Giuseppe Gasparro

New York

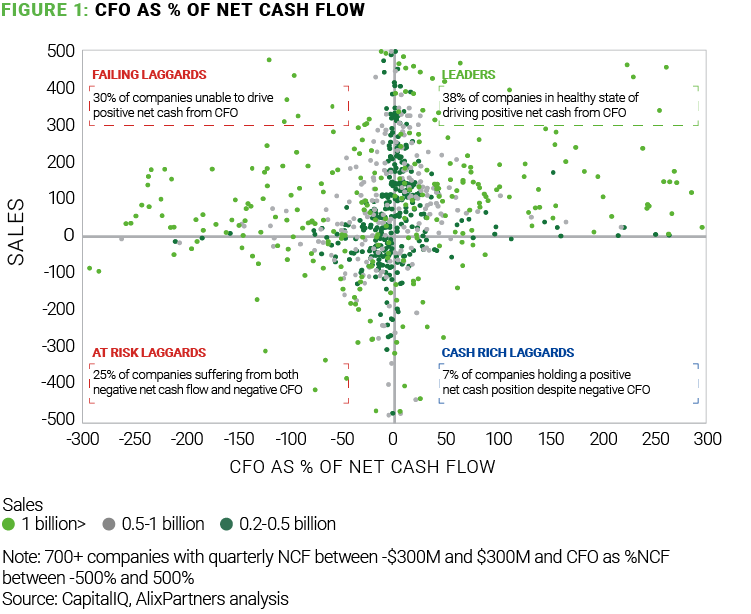

After the last two years of strong growth and profitability, tech companies are facing a new reality – only 38% of tech companies generate positive cash flows from operations (figure 1). Many of those companies will face a tougher reality going forward as rising interest rates will slow down debt-driven growth funding and dramatically lower valuations will limit the ability to raise new equity to fuel growth. As a matter of fact, more than half of the Nasdaq-listed companies currently trade below their pre-pandemic high of February 2020.

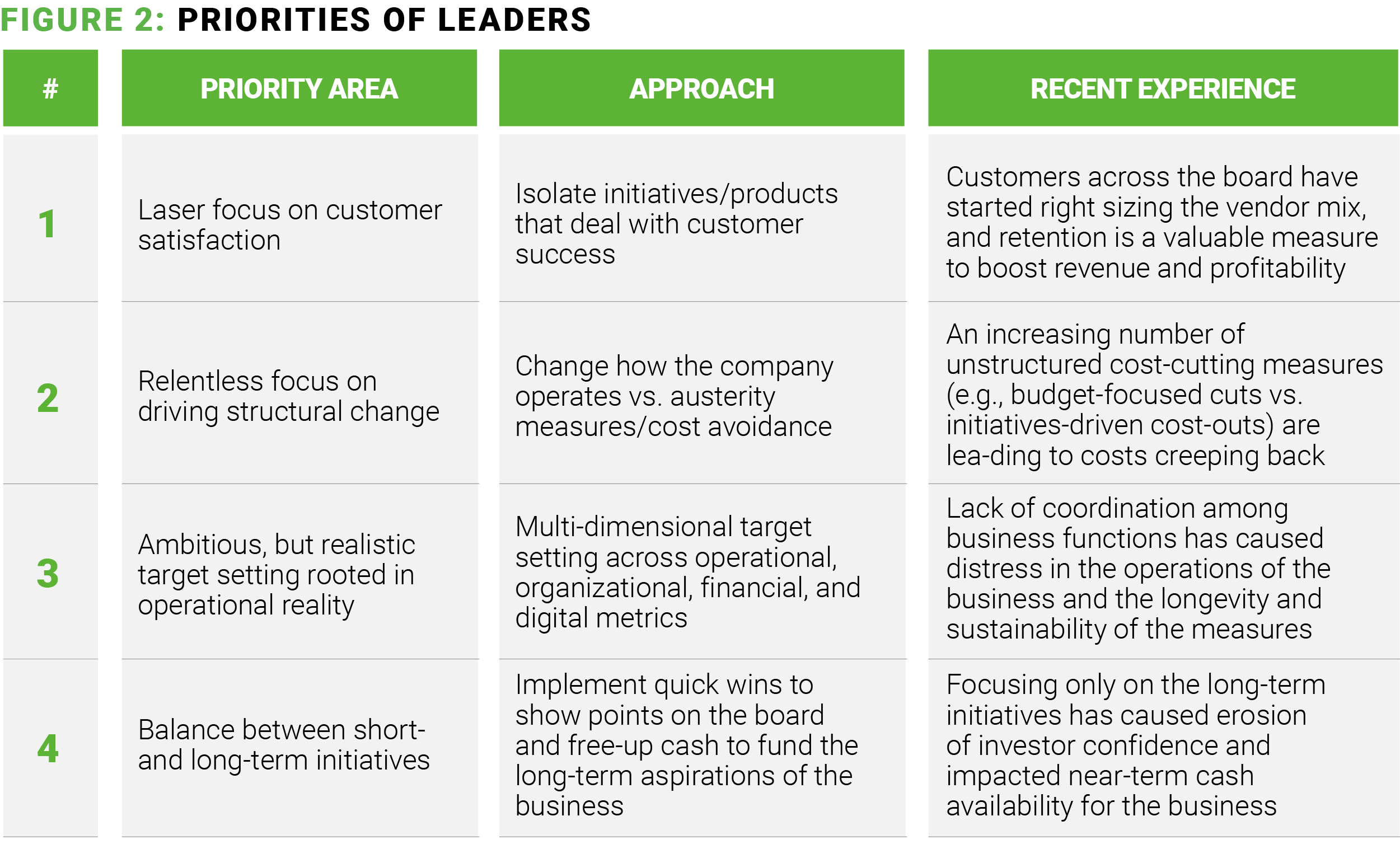

Primary research from our recent project experience with some of the 38% leaders (figure 1) suggests that the high performers focus on these four priorities to drive positive cash flow (figure 2) from operations, which enables them to further accelerate growth:

No one can predict when interest rates will start decreasing and allow for “cheap growth funding” – any tech company can become the next leader with a committed and disciplined leadership team. Start your leadership journey now!