Stephen Dyer

Shanghai

What keeps business leaders up at night? It’s not just one roadblock facing their respective industries, but several interconnected and self-reinforcing pressures that are continuously at work. In 2023, the pace of disruption and cycles of upheaval will move even faster — and offer up opportunity amid the challenges.

AlixPartners recently issued its fourth annual Disruption Index survey report, assessing the continued impact of disruption on different businesses, industries, and countries. The report analyzes how senior executives view disruption, its impact on their roles, the challenges it presents for them, and how it impacts their companies.

Disruption is driving the global economy. One of the key findings common across business leaders in China and executives at global consumer products companies is the persistently high level of disruption and the significant impact they see it having on their businesses.

Before discussing the survey’s findings, let’s first define what is meant by disruption and its importance within the context of business conditions today. Disruption, by definition, is any significant change from the normal expectations of events. For business leaders, this occurs in several areas ranging from geo-political changes to climate shifts. For example, travel restrictions imposed by countries due to the pandemic could be defined as a health and safety disruption. The conflict between Ukraine and Russia, a geopolitical disruption, has impacted global wheat and oil supplies and commodity prices for many consumer products companies.

As disruptions occur, changes within an organization are inevitable, and they impact companies in various ways. It is mission critical to recognize that these changes occur at both the organizational and individual levels — the pandemic has served as a prime example. In China, employees faced lockdowns, travel restrictions, and huge changes to how they sourced food and daily supplies. The pandemic also impacted organizations along the supply chain and required them to manage extreme volatility in freight rates, travel time and container availability. While leaders should have a good grasp of organizational impacts, it is equally important to understand what disruptions mean to employees at an individual level.

The impact of disruptions is growing as their frequency and intensity increase. This has certainly been the case for consumer products companies in China. For several years, consumer products companies have faced changing consumer needs due to the pandemic, slowing economic growth, increasing disruption to supply chains, and general inflation hitting labor, raw materials, and commodity prices.

While a number of disruptions linked to the pandemic are now receding, many challenges still remain. Digital technologies around AI, cloud and robotics are continuing to evolve and will all provide opportunities to drive productivity and efficiency. Weather patterns have become more volatile, impacting supply chains — particularly in food and beverage production.

Looking at disruption from an industry standpoint, business leaders in the consumer products industry are amongst the highest in their scoring of the impact of disruption on their industry. Looking back at survey feedback over the past three years, consumer product business leaders have seen the level of disruption increase each year, from indexing at 70 (on a scale of 0-100) in 2021 to 82 in 2023. This makes consumer products the industry with both the second-largest increase in disruption (behind telecoms) and the second-highest level overall in 2023 (behind energy).

This is understandable based on the changes affecting the consumer products industry. E-commerce continues to create new avenues and approaches to reach consumers, along with emerging entrants to the market spurring more competition. By 2026, 35% of revenue for the top ten largest consumer categories globally — or US$1.43 trillion — is expected to come from online shopping, and companies need to figure out how to protect margins while still accommodating this expected growth. At the same time, commodity and freight inflation and deflation continues to affect global supply chains, while companies are putting an even greater emphasis on product costs, overall cost reductions and productivity improvements. For example, most industry executives cite difficulties in sourcing ingredients and materials and the subsequent impact on end product costs as a key challenge. Meanwhile, domestic brands in China are continuing to evolve and improve, placing further pressure on global brands to maintain and grow market share.

Not only is consumer products as an industry facing disruption, but business leaders overall in China also see both an increased and more significant level of disruption. China is the only country to see year-on-year increases over the past three years. In fact, its 2023 levels are significantly higher than any other country surveyed — indexing to over 86 compared to the next highest, Japan, at 75. Looking into the details of the survey responses, geopolitics is a major driver of disruption. In China, 84% of respondents said geopolitical challenges are forcing their companies to adjust their growth strategies, while 81% said that their business models are either already changing or will undergo changes within the next 12 months. Investments in technology will continue to be a key area of focus, with 93% responding that they will make the same or increased level of investment.

Faced with high disruption levels from both a country and industry standpoint, China’s consumer products leaders must focus on “change proofing” their organization against the continued impact of market disruptions. Critical challenges such as business model changes, interest rates and inflationary impacts, and social/environmental concerns are expected to continue for at least several years. As disruptions occur, it is easy to fall into a reactive mode. But for those that can successfully manage disruption, there is an exponential benefit from the efficiency that would minimize impact to their day-to-day operations.

An effective way to navigate disruption is to build organizational resilience – and this starts in two places. First is identifying disruptions that impact the organization as well as the response and performance by the functions within the impacted company. This allows the organization to understand how it is currently mitigating the disruptions and where its pain points might potentially occur. For a consumer products executive in China, this may be the impact of online marketplaces such as an online group-buying platform and the potential opportunities this presents for their brand and products. Companies can then look at building resilience into their organization from an individual level upwards. It is essential to incorporate elements of “resilience” in a company’s everyday processes. For example, when hiring, companies can look to include psychometric assessments that identify potential employees with characteristics that point to personal “resilience” traits. As awareness of disruption and its impacts increase, companies may also consider shifting from a reactive to proactive approach in how they address disruption.

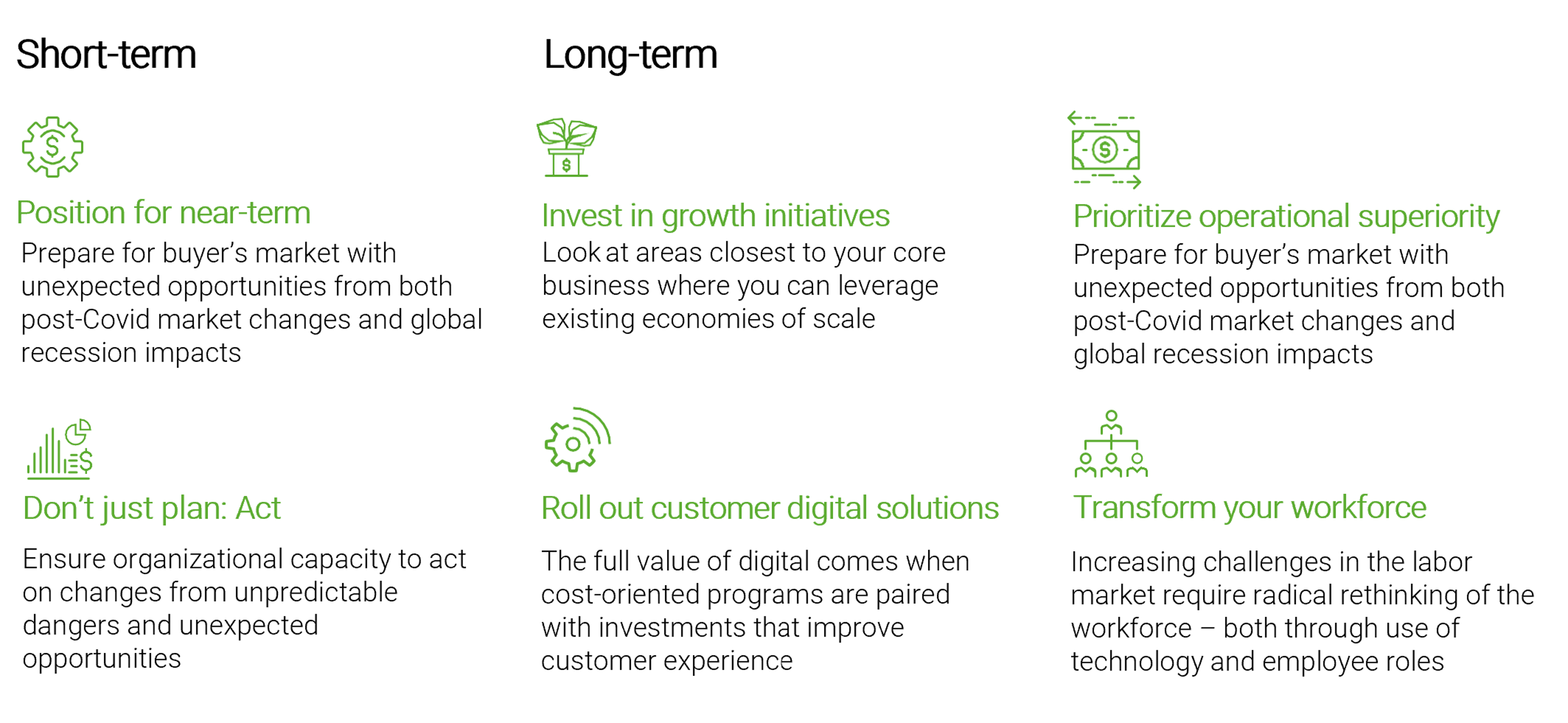

The second area then takes a view of these proactive strategies from both a short-term and long-term perspective. In the short-term, consumer products leaders should position themselves for near-term opportunities and take actions to drive changes in their business. The systematic and deliberate build-up of a cash/credit fund for periods of disruption is important. These funds are deployed during disruptive times to build companies’ operational advantages, and can even potentially be used for strategic investments including acquisitions.

The challenge for consumer products firms is also to maintain a long-term focus in four specific areas. The first is continued investment in growth initiatives to deepen and expand the revenue foundation for the business — this could be through acquisitions, product line extensions, and/or building the customer base. The next focus area is investing in technology with a priority on customer digital solutions. Building seamless transfers of data and information to better manage business processes can drive significant efficiencies and strengthen relationships.

The third area is building advantages in operational execution to react faster than the competition and gain a greater advantage amid ongoing disruptions. The final area is transforming the workforce — being driven by the combined long-term impacts of an aging population and changing work priorities for younger generations. Consumer products companies must focus on improving both job satisfaction and productivity in tandem.

New Oriental was China’s leading private education provider. Battered by COVID and the “Double Reduction” education policy that limited after-school tutoring, New Oriental took the drastic step of pivoting to selling consumer products and agricultural products online. They started on Douyin before building their own app and digital ecosystem.

The bold transition from education to livestreaming was a result of the company looking at the resources that it had, such as online streaming experience due to having held online classes, and “influencers” in terms of its star teachers. In addition, New Oriental had in its earlier forms shown that it was always willing to transform itself quickly — from offline to online classrooms and from language test prep to after-school tutoring and content production. Hence, the organization had previously proven it was able to “disrupt” itself and willing to pivot as needed.

Executives in China’s consumer goods space have no shortage of worries to keep them up at night. The changing consumer, the need to continue to increase productivity, and continuing to manage complex supply chains are among the top concerns. In addition, pricing will likely be less of a lever that can be utilized to support profitability.

Solutions, in the form of new business models and capabilities, will be critical for consumer goods brands to maintain success. The companies that are able to enjoy continued success will be differentiated by the organizational resilience they have forged and the appropriate financial buffers they have built to weather the adverse impact of disruption, while also proactively taking advantage of it to improve their competitive position. As we continue to see disruptions impact consumer goods companies, companies’ ability to navigate challenges and capture opportunities will swiftly set apart the growth leaders and laggards of the future.