Dan Hearsch

Detroit

The automotive industry’s exposure to supply-chain shortages has grabbed the spotlight with primary focus on inventory shortages and price inflation. Behind every headline, however, is an industry of players dealing with fallout from dealers to suppliers to finance companies.

Among those affected are automotive parts distributors. They are dealing with demand and supply shocks that complicate the equation behind having the right product, in the right place, at the right time, and at the right price. Being able to quickly meet market demand has been table stakes for distributors and many have employed a strategy that mirrors the just-in-time approach applied in many factories.

A hornet’s nest of disruption has made this strategy harder to employ, and a new approach may be needed. Distributors now need to consider a just-in-case approach. The amount of inventory needed to reach an adequate level of safety stock has risen, and the costs associated with buying and carrying more stock are increasingly offset by the risk of not being able to make a sale when pricing power is at its prime and customer demand is healthy.

There are several reasons why the need for replacement parts is high.

Demand has risen of late as the price of new and used cars – up 11.4% and 40%, respectively – has potentially discouraged consumers’ willingness to upgrade their vehicles. The average age of U.S. vehicles is now 12.1 years, and the U.S. vehicle parc now exceeds 275 million. Americans are back to driving as many miles as they had prior to the pandemic, and the most-recent traffic fatality data suggests vehicle crashes are rising amid lighter traffic patterns.

Auto parts distributors historically respond well to demand fluctuations. The supply of parts, however, has dramatically declined amid the ripple effects of material shortages, logistics bottlenecks, and manufacturing constraints. This is a new and unpredicted wrinkle. Lead times from suppliers have increased significantly and become nearly impossible to forecast.

In the past, automotive part distributors have depended on using historical averages to predict future average and standard deviation of lead times. But in today’s environment, history is not an accurate predictor.

In a recent survey of 500 independent automotive repair shops, operators said shop turnaround increased 1.5 days compared to pre- pandemic and 45% attribute higher turnaround times to delays in parts deliveries. Two-thirds of the respondents “frequently” or “very frequently” face delivery disruptions.

It's anyone’s guess as to when these shortages will reverse themselves. Business, however, is not a guessing game.

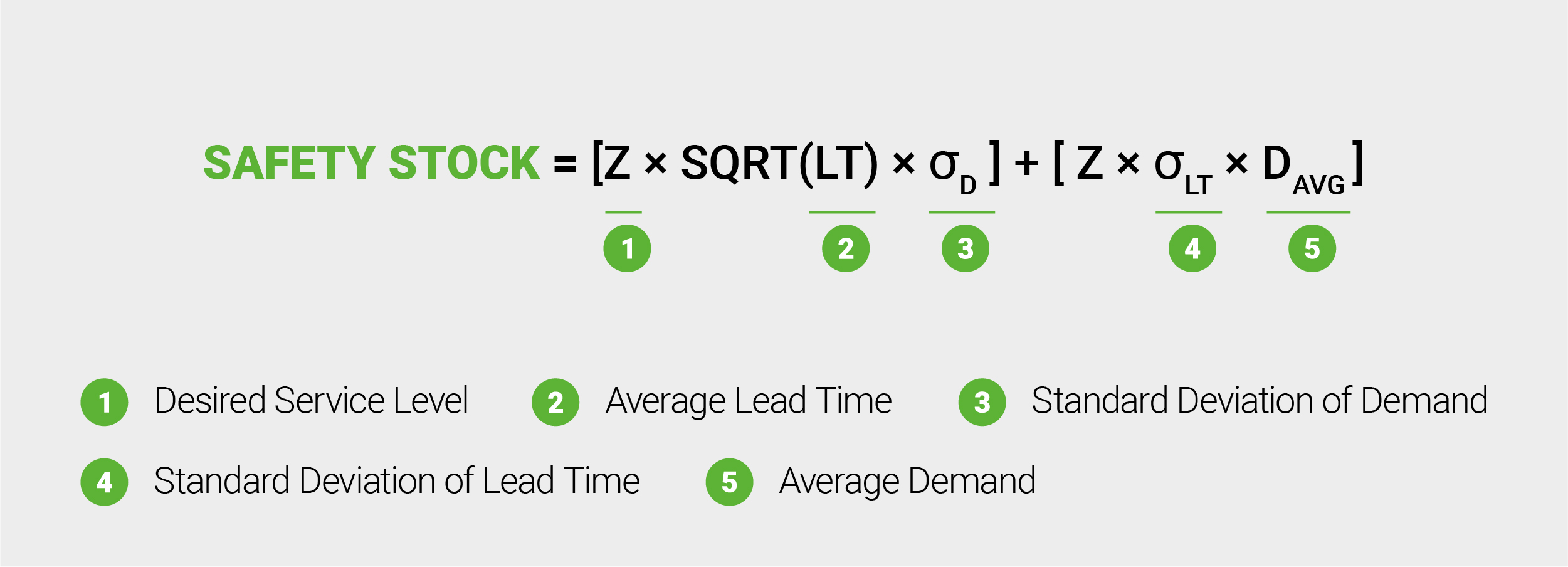

Distributors need to consider reassessing their “safety stock” reserves or the level of additional stock maintained to mitigate the risk of stockouts (lost sales) caused by uncertainty in demand and supply. For the time being, there is considerable risk in running inventories too lean.

Given the competitiveness of the market and the ability to substitute products, automotive parts distributors currently strive to deliver the same level of service today as they have in the past.

With consumers opting to keep their current vehicle instead of entering today’s cutthroat new and used car markets, automotive parts distributors are playing an increasingly integral role in supplying parts to maintain and keep vehicles on the road longer.

Historically, auto parts distributors have used multiple methods and spent innumerable hours working to understand demand for their products. Various data sources are available (e.g., car parc, average miles driven, vehicle age, part failure rates, sales history) that can be used to predict which parts customers will demand at a given time and location. Those same data sources can still be used in today’s environment to effectively plan for average demand and standard deviation of demand.

Auto parts distributors are now faced with a dilemma – maintain current inventory levels and suffer more stockouts and potentially lost sales or increase inventory and deal with the additional stress on working capital and holding costs. While it’s hard to swallow higher costs, the current level of price inflation (motor-vehicle parts and equipment were 12.6% more expensive in January compared with a year earlier) rewards decision makers who are fluid in their position on inventory in the interim.

As automotive parts distributors are now planning based on best-guess, worst-case scenarios for average lead time and standard deviation of lead time, the prevailing inventory planning approach needs to shift from just-in-time to just-in-case.