Our recently published 2026 Global Data Center Market Outlook polled more than 400 senior executives across the data center industry—including investors, operators, technology providers, and real estate investment trusts (REITs)—to gain insight into current market trends and identify key strategies to maximize value creation.

More than 50 of these executives are located in the Middle East. This article focuses on the unique differences of this region with regard to data center builds and operations in the coming year and beyond.

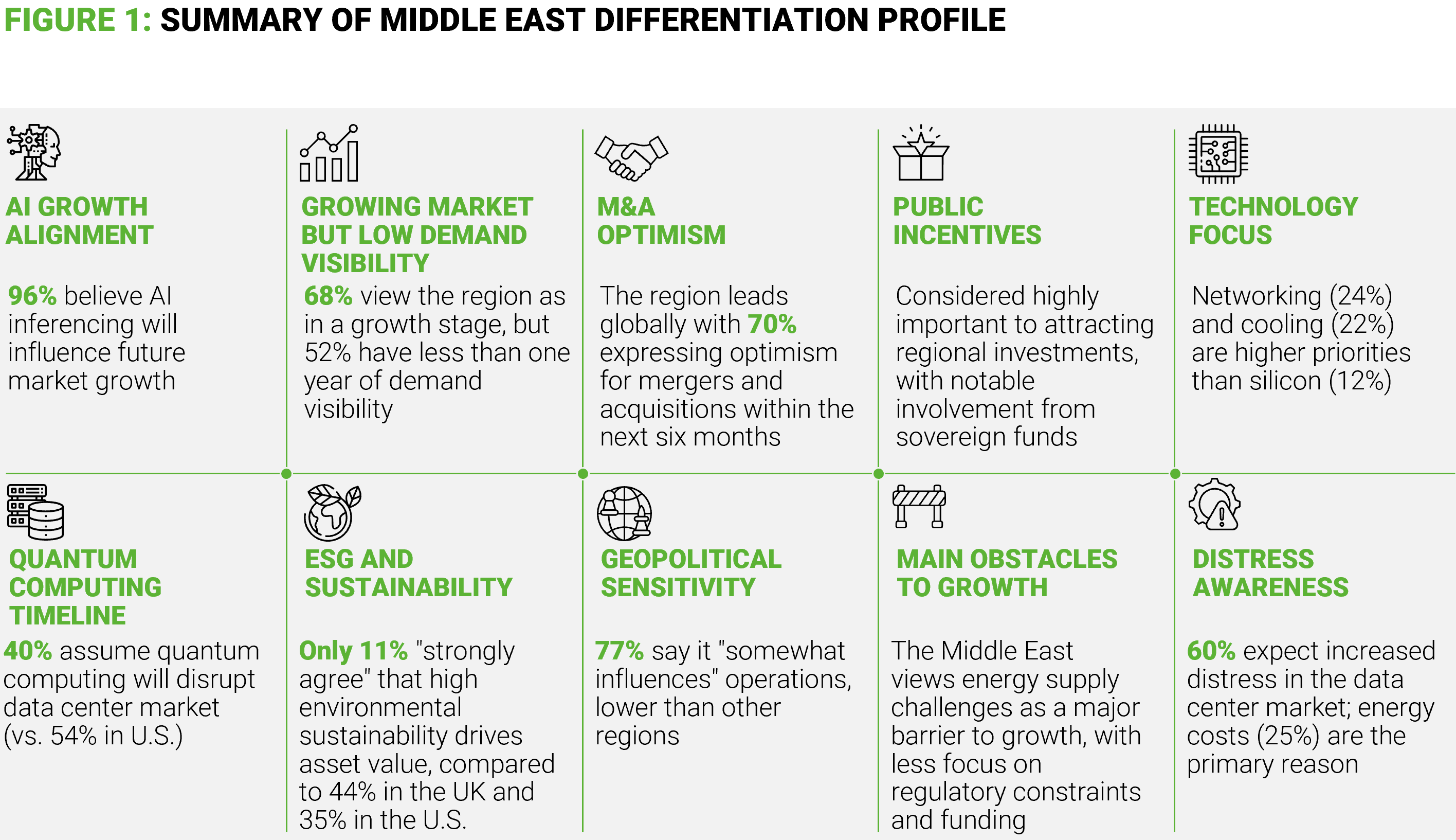

1. AI growth alignment with global trends

The Middle East is fully aligned with global sentiments on AI-driven growth, with 96% believing AI inferencing will influence future market growth. Notably, 66% say AI will "somewhat influence" growth (higher than other regions' "strongly influence" rates), indicating broad consensus but measured enthusiasm. The region also shows strong belief that GPU efficiency improvements will drive a decline in LLM training (53% cite this as the main cause, higher than most markets).

2. Growth-stage mindset with low demand visibility

Middle East respondents overwhelmingly see the data center industry as being in a growth stage (68%), with only 32% considering it mature. However, the region also reports low demand certainty, as most have less than two years of visibility. This combination of growth optimism and short-term visibility reflects an agile, opportunistic investment posture focused on rapid adaptation to market dynamics.

3. Highest M&A confidence and market consolidation optimism

The Middle East demonstrates the strongest belief in M&A activity of any region, with 70% of respondents expecting M&A attractiveness to increase within the next six months, compared to 60% globally. This reflects aggressive market consolidation strategies and a strong appetite for synergy-driven growth, positioning the region as particularly dynamic in deal-making and partnership formation.

4. Strong reliance on public incentives and sovereign wealth involvement

Middle Eastern respondents place high importance on government incentives and sovereign wealth fund involvement in attracting data center investments. This reflects the region's strategic use of public-private partnerships and state-backed capital to accelerate infrastructure development and establish competitive advantages.

5. Selective technology adoption priorities

The Middle East is focused on getting data centers up and running, prioritizing connectivity and cooling to become a true global hub. 24% prioritize new networking speeds (above the global average of ~20%), while 22% focus on new cooling techniques. This selective approach suggests the region concentrates on proven, scalable infrastructure improvements over cutting-edge silicon innovation.

6. Less expectation of quantum computing disruption

The Middle East is more conservative on quantum computing expectations than other regions. Although respondents generally believe quantum computing is coming, only 40% expect it to significantly disrupt the data-center market (vs. 54% in the U.S.). At the same time, 72% of Middle East respondents expect the quantum disruption to happen in 2-5 years, compared to just 58% in the U.S. This aligns with the region’s focus on near-term infrastructure challenges rather than speculative technology bets.

7. Lower conviction on ESG and environmental sustainability

The Middle East shows notably softer conviction on environmental sustainability compared to Western markets. Only 11% "strongly agree" that high environmental sustainability drives asset value, compared to 44% in the UK and 35% in the U.S. While overall agreement remains relatively high at 64%, the region exhibits a 25% neutrality rate, the highest among major markets. This suggests that ESG considerations are acknowledged but not yet prioritized as heavily as operational and financial metrics.

8. Geopolitical risk sensitivity

The Middle East demonstrates lower sensitivity to geopolitical uncertainty compared to other regions. Most respondents say geopolitical factors "somewhat influence" their strategy, with very few citing "strongly influences". This contrasts with heightened geopolitical concerns in Europe and suggests confidence in regional stability or a baseline acceptance of current geopolitical dynamics.

9. Energy supply as a critical obstacle

While regulatory constraints and funding are top barriers globally, the Middle East places high emphasis on energy supply challenges. Energy costs and energy availability are ranked alongside regulation and construction availability as the top obstacle to data center growth in the region. This distinguishes the Middle East from markets like the UK (where funding is paramount) and reflects the region's focus on securing sustainable, scalable power infrastructure to support rapid capacity expansion.

10. High distress awareness with energy cost focus

60% of Middle East respondents expect increased distressed situations in the data center market—higher than Germany and France (<50%) but in line with North America. Critically, the region identifies rising energy costs (25% cite this as the top driver) and intense competition (24%) as the primary root causes of distress, more so than other markets. This heightened sensitivity to energy economics underscores the strategic importance of power supply in the region.