Jeff Goldstein

Boston

The bull market for global ad spending, which expanded by over $450 billion (an 8% compound annual growth rate) from 2009 to 2022, has come to an end.

Emerging disruptions are closing in from all angles as advertisers shift their spending to stronger channels and partners with demonstrated ROI. We see four major factors driving this transformation.

Macro challenges. CMOs are looking to optimize their marketing budgets to reflect slower revenue growth, and we’ve already seen the impact on corporate earnings. On average, S&P 500 companies saw year-over-year revenue growth decelerate from 28% in 2021 to 16% in 2022, driven by higher interest rates and slowing consumer spending. According to Standard Media Index's US Ad Market Tracker, the ad market fell in proportion to corporate returns, declining 12% in December 2022 alone—the sixth consecutive month showing year-over-year declines.

Consumer behavior. Inflation and slowing economic growth are crowding out discretionary spending, while an increasing number of consumer choices for products and platforms are forcing marketers to spread their advertising spend across more channels.

New competition. Disruptive ad platforms and channels entering the market bring new models and technologies to bear that erode white space and take market share from legacy competitors.

Privacy rules and regulation. Data privacy regulations such as General Data Protection Regulation (GDPR) and Google and Apple limiting third-party data access hamper targeting ability. Additionally, the EU has taken steps toward enforcing its Digital Services Act (DSA), which imposes increased data transparency requirements and mandated paid advertisement disclosures that will require alterations for monetization through existing algorithms.

While optimism continues that the U.S. may avoid a recession in 2023 and that any global recession will be brief, corporate profits remain under pressure. According to the latest AlixPartners Disruption Index, 53% of global companies expect an economic downturn to have a major impact on revenues over the next 12 months.

Even more significantly, our research shows that the ad market takes significantly longer to recover than the broader economy and corporate earnings. In the last recession, from 2008 to 2010, ad spending fell 13%. It then took 2 years for advertising spending growth to catch up to GDP growth, and a further 5 years (7 years total) for the ad market to recover the previous peak as a percentage of GDP.

During periods of economic crisis, companies scrutinize budgets looking to pull back spending, and advertising is one of the first areas cut. According to a World Federation of Advertisers survey, nearly 30% of major advertisers say they’re cutting their ad budgets into 2023.

However, despite marketing budget constraints, we do not expect businesses to halt all marketing spend and instead expect the focus will be on optimizing marketing channels. Over time, channel shifts will give way to new market norms that define the advertising industry in a rebound.

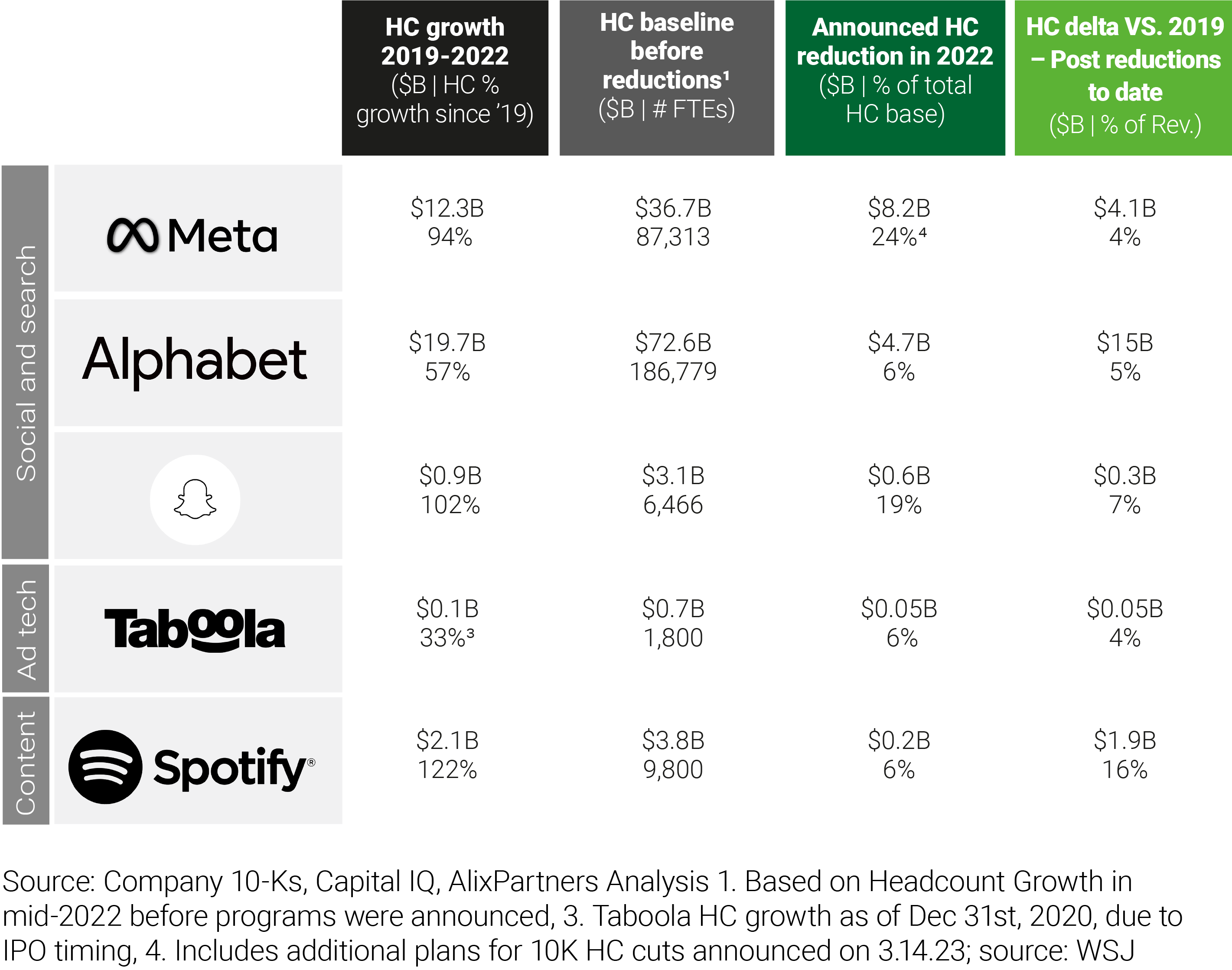

As an initial reaction to ad market declines, major media companies have conducted headcount reductions, starting in Q2 2022. Layoff announcements gained momentum during the 2nd half of 2022, with over 800 tech and media companies announcing cuts in Q3 and Q4. However, our analysis shows that simple headcount reductions are insufficient to remove capacity added since 2019, leaving a sizeable margin for further operational efficiency.

More importantly long-term, for any company that relies on advertising revenues, cutting headcount without sustainable change to workloads—a model reinvention—will be insufficient to weather extended disruptions and will make it challenging to remain viable in a shifting ecosystem. It also risks causing institutional fatigue and critical talent departures.

Evaluating key operational and strategic levers across the business today can drive short-term value while delivering a long-term model reinvention. Get momentum, show predictability, and reallocate resources to increase the ROI of deployed capital.

We are in a critical adapt-or-die period for advertising-supported businesses. Given the extent of pressure bearing down and the likely extended period of slower ad spending, short-term fixes will prove insufficient. What’s needed is a fundamental model reinvention, today, to position for a future rebound.