Consumer product (CP) companies have benefited recently from a favorable environment that made broad-based price increases possible, not only offsetting the negative impact of cost inflation on margins but also boosting revenue growth above historic norms. But economic conditions are shifting fast, and an indiscriminate approach to pricing will not be a viable performance-enhancing lever in the foreseeable future. CP companies will need to embrace a more structured, disciplined, scientific, and surgical approach to pricing. We call it “Precision Pricing”.

Raising the (pricing) bar

In late spring of this year, CP companies started to announce their intentions to raise prices in response to unprecedented input cost inflation. Much of the pricing action took effect during the summer.

Our analysis of SPINS data for the 12-week period ending October 30, 2022, shows that 96% of 481 CP subcategories saw price increases. Prices have increased on average by 12.9%, with top quartile price increases coming in at 17.1%. As a point of comparison, during approximately the same period a year ago, 90% of the same 481 subcategories saw price increases, averaging 5.6%. In other words, price increases across the CP landscape were, on average, 7.3 percentage points higher in 2022 versus in 2021.

Indiscriminate price increases don’t always work

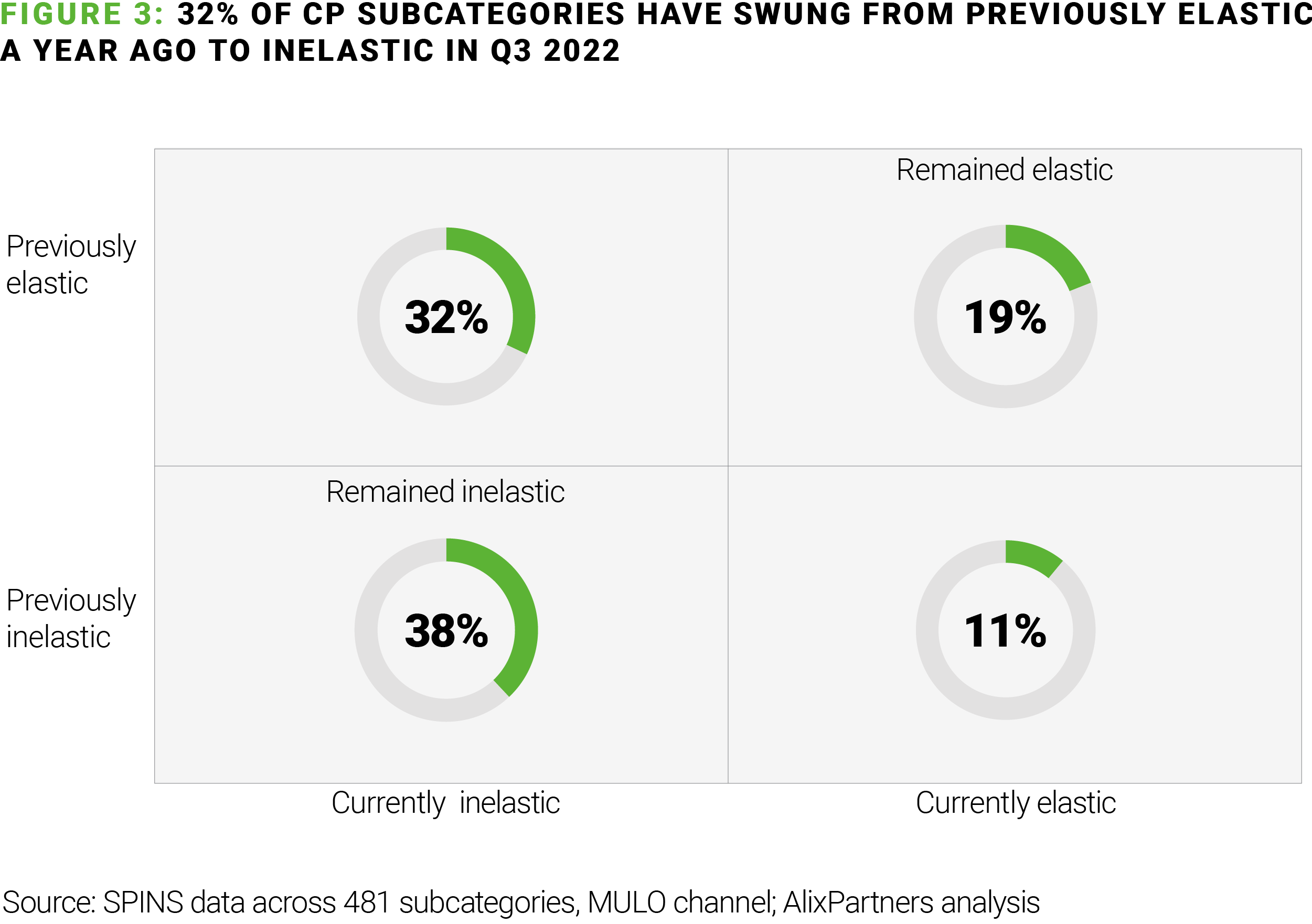

Consumer spending resilience has allowed CP companies to get away with indiscriminate price increases that have resulted, for the most part, in Q3’22 revenue growth well above historic norms. Our analysis has shown that 70% of the 481 subcategories evaluated have proven to be inelastic during the 12-week period ending October 30, 2022, generally meaning that the percentage increase in price more than offset the percentage change in volume downward, leading to an overall expansion in value.

However, this approach to pricing has left some victims along the way. Our analysis finds that 24% of the 481 subcategories were elastic, and the rate of volume decline turned out to be higher than the rate of pricing increases—and, hence, those subcategories contracted in value.

To make matters even trickier, almost half of the 70% of subcategories that have shown inelastic behavior in Q3’22 were elastic just a year ago. As much as 32% of subcategories have swung from being elastic last year to becoming inelastic this past summer, and the pendulum can swing further if economic conditions continue to deteriorate. This is an important reminder that price elasticity of demand is rarely static, especially for more discretionary subcategories. Elasticity can shift materially due to changes in the macro environment (e.g., inflation, consumer sentiment, consumer spending), competitive intensity (e.g., new entrants, promotional activity), and supply disruptions (e.g., supply shortages, out-of-stocks).

Practical “Precision Pricing” advice you can adopt right away

With deteriorating consumer confidence, decelerating consumer spending, a recession looming on the horizon, and retailers much less willing to accept price increases, CP companies will need a more structured, disciplined, scientific and surgical approach to pricing, or Precision Pricing. Precision Pricing is not a new idea, but we still find it to be an underdeveloped capability within the CP industry. It may sound complicated—and, indeed, it requires time and investment to fully develop into a differentiated capability and a source of competitive advantage—but that doesn’t mean that you can’t adopt some basic principles and practices right away to try to avoid revenue and/or margin leakage due to indiscriminate pricing actions as the market begins to turn.

Here are three practical ways to get started:

Understand true cost and margin: Growing profits, and not just revenue, should be the main driver of pricing decisions. However, too often, pricing decisions are made based on revenue considerations and simply ignore potential margin impacts. To avoid this, start by making sure that you have accurate visibility into true current cost, and that you understand how pricing decisions may impact margin. For example, are you creating a pricing structure that may motivate consumers to favor a lower-margin product versus higher-margin ones? One of the challenges in today’s high-inflation environment is that most CP companies set standard costs on an annual basis, while input costs may increase multiple times and at different rates during the year. So, watch out for standard cost inaccuracies that may misguide pricing decisions.

Adopt a segmented approach: A one-size-fits-all approach to pricing will rarely work. The more targeted and precise you make your pricing decisions, the more effective they will become. And that starts by segmenting your business in ways that are meaningful from a pricing definition perspective. For example: by type of product (e.g., mainstream, mass-produced vs. custom, made-to-order), by product category (e.g., based on demand elasticity, product profitability), by channel (e.g., based on shopping occasion and how it may affect elasticity), by retail customer (e.g., based on customer size, growth, strength of relationship, shopper profile), by geographic region etc. Each of those segments may justify a different, more targeted, fit-for-purpose approach to pricing.

Make it scientific: No, you can’t just “wing it”. First and foremost, your decisions should be driven by data. As an example, understand elasticities at a more granular level and how they may be changing over time and under different circumstances. Second, evaluate different scenarios and run simulations, factoring in different economic conditions and competitive dynamics, to anticipate potential impacts of your pricing decisions on revenue and margin. Third, be disciplined in monitoring execution and assessing results—what worked, what did not work (and why), and what to do similarly/differently next time. And, finally, if you feel ready to begin to take bigger steps forward, begin to experiment with AI-enhanced pricing models and tools, which will enable you to evolve toward a greater level of pricing intelligence and precision.

These basic principles and practices will help you navigate the next economic cycle more confidently from a pricing perspective and will put your organization on a path to building differentiated capabilities that will serve you well in the long run.