Michael Crisanti

Chicago

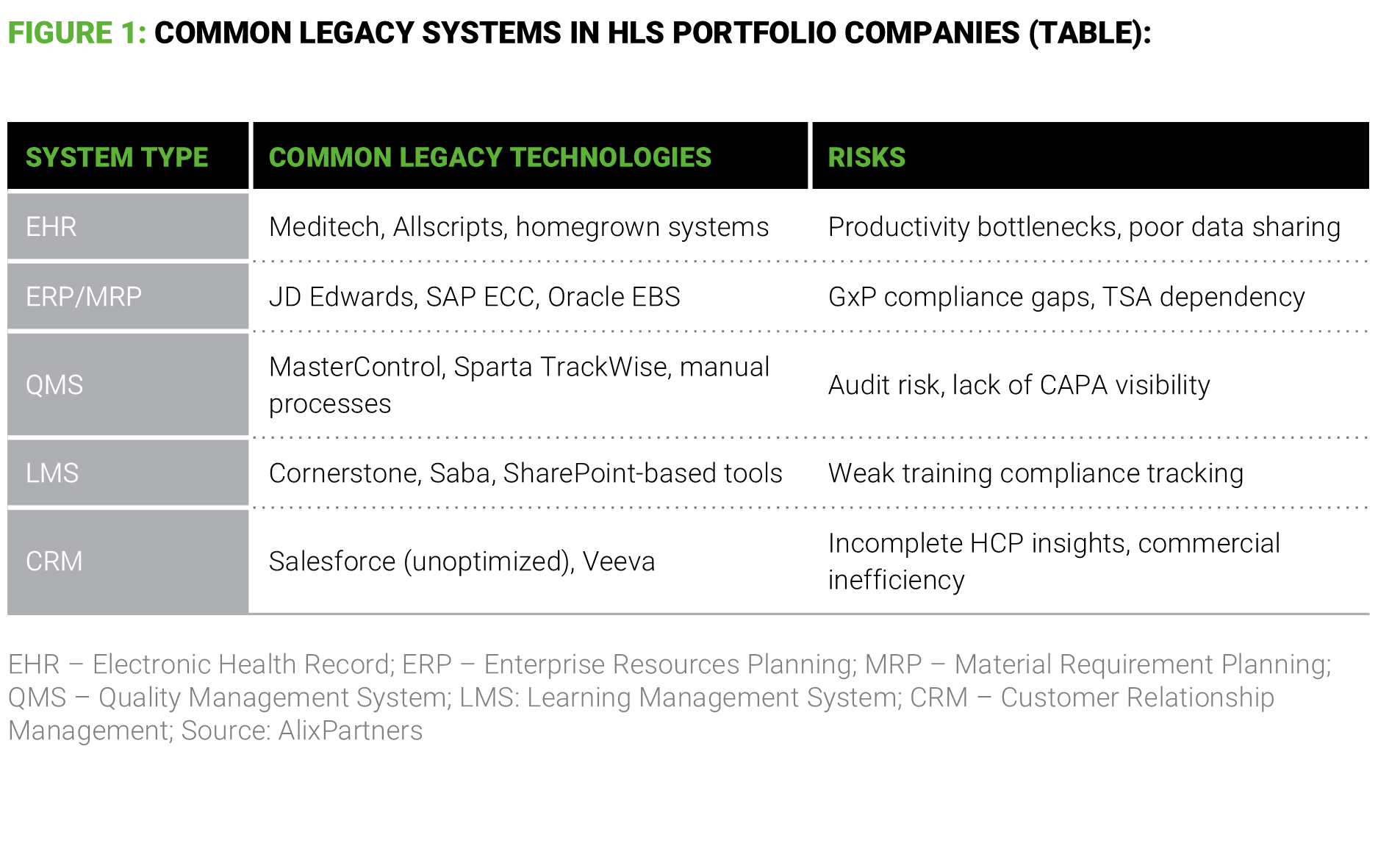

Technology is no longer a back-office function—it's a strategic lever for accelerating EBITDA, scaling platforms, and achieving rapid value creation. Yet many healthcare private equity portfolio companies sit on a growing pile of technical debt, often called “tech debt”—legacy systems, fragmented data platforms, outdated EHRs/ERPs—that quietly drain productivity, increase compliance risk, and delay integration.

PE firms can maximize ROI by proactively investing in healthcare and life sciences technology, starting with a clear roadmap to reduce tech debt, modernize infrastructure, and avoid missed synergy targets in both separations and integrations. While there’s a cost to remediating this tech debt, there’s a larger cost to ignoring it.

I. The hidden drag of tech debt in healthcare portfolio companies

Tech debt consumes up to 40% of healthcare IT budgets, silently draining resources from innovation, yet 85% of healthcare/life sciences companies struggle to prioritize digital transformation amid complexity and legacy burdens. Legacy tech—electronic health records (EHRs), custom-built systems, and siloed platforms—has become an albatross on the backs of healthcare companies—slowing productivity, blocking innovation, and inflating costs.

II. The cost of inaction

Experience with clients has demonstrated how targeted investments in cloud, automation, and data integration reduce SG&A or improve throughput. A global medtech company planned to carve out a contract development and manufacturing organization (CDMO) with 180 shared apps but only 18 full-time IT employees. With hands-on support from our experts, the CDMO was able to design and stand up its entire IT function, which eventually grew to some 50 full-time employees; accomplish ERP vendor selection and roadmap; and de-risk its TSA exit by establishing cybersecurity and operations readiness.

Had the new CDMO dragged its heels, however, the legacy systems would have created technology bottlenecks that delayed milestones and ROI and increased costs. The key in these situations is to structure the TSAs properly, because poorly written agreements and compliance failures invariably necessitate costly reworking. The failure to modernize IT systems causes analytics and automation opportunities to be missed and margins to suffer.

The CDMO reduced manual compliance efforts by 35% and avoided $2 million per year in redundant support costs. While every situation is unique, realistic timelines must be established and adhered to for both offensive or growth actions and defensive moves aimed at cost and risk reduction. Investments in CRM and AI that enable sales, a patient portal, and interoperable APIs will increase revenue and market reach within 12 to 24 months. Defensive steps such as ERP modernization, a good-practice QMS, and EHR consolidation effectively reduce SG&A, streamline compliance, and enable a swift, orderly TSA exit within six to 18 months.

This intervention—hands-on support and accurate cost modeling grounded in sector-specific benchmarks—saved $57.7 million in post-close costs, in line with projections, and ensured a smooth launch.

III. Private equity’s role in driving tech-enabled growth

Private equity board members bring a unique combination of skills that can set the tone for tech investment. They have accountability to a value creation plan with clear margin/EBITDA targets and, as external parties, a willingness to challenge the IT status quo. Their access to a broad digital network of advisors positions them to identify experts who can serve as a CIO-in-residence while the transition is taking place. By experience, they are comfortable with transformation timelines and have the expertise to greenlight a 12-18-month ROI play.

In a pharma carve-out scenario, pre-close diligence revealed that the legacy IT landscape—still 75% dependent on the parent company’s infrastructure—posed significant complexity and risk. A detailed cost-benefit analysis was conducted to evaluate modernization versus TSA reliance, identifying €46–69M in potential IT savings through simplification, cloud migration, and team rightsizing. This analysis was instrumental in shaping the PE firm’s investment thesis and informing the bid strategy.

The diligence also flagged critical Day 1 risks, including ERP entanglements and gaps in TSA scope, prompting early mitigation planning and a phased separation roadmap. A greenfield IT deployment strategy was prioritized, with the carve-out team targeting full autonomy 24 months post close. The IT modernization plan not only reduced stranded cost exposure but also enabled a leaner operating model, with headcount optimized from 295 to ~200 FTEs.

Post-close, the transformation playbook guided the exit from TSAs and accelerated the deployment of a simplified, cloud-native application stack. This enabled faster integration of commercial and R&D systems, improved data access, and unlocked €175–370M in incremental value creation across OpEx and COGS. The investment committee cited the proactive tech-debt remediation strategy as a key lever in de-risking the transaction and enhancing long-term platform scalability.

Technology is the nervous system of every healthcare & life science company, literally enabling every function. In organizations that have solved interoperability issues, all functions should be able to share information in a way that not only improves performance and creates efficiencies but may eventually enable the use of advanced AI capabilities. In the case of a carve-out or spinoff, the new entity must function fully and completely independently from the jump, and that requires understanding that a plan for modernizing its technology is as important as finalizing the transaction. Here are four guiding principles that will help ensure a smooth transition and successful launch.

Actions to eliminate technical debt

Once you’ve conducted a full system-wide technical debt audit, here are key strategies to take: