Fewer than 64% of U.S. households subscribe to pay TV; this number was 89% ten years ago. Cord-cutting is not a new trend, and the decline of pay TV is not a new story, but the trajectory at which both are accelerating deserves focus and attention. Media and entertainment companies are facing a new level of disruption, presenting risks and opportunities for every sector. The ability to effectively execute business transformation will create measurable gains for those that take definitive action.

The Cord-Cutting Index we are releasing today attempts to predict cord-cutting trends for the near future and provide companies with tools to compete.

Our analysis is influenced by 1) Key trends in broadcasting and content programming; 2) Media innovations that impact customer behavior, and 3) Correlation between subscriber and usage trends across different mediums.

PREDICTIVE ANALYSIS: Cutting the Cord, 2022-2027

Trends across different delivery models often produce similar paths in the face of industry disruption. Interestingly, by evaluating adjacent industries such as radio and newspapers, correlations emerge between pay TV subscribers and usage trends.

As a result, our model suggests that the drop-off in pay TV subscribers will continue to accelerate over the next five years, with an expected 12% decrease by 2027. We predict the number of pay TV subscribers to drop below 50 million by 2026 or 2027.

FIGURE 1: CORD-CUTTING PREDICTION – TOTAL PAY TV HOUSEHOLD SUBSCRIBERS IN THE U.S. [2022-2027]

Our analysis shows the current attrition rate of pay TV households is most similar to trends in print newspaper subscriptions, with a lag time of approximately five years.

As we pressed further to map print newspaper subscription outcomes against the recent decline in pay TV subscribers, we found the dramatic shift over the past several years predictive by nature. We enhanced the methodology by layering on Over-the-Top (OTT) subscriber growth along with changes in video ad spend. The analysis showed an exponential shift towards digital video ad spend within the industry.

This analytical model is a tool that will help industry players understand pay TV subscriber declines (Figure 1) and adjust their business plans to brace for the impact.

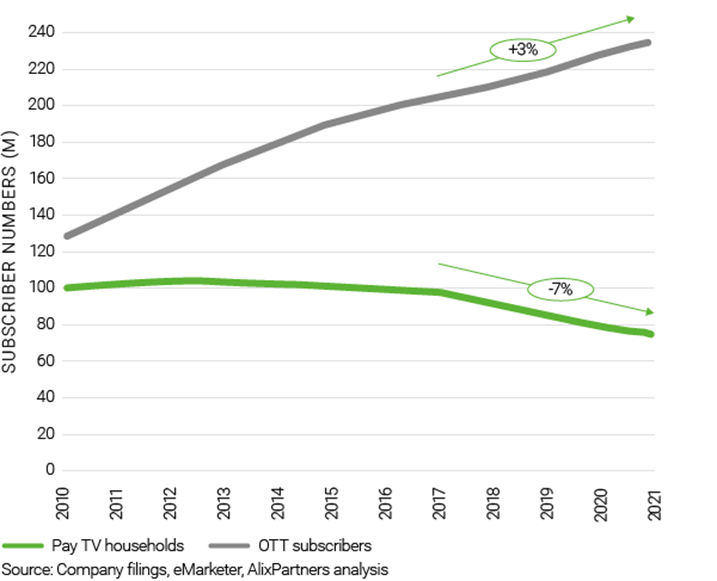

MEDIA DISRUPTION SNAPSHOT, 2011-2021

Pay TV is experiencing its biggest annual decline since its peak in 2011 when over 105 million households were subscribers. Pay TV subscriptions in the U.S. saw a continuous decline at a 7% CAGR during the 5-year period ending in 2021 (Figure 2).

FIGURE 2: OTT SUBSCRIBER VS PAY TV HOUSEHOLDS TRENDS [2010-2021]

Ten years ago, 89% of US households still subscribed to pay TV. Now, that number has fallen below 64%, not including subscribers to Virtual Multichannel Video Programming Distributor (vMVPD) services such as YouTube TV, DirecTV Stream, and Sling TV.

As the COVID-19-era marked the beginning of remote work, online school, and intermittent lockdowns across the globe, leisure time expanded. Simultaneously, media consumption jumped exponentially worldwide, yet five million Americans still decided to cut the cord and shifted towards streaming content.

THE RACE FOR CONSUMER ATTENTION

Subscription Video on Demand (SVOD) providers such as Netflix and Disney Plus lead the charge with massive content libraries. Advertising-Supported Video on Demand (AVOD) providers such as Pluto and Tubi and vMVPDs contribute additional users to the larger OTT streaming ecosystem.

Streaming services are attracting revenue from pay TV in the form of advertising and subscriber fees, but they are also competing for content, network partnerships, and viewer loyalty.

Customers are choosing technologies that can be set up quickly, work seamlessly across their devices, and provide the content they want—when and where they want it.

The shifting landscape translates to new opportunities for pay TV providers, content developers, advertisers, and streaming platforms. But there are just as many risks, especially for companies that are not leaning into these trends, may lack real-time analysis, and are ultimately unprepared for strategic execution.

OVERCOMING DISRUPTION THROUGH EXECUTION

According to our latest Disruption Index report, 96% of Media executives say their business models need to change in the next three years, and nearly half say they’re concerned their company isn’t adapting fast enough to compete.

So then, how can companies overcome these disruptions? Analyze, adapt, and execute.

- Clearly articulate the company’s vision and focus on core business competencies

- Identify the company’s performance on operational, organizational, and financial metrics through real-time data reporting and digital capabilities

- Track and analyze metrics against reference points to enable fast and effective decision-making

By focusing on relevant data points using real-time analysis and reporting, business leaders and executives can make better decisions to meet the demanding pace of change. Similarly, reference points can provide valuable comparisons to help organizations boost automation and drive digital adoption. Innovative tools such as Palantir Foundry help organizations use data to measure impact, adapt quickly, and optimize performance, as evidenced in Palantir’s work with Grupo Globo.

Massive disruption is an opportunity for companies to shift positions and outperform the competition. This series intends to offer data and insights to help companies stay competitive in this dynamic environment.

Subscribe to the AlixPartners blog to FOLLOW THE SERIES

Regular analysis, predictions, and implications for tech, media, entertainment, cable, and telecom companies.

Topics and trends this series will explore:

- Subscription streaming could develop into a winners-take-most market. What happens to those who aren’t at the top?

- Customers are recreating the bundle by aggregating their preferred services. Are they spending more than they did during the peak of pay TV?

- At what point will cable, satellite, or telephony providers decide that the pay TV bundle does not return enough to justify fixed costs? Is there a path to recovery before this happens?

- Will vMVPDs decline as customers opt to have more SVOD subscriptions?

- Will over-the-air local channels survive? What will local content look like in five to 10 years?

- How do companies integrate innovative tools like Palantir Foundry to track real-time analytics to measure impact, adapt quickly, and optimize performance?