Randy Burt

Chicago

Heading into 2023, the state of the consumer products market is more challenging than ever, and many companies will continue to struggle to deliver margin gains as consumers brace for another difficult year. Consumer sentiment is at a historic low, inflation remains high, and supply disruptions are still a burden – creating both revenue and cost troubles. Consumer debt is rising faster than income and many consumers have or are quickly exhausting savings accrued during the pandemic. As a result, many have already begun to trade down.

Heading into 2022 a year ago, consumer products companies faced unprecedented level of uncertainty in the face of inflation, historically tight labor markets, and supply disruptions. Despite the tumult, many grew both revenue and EBITDA margin. Learning from those successes – while recognizing consumers’ changing mindset and financial wherewithal – will be critical to driving financial performance in this coming year.

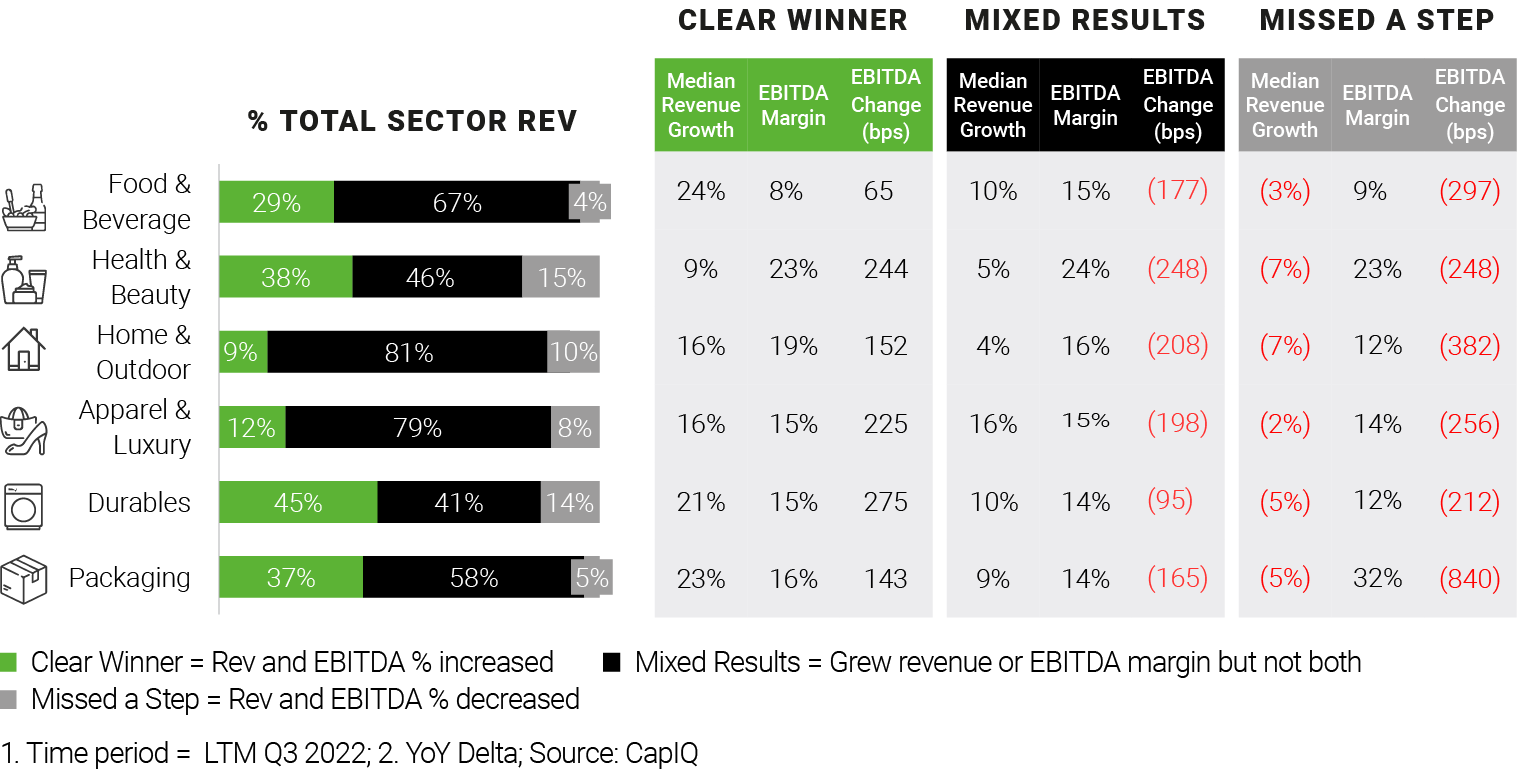

To understand performance of consumer products companies over the last twelve months ending Q32022, we separated more than 200 of them into three segments based on financial performance. We used EBITDA (earnings before interest, taxes, depreciation, and amortization) margin along with sales and revenue growth to separate companies into “clear winners,” “mixed results,” and “missed a step” categories. Here is how we defined these categories:

Overall, CP companies fared decently over the last twelve months, with companies representing nearly a third of the total revenue of our sample set managing to increase both revenue and EBITDA margin. Companies representing approximately 63% of total revenue in our sample set managed to grow either revenue or EBITDA but not both. Companies representing about 8% of revenue in our sample set saw both revenue and EBITDA margins decline.

We also separated the results into six subcategories by industry: apparel and luxury, durables, food and beverage, health and beauty, home and outdoor, and packaging. Health and beauty companies fared the best, with that sector boasting the largest share of revenue from Clear Winners. Meanwhile, the home and outdoor group had the most significant number of companies that either missed a step or made a calculated tradeoff.

Success in 2021 required flexible thinking and quick adjustments to challenging economic circumstances, combined with an unprecedented level of collaboration across the enterprise - and with key trading partners. The Clear Winners took advantage of an integrated margin management approach, characterized by tight linkages and strong collaboration across functions and powerful analytics integrated across the elements of the P&L. Two learnings stand out:

In other words, the Clear Winners ensured end-to-end cross-functional connectivity, prioritized relentlessly, and demonstrated agility – the result of which was success at growing revenue while increasing margin and retaining customers. They knew what their customers needed and would pay for, didn’t try to sell them much else, and demonstrated enough pricing power to overtake the impacts of inflation. However, given the current state of the consumer, the macroeconomy, and supply chains, many consumer products companies will struggle to deliver future margin gains. Perhaps the most important driver of profitability over the last year – raising prices – is unlikely to be widely available as lever.

Successful companies must find new ways to add value while keeping a few key strategies in mind:

Success in 2023 will demand bold actions and new thinking. CP companies that act now to set aspirational goals, reenergize collaboration, and focus on agile, efficient execution will have the best chance at success.