Highlights from the 2025 Consumer Sentiment Index | Home

The home sector faces a challenging backdrop. A stagnant U.S. housing market has caused a mild form of arrested development for younger generations, who have been prevented from entering or moving up in the housing market. This has shaped their shopping behaviors, which we studied in the 2025 Consumer Sentiment Index: Home.

The broadest takeaway from the data was a desire to move toward the next upgrade.

Price isn’t everything; consumers are highly aspirational.

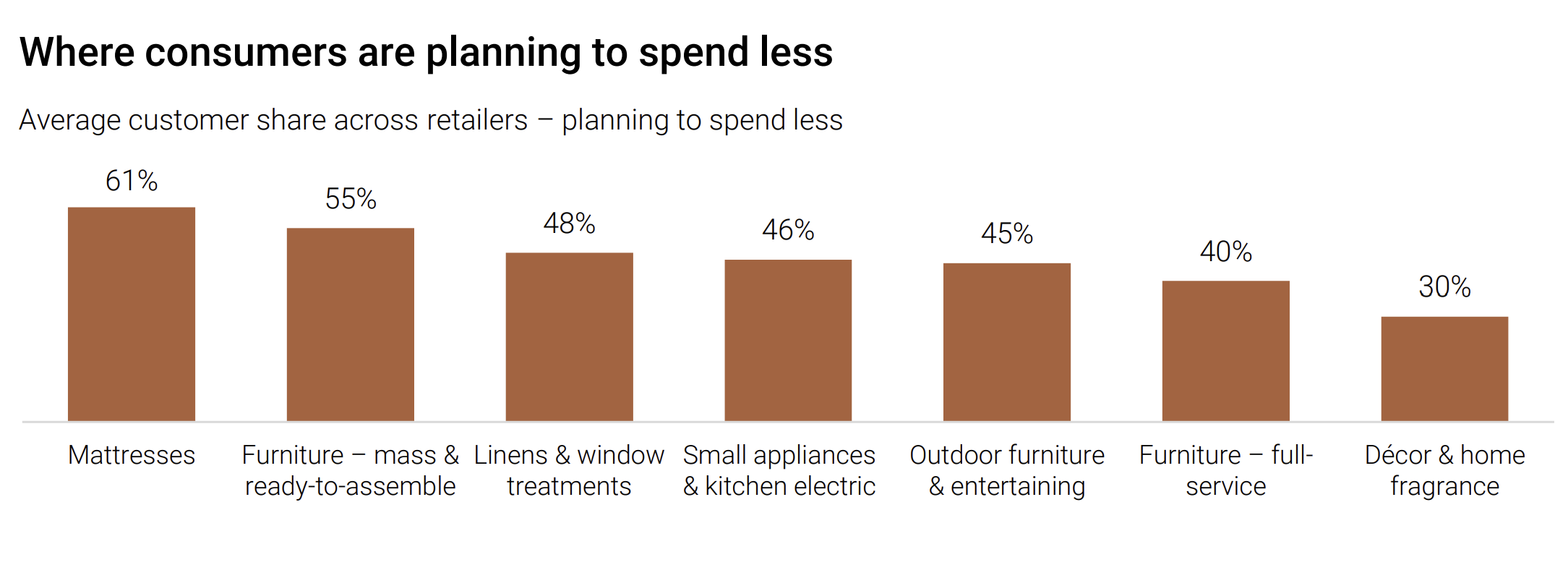

Of consumers who are cutting spending, ready-to-assemble furniture and mattresses are their top targets, cited by 55% and 61%, respectively, of those cutting spending due to price, rather than trading down.

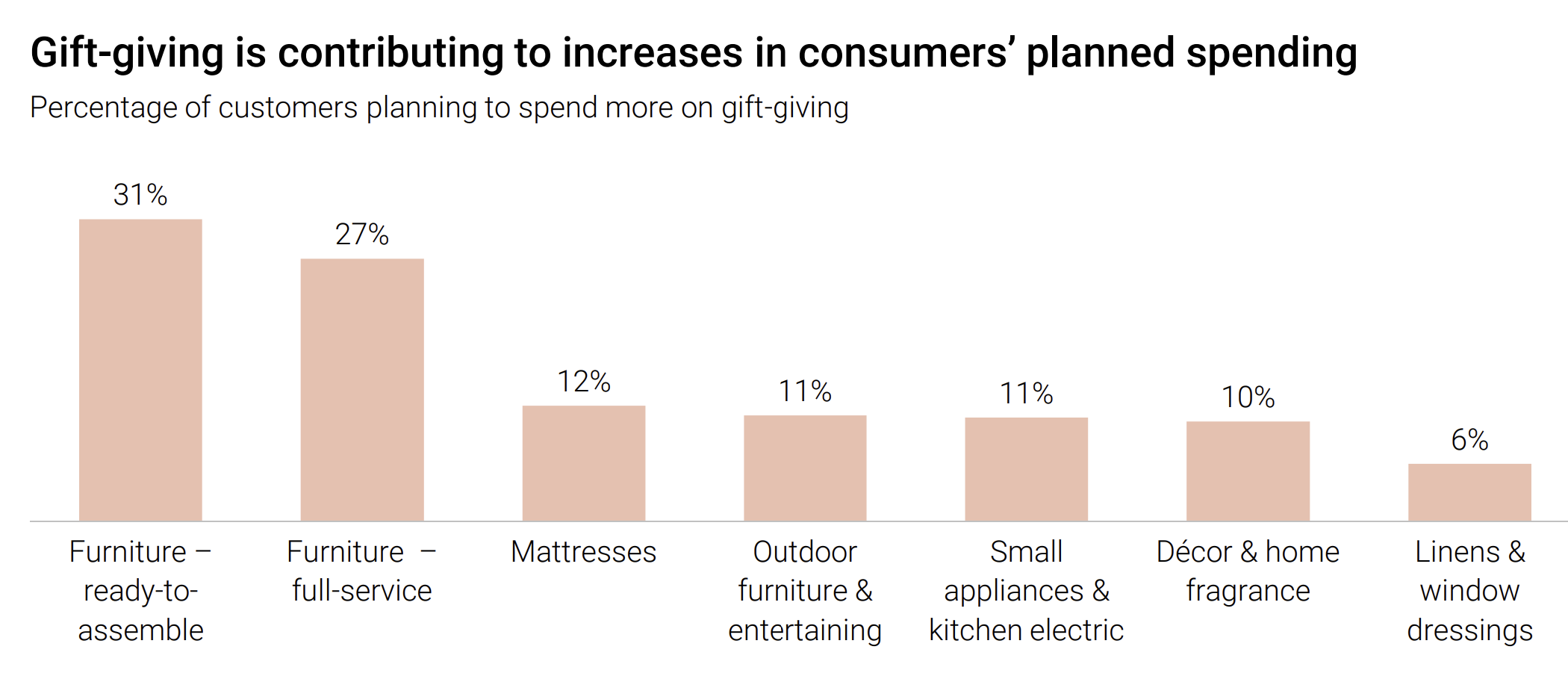

Gift-giving could be a bright spot amid reduced traditional home furnishing rates.

Big-ticket gift givers in full-service furniture and mattresses care more about sustainably sourced product, clear product marketing collateral, and a wide range of products.

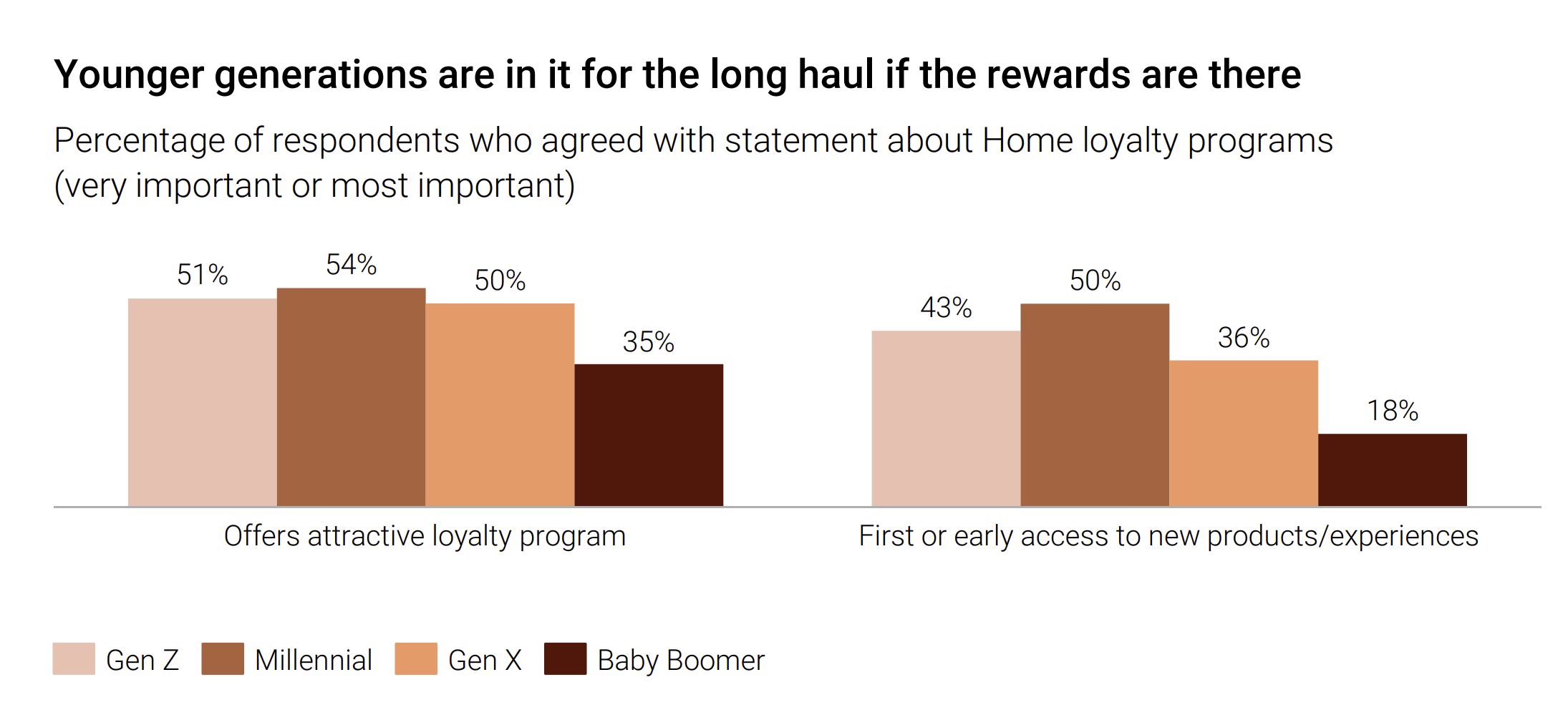

Aspirational sentiment holds across generations.

Millennials are beginning to trend toward full-service higher quality pieces that may take them to and through the next stage of their life—a majority want personalized help, loyalty programs, and early access to product.

An interest in nicer homewares is filtering down to those in their first adult homes.

Over half of Gen Z are interested in loyalty programs and 43% want early or first access.

The instore experience is a differentiator across sectors.

IKEA is beloved by women shoppers (74% of whom ranked the retailer #1, versus 26% of men shoppers) and Millennials (68% vs. all others). Walmart wins for its same-day delivery and broad assortment, and for tapping into higher end plays.

Retailers need to balance the demands of younger and older shoppers: Right-sizing assortment to product fit for long-term renting and shifting into categories that younger cohorts are likely to shop is key, while not alienating core Baby Boomer customers—the latter are big-ticket shoppers today, but the former will be in the future. The loyalty and digital experience should be adapted to accommodate Gen Z proclivity for social connection and ESG.

Now more than ever, home is where you make it, and the emotional resonance of key purchase drivers offers a key to the consumer, whichever stage they are at.

Click to read the full report below:

About the CSI

We polled over 5,000 consumers on their preferences and priorities across 37 major retailers and seven sectors: décor and home fragrance; full-service furniture; mass and ready-to-assemble furniture; linens and window treatments; mattresses; outdoor furniture and entertaining; and small appliances and kitchen electric. To learn more about the CSI and explore insights from the interactive dashboard, contact our authors.