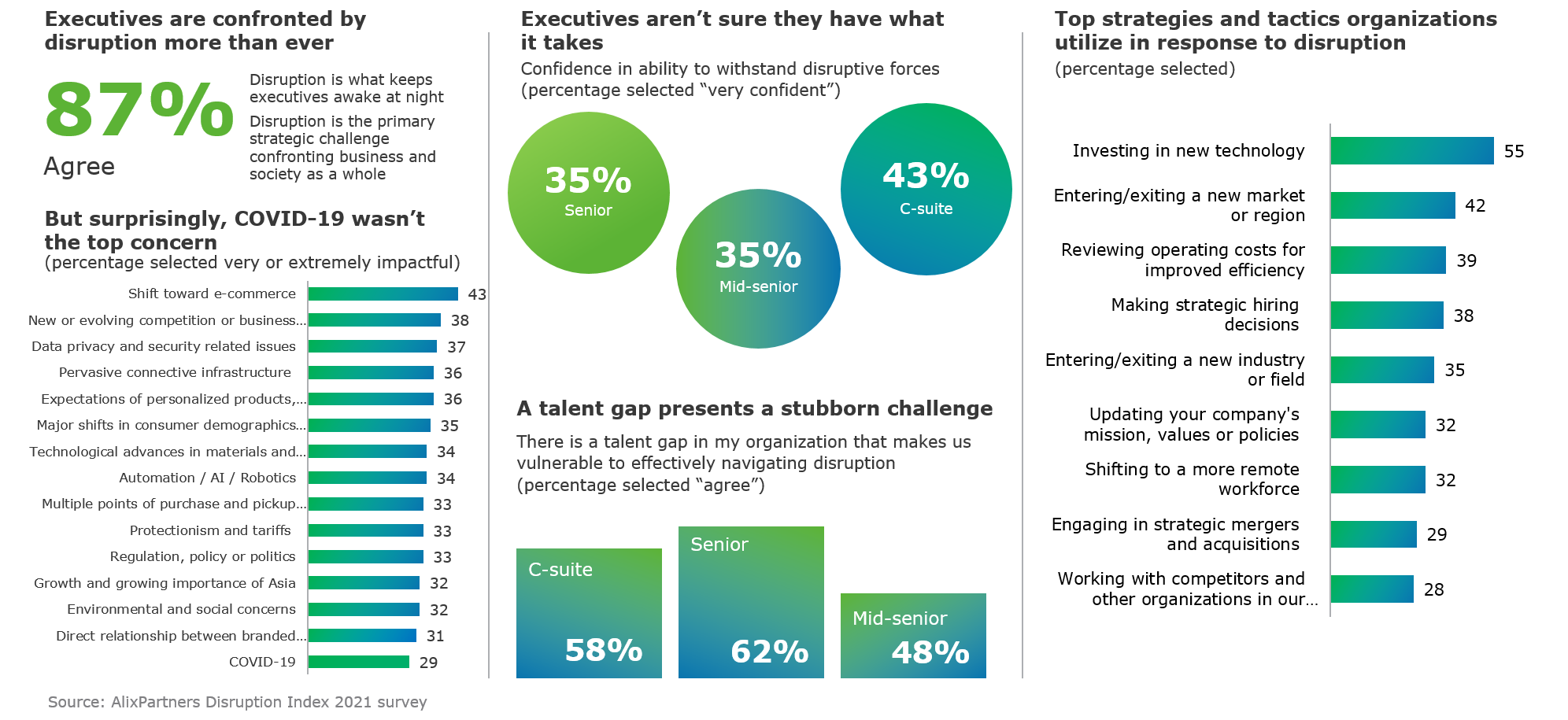

Retail, as an industry, is subject to multiple concurrent disruptive forces and is one of the most disrupted sectors we analysed – second only to financial services. In fact, the level of disruption facing the sector is so multi-faceted that the pandemic ranks far below other challenges. Covid has been an accelerant but there are bigger concerns keeping executives awake at night.

The most commonly cited disruptor was the increased shift to e-commerce. While the ‘Amazon effect’ is now hardwired into the minds of many retail leaders in terms of the pervasive presence of Bezos’ behemoth in consumers’ shopping habits, there is still much to play for in terms of e-commerce. However, the stakes are high, the complexity is challenging and the returns on investment relatively modest. Add to that a lack of clarity around the ‘stickiness’ of changed consumer shopping habits and it appears that some large, calculated risks will need to be taken.

Next on the list of concerns for retailers is the emergence of new competitors. While Amazon continues to cast a long shadow over retail, there are some things it has struggled to do – luxury and grocery spring to mind – and other things consumers don’t want it to do. New competition arguably presents a greater challenge. Newer businesses are seldom encumbered by legacy infrastructure and footprint challenges. They can combine hyper-targeted marketing – often driven through social channels – with the agility to switch gears without significant levels of additional investment. This is particularly useful as e-commerce grows. Where established retailers spent considerable sums on the technological infrastructure that powered the initial tentative forays into e-commerce, newer market entrants have deployed software as a service and cloud hosting (ironically often using Amazon’s highly profitable AWS infrastructure).

As with so many causes of disruption in consumer facing businesses, rapidly evolving consumer attitudes and priorities present an additional challenge. Concerns continue to grow about the environmental impact and social contribution (or otherwise) of the products they buy and the businesses they buy from. This adds a new dimension to what we have previously termed the ‘self-centric consumer’. As well as ease of access, personalisation, the right price and a seamless service, consumers increasingly want authentic values to lie behind their purchases.

In terms of disruption, these are just the tip of the iceberg for retailers. The bad news is that disruption is the new economic driver. Retailers, like so many other businesses, will need to engineer previously unseen levels of agility into their operations and business models to navigate both known disruptors and those yet to materialise. And, while many are deploying new technology to counter some of these challenges, that brings a whole host of other issues around automation, data privacy and cybersecurity.

With only 40% of retailers in our index feeling confident that their businesses can manage the current disruption, it does not bode well for the sector. Add to that increasing concerns around talent gaps in the industry, exacerbated by the fact that multiple industries are now competing for similar skills in technology, data analytics and software engineering, there is much to do.

Fortunately, it’s not all doom and gloom. Crises bring opportunities and retailers are at a once-in-a-generation inflection point. Those that commit to radical transformation, focused on the next generation of retail – agile, technology powered, data-driven, and relentlessly consumer-focused – will prosper.

Those that take tentative steps are far less likely to. Uncertainty will endure for some time and disruption is here to stay. The retailers who recognise and embrace this paradigm will be those that are fit for the future – whatever it may bring.