Over the last several months, clients from various geographies have turned to AlixPartners for assistance as they started noticing reduced investment returns and revenues showing a significant negative impact due to slippage in US dollar value, when compared with most major currencies around the world.

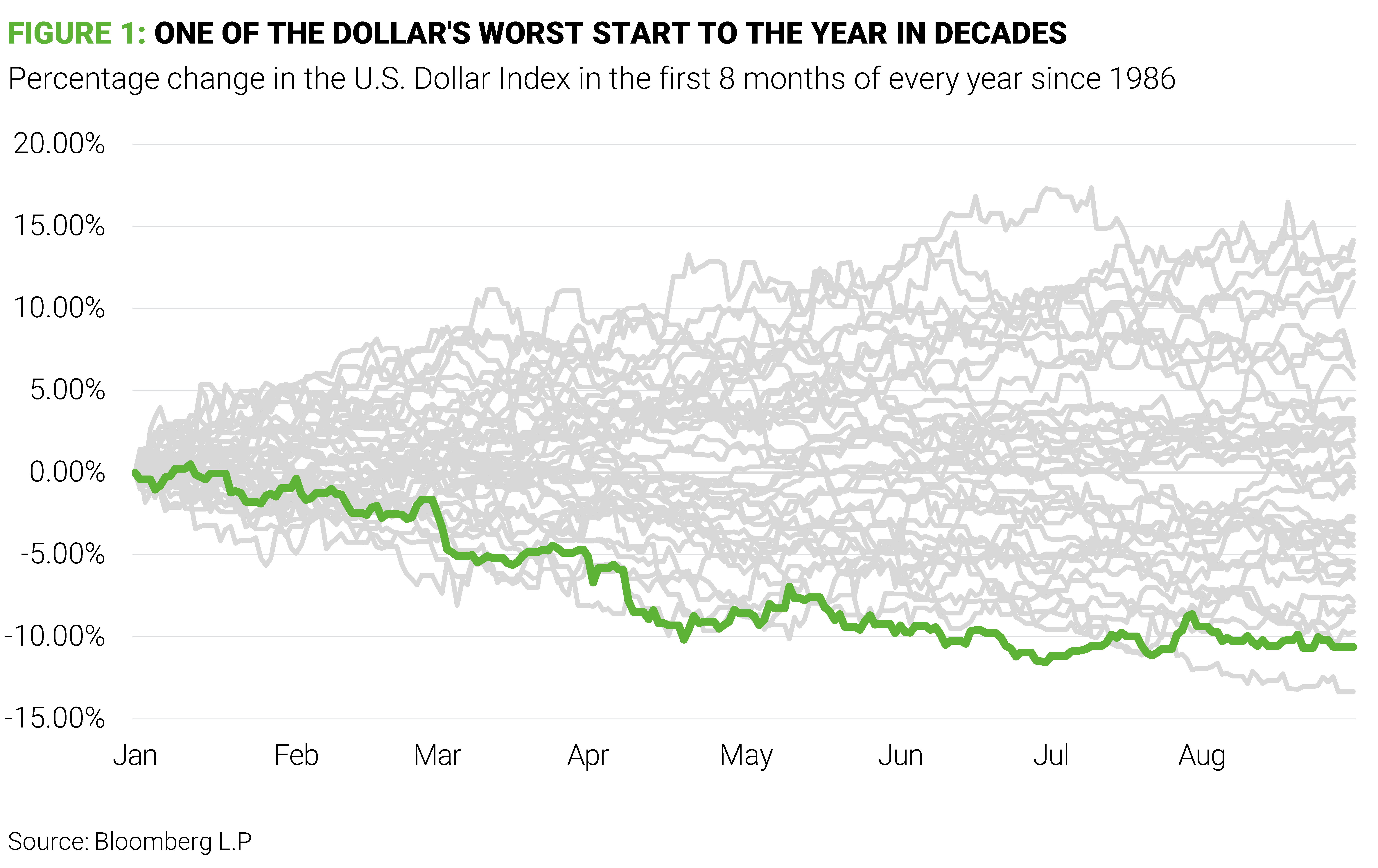

Political instability, tariff uncertainty, and volatile markets have led the dollar to its weakest start to a year since 1973 (figure 1). This turbulence has prompted many firms to reassess whether their FX risk management programs are still delivering the protection they need.

Source: FactSet, cited in The New York Times The Dollar Has Its Worst Start to a Year Since 1973 - The New York Times

Source: FactSet, cited in The New York Times The Dollar Has Its Worst Start to a Year Since 1973 - The New York Times

Is everyone hedging FX?

In short, no. In January 2025, Risk.net reported that three of the “Magnificent Seven” tech giants – Amazon, Meta, and Tesla – were not hedging FX, which may have come as a surprise to those assuming that FX hedging was the norm.

From our work with clients worldwide and across diverse industries, we’ve observed a similar trend – that not everyone is hedging their FX exposure. Reasons include cost concerns, the oversight required, traditional thinking that the U.S. dollar is a safe bet, and a desire to preserve upside potential.

PE firms evaluating their portcos or potential investments should consider whether and how those companies are hedging FX, and how that fits in with broader risk management strategies.

Similarly, a diversified customer base, alternative sourcing and distributed office presence are some of the operational measures for institutions to consider.

More uncertainty, higher costs

2025 has heightened uncertainty for the FX market, impacting hedgers, dealers, and speculators. Key challenges include:

- U.S. government tariff whipsaw disruption

- Increased volatility, including in historically low-volatility currency pairs

- A deviation from long-standing historical relationships, such as low hedging costs, the dollar smile, and low EUR/USD volatility

Coupled with a falling dollar, stress in the FX market has driven up costs for hedgers. The rise includes higher costs for FX options, wider bid-ask spreads, and unpredictable liquidity during volatile periods.

While FX has traditionally been an OTC and dealer-driven market, new trading platforms have emerged, including single-dealer and multi-dealer platforms. These platforms offer new trading options for firms looking to hedge FX exposure.

Adapting FX hedging programs to evolving needs

Many firms are reassessing their hedging programs to better align with changing market conditions. While some are fine-tuning existing programs, others are exploring implementing new programs where none previously existed.

This process tends to be slower for corporates, but faster for financial firms, and it remains complex. It is difficult to determine the best time to enter the market and establish robust governance.

How AlixPartners can support your FX hedging strategy

Solving for a particular investment, revenue stream or expense exposure in a given currency is indeed part of the solution. However, firms often miss out on developing an understanding of their overall exposure to FX and addressing the core problem. We help clients to design and implement well-controlled environments in which risks become transparent and can be managed effectively and efficiently. This is typically achieved by evaluating the overall FX risk management framework and helping implement enhancements that are aligned to the core business model. There are many considerations for firms seeking to start a new hedging program or revise an existing program. Some are listed below:

- Clarify inherent risk: Develop a baseline understanding of why the business is prone to FX risk, and the need to mitigate the risk

- Risk appetite: Define acceptable vs non-acceptable risk; clearly articulate the risks that are deemed undesirable and to what extent these require management. This view needs to be explicit and strategically aligned

- Risk limits: Based on the stated risk appetite, set risk limits and near-miss thresholds. Define the cadence for reviewing these limits while monitoring point-in-time exposures. Leverage appropriate parameters and data sources for accurate real-time reporting

- Hedging strategy: Translate the expressed risk views into a hedging strategy, which can include non-linear components

- Trigger thresholds/qualitative rationale (where applicable): Establish data points and values that trigger hedging strategy execution

- Execution: Ensure a treasury department, traders, and a trading platform, along with mid- and back-office functions, are in place. Assess the creditworthiness of counterparty banks or brokers

- Accounting: Maintain accurate accounting on hedge results to track effectiveness, but also potentially for tax purposes

- Governance: Structure the overall FX hedging program with clear lines of responsibility, documentation of the strategy, and frequent result reviews through a risk view dashboard. Maintain an approved list of counterparties.

For more information, contact our authors.