Marc Iampieri

New York

This article was co-authored by Marc Iampieri and Deborah Praga of AlixPartners and Patrick Carroll of The CF Team.

California is getting greener—but companies may see red on their balance sheets if they don’t keep up with legislation.

The state recently enacted SB 261, a first-of-its-kind climate disclosure law that mandates companies doing business in the state (with more than $500 million in annual revenue) to provide public reporting on climate-related financial risks and mitigation strategies. Companies must publish a report every two years, with initial reports due on January 1, 2026 based on 2025 data.

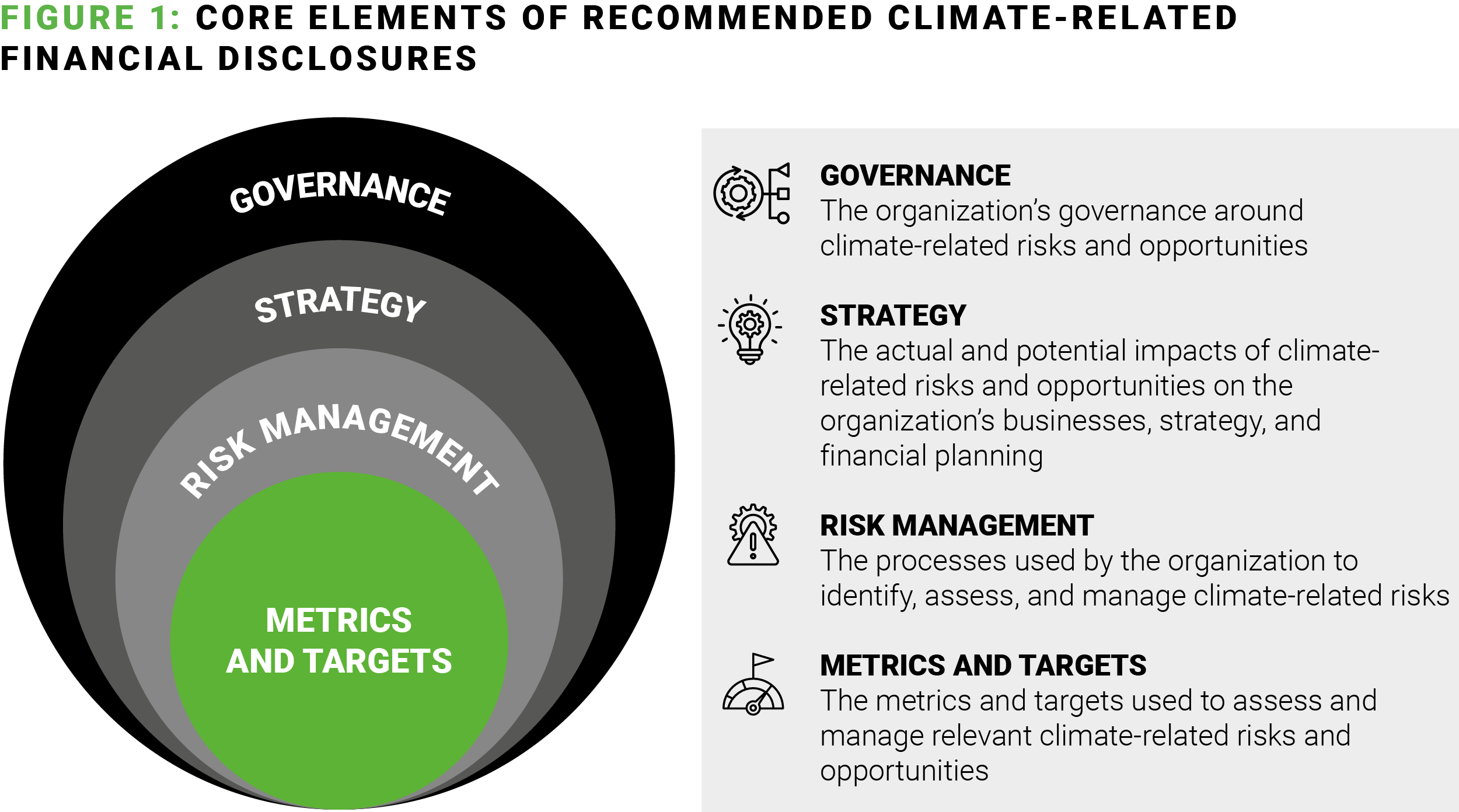

While most major companies have previously published these types of reports using the Task Force on Climate-Related Financial Disclosures (TCFD) framework, SB 261 takes further aim at industry leaders to drive action or face the consequences. Here’s what companies need to know.

A $50,000 annual penalty may not seem a harsh fee for companies that fail to file, but the reputational damage that non-compliance brings will carry far greater costs. State and activist groups publicize those that don't comply, which leads to investors redirecting dollars and customers pulling spend. On top of this, companies that concentrate assets or supply chains in locations that are vulnerable to wildfires, rising sea levels, and other climate-related extreme weather events face physical risks that can hurt their bottom line.

As an example, consider global climate nonprofit Ceres’ recent report analyzing the progress made by 50 of the largest public food and agriculture companies in North America regarding the Food Emissions 50 initiative. The report homepage links out to individual company scorecards, which detail that eight of the 50 companies—BJ’s Wholesale Holdings, Bloomin’ Brands, Darden Restaurants, Flowers Food, Kroger, Loblaw Companies, Performance Food Group and Texas Roadhouse—fail to hit any of the five key metrics towards tackling climate risk and accelerating a transition to a lower-emissions economy. Coverage of the report proliferated across industry and climate-related media and newsletters.

Climate strategy is now necessary to operate a company in 2025. Companies will need to create a comprehensive report for how they manage risks from the board level all the way down to how they’re managed on the factory floor—and at every level in between.

At the top, this requires c-suite involvement in delegating responsibilities. By assembling the right upper management team and promoting internal awareness throughout the organization, companies can govern risks while also finding opportunities to better track their carbon footprint and commit to science-based reduction measures. More so than compliance, companies must focus on holistic change management initiatives that transform operations from the ground up.

When authoring a report for SB 261, it’s prudent to engage with subject matter experts. Prioritizing the most critical business units, categories, and product lines will help to build the foundation for evolving business models needed for SB 261 and similar legislation.

At AlixPartners, we have worked with companies on climate-related compliance projects that led to business model transformations with significant financial impacts. In 2023, we helped building materials company Kingspan to reconfigure its supply chain as part of its “Planet Passionate” initiative. With a goal to cut its carbon output in half from its primary supply chain by 2030, Kingspan needed to build out opportunities around due diligence, digitalization, and procurement. Through a comprehensive review of its supply chain, we aided the company’s efforts to meet European regulation requirements while enhancing its supplier due diligence framework and clarifying its material ESG topics.

California is a massive market, and the impact of failing to comply with SB 261 regulations is real. But if companies take a few important steps, they can easily mitigate risks.

There is a straightforward fix to ensure compliance through key change management initiatives—you can get in front of this law, you just must do it now. The longer you wait, the larger the financial and reputational repercussions. With each successive generation, customer pressure on top of legislative pressure will only increase.

California is getting greener and companies must follow suit. AlixPartners and The CF Team are partnering to help companies navigate SB 261 and hit the January 1 filing deadline. Reach out to the authors to learn how our experts can aid your reporting efforts.

Marc Iampieri is AlixPartners’ global co-leader of logistics and transportation. For more than 25 years, he has helped companies to resolve complex supply chain and distribution challenges. He frequently advises clients in the consumer goods, retail, energy, and industrial industries regarding their logistics strategy and operations.

Deborah Praga is AlixPartners’ global ESG lead, serving as a trusted expert advisor to clients on operationalizing practical, value-add solutions to ESG challenges. She also drives AlixPartners’ internal efforts in this area, utilizing more than 11 years of consulting experience to bring a practical approach to solving sustainability challenges.

Patrick Carroll is the CEO of The CF Team, a consultancy committed to providing all the resources mid-market companies need to manage their climate risk and carbon footprint reporting requirements. He is one of the specialized experts AlixPartners works alongside to serve clients in this space.

Patrick and Marc have worked together since 2006, and from 2013 to 2019, Patrick worked with Marc at AlixPartners on the consumer products and operations team. After learning carbon accounting and how to drive corporate climate action by the numbers, Patrick recognized the white space in the market for climate and ESG consultants who can also have nuanced discussions about P&L and supply chain strategies. Out of this, The CF Team was born.