Managing geopolitical risk will take more than resilience

96%

agree that geopolitical disruptions will directly lead to increased distressed situations

In an era defined by geopolitical upheaval and economic complexity, the old rules no longer apply. As global financial markets react to intense geopolitical tension, business leaders face a paralyzing forecast of anxiety and uncertainty. Yet with this complexity comes the opportunity for executives to act and create stability in a volatile world.

Our 20th Annual Turnaround and Transformation Survey reveals how management teams can respond – and where many may be falling behind. With fears of recession rising and the cost of capital tightening, the pressure to act has never been greater.

This year marks two decades of our survey. In that time, we’ve tracked how businesses have weathered global financial crises, pandemics, and sector-specific slowdowns.

2025 presents a uniquely volatile mix of geopolitical tension and economic fragility. From tariff shocks and global conflict to regulatory volatility and political turnover, the pace of change is accelerating. Amid today’s destabilizing forces, one message is clear: leaders must avoid paralysis and act now.

70%

of respondents expect economic

decline in their region in the next 12 months

53%

identified the Americas as the

region most likely to face distress in 2025

74%

anticipate a recession in

their region in the next 24 months

70%

predict an increase in out-of-court

restructurings over the next 12 months

43%

Geopolitical

instability

27%

Regulatory change

including tariffs

12%

Cost/availability

of capital

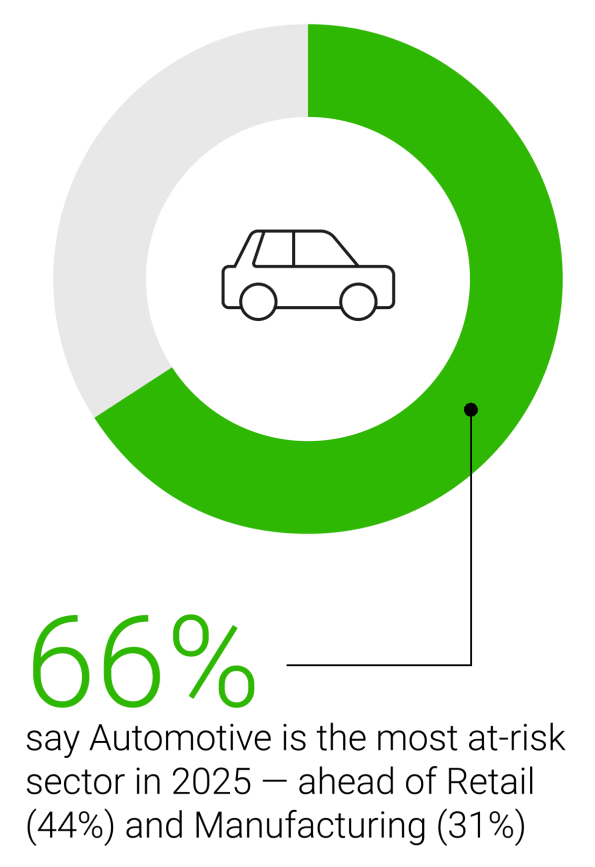

*Each respondent was asked to identify up to three different sectors

Download the 2025 Turnaround and Transformation Survey to gain

deeper insight into:

• Viewpoints from 25 global experts

• The top-ranked sectors for potential distress

• Macro forces reshaping business priorities

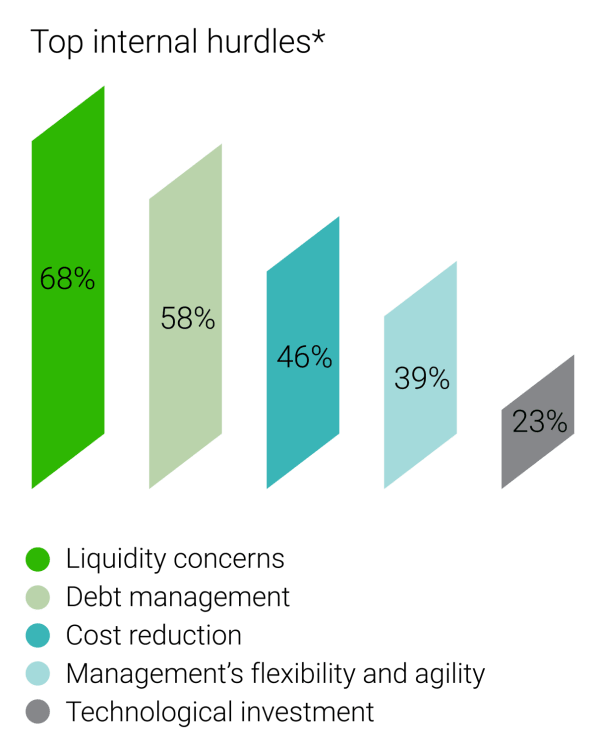

• The factors holding back transformation

• Immediate actions companies should take to stay ahead