Heading into 2023, the state of the consumer products market is more challenging than ever, and many companies will continue to struggle to deliver margin gains as consumers brace for another difficult year. Consumer sentiment is at a historic low, inflation remains high, and supply disruptions are still a burden – creating both revenue and cost troubles. Consumer debt is rising faster than income and many consumers have or are quickly exhausting savings accrued during the pandemic. As a result, many have already begun to trade down.

Heading into 2022 a year ago, consumer products companies faced unprecedented level of uncertainty in the face of inflation, historically tight labor markets, and supply disruptions. Despite the tumult, many grew both revenue and EBITDA margin. Learning from those successes – while recognizing consumers’ changing mindset and financial wherewithal – will be critical to driving financial performance in this coming year.

Lessons learned and how to move forward

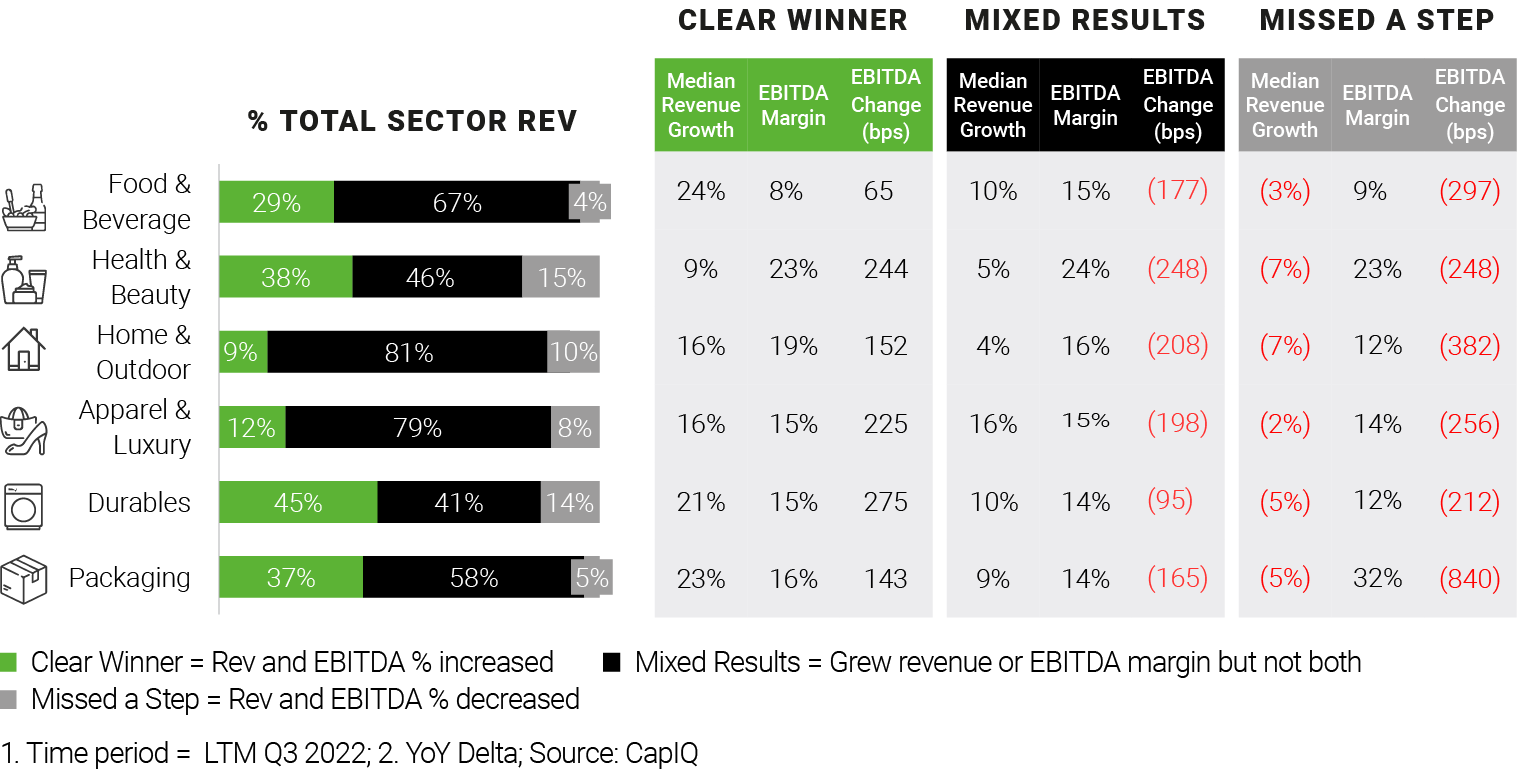

To understand performance of consumer products companies over the last twelve months ending Q32022, we separated more than 200 of them into three segments based on financial performance. We used EBITDA (earnings before interest, taxes, depreciation, and amortization) margin along with sales and revenue growth to separate companies into “clear winners,” “mixed results,” and “missed a step” categories. Here is how we defined these categories:

- Clear Winners grew both revenue and EBITDA margin

- Mixed Results companies grew either revenue or EBITDA margin but sacrificed the other to do it

- Missed a Step companies saw both revenue and EBITDA margin decline

Overall, CP companies fared decently over the last twelve months, with companies representing nearly a third of the total revenue of our sample set managing to increase both revenue and EBITDA margin. Companies representing approximately 63% of total revenue in our sample set managed to grow either revenue or EBITDA but not both. Companies representing about 8% of revenue in our sample set saw both revenue and EBITDA margins decline.

We also separated the results into six subcategories by industry: apparel and luxury, durables, food and beverage, health and beauty, home and outdoor, and packaging. Health and beauty companies fared the best, with that sector boasting the largest share of revenue from Clear Winners. Meanwhile, the home and outdoor group had the most significant number of companies that either missed a step or made a calculated tradeoff.

Success in 2021 required flexible thinking and quick adjustments to challenging economic circumstances, combined with an unprecedented level of collaboration across the enterprise - and with key trading partners. The Clear Winners took advantage of an integrated margin management approach, characterized by tight linkages and strong collaboration across functions and powerful analytics integrated across the elements of the P&L. Two learnings stand out:

- Smart and timely price increases: Companies that performed well were able to realize multiple price increases – leveraging brand strength, strong customer relationships, and a detailed understanding of customer and product profitability. The most successful companies were able to model and respond to cost increases from raw material, packaging, labor, and transportation, and take price increases while continuing to grow the top line. A true understanding of customer, consumer, and category dynamics was necessary to push through prices increases and reduce promotional spending without impacting market share.

- Quick, effective reaction to supply chain disruptions: Successful companies quickly reacted and managed through disruptions, prioritizing profitability via product portfolio rationalization, implementing flexible formulations, and employing a design-to-value approach to lower costs. This demanded not only agility from supply chain teams but also close integration with commercial functions.

In other words, the Clear Winners ensured end-to-end cross-functional connectivity, prioritized relentlessly, and demonstrated agility – the result of which was success at growing revenue while increasing margin and retaining customers. They knew what their customers needed and would pay for, didn’t try to sell them much else, and demonstrated enough pricing power to overtake the impacts of inflation. However, given the current state of the consumer, the macroeconomy, and supply chains, many consumer products companies will struggle to deliver future margin gains. Perhaps the most important driver of profitability over the last year – raising prices – is unlikely to be widely available as lever.

Successful companies must find new ways to add value while keeping a few key strategies in mind:

- Adopt an internal activist investor mindset: Seek out structural productivity improvement opportunities and break down the norms of the past; evaluate cross-platform, cross-business unit opportunities and the participation strategy of the business.

- Manage margin even more closely: Develop or reinvigorate an integrated margin management approach and ensure incentives and processes enable the high degree of cross-functional collaboration required to do this well.

- Make the right pricing calls: Innovate price-pack architecture to improve affordability while making strategic and surgical pricing and promotion investments; lean on analytics and break from reflexive repetition of prior promotional events.

- Implement a total cost of ownership (TCO) approach to de-risk supply chains: Understand all the implications of supply chain choices and use a TCO mindset to drive supply chain improvements such as diversifying the supply base; balancing cost, speed, and flexibility; and shortening the length of the end-to-end supply chain.

Success in 2023 will demand bold actions and new thinking. CP companies that act now to set aspirational goals, reenergize collaboration, and focus on agile, efficient execution will have the best chance at success.